Specifically, Mrs. Mai intends to sell her entire holding of over 3.4 million UNI shares (equivalent to 8.09% of the company’s capital) to balance her personal finances. The transaction is expected to take place between November 19 and December 12.

Mrs. Mai’s decision to divest comes just one day after several UNI executives and their relatives registered to sell all their shares. Among them, Mr. Vũ Thanh Thủy, a member of the Board of Supervisors, and Mrs. Nguyễn Thị Lệ Thanh, Mr. Thủy’s mother and a Board of Directors member, registered to sell their entire holdings of 1.42 million shares and over 605 thousand shares, respectively. Additionally, Mr. Thủy’s father and sister, Mr. Vũ Duy Bé and Mrs. Vũ Thanh Thảo, also plan to divest their entire stakes, totaling over 1.5 million shares and nearly 1.38 million shares, respectively.

Mrs. Mai’s sister, Mrs. Vũ Thị Kim Liên, has also registered to sell all her UNI shares (over 1.08 million shares, equivalent to 2.54% of the company’s capital).

These transactions are scheduled to occur between November 18 and December 12, with the same stated purpose as the UNI CEO’s: “balancing personal finances.” The reason behind the simultaneous divestment by the company’s leadership and their relatives remains unclear.

Multiple Executives and Relatives Divest Entire Stakes in UNI

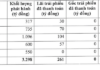

UNI, established in 1993, operates in the telecommunications equipment sector. The divestment occurs during a period of lackluster business performance for the company. Since its peak in 2015, UNI‘s revenue and profit have steadily declined. From 2020 onwards, annual revenue has ranged from a few hundred million to over 1 billion VND, with profits ranging from tens to hundreds of millions. In 2024, the company reported a mere 1.1 billion VND in revenue and a profit of only 1 million VND.

Most recently, in Q3 2025, UNI generated 2.45 billion VND in revenue, a significant increase compared to previous quarters and more than 12 times higher than the same period last year. However, after-tax profit was only 22 million VND, a 24% decrease.

– 08:08 19/11/2025

Ministry of Industry and Trade Set to Receive Over VND 5.4 Trillion in Dividends from VEAM

VEAM is set to distribute approximately VND 6,189.7 billion in dividends for 2024, at a rate of 46.5808%. Notably, the Ministry of Industry and Trade alone is expected to receive nearly VND 5,476 billion from this dividend payout.