With over 36 million outstanding shares, HTG is set to allocate approximately VND 90 billion for this dividend payment, commencing on January 19, 2026.

In 2025, HTG targets a revenue of VND 5,050 billion and a consolidated pre-tax profit of VND 360 billion, with a dividend payout ratio ranging from 25% to 50% of its charter capital. This interim payment ensures the company meets the minimum dividend commitment presented to the Annual General Meeting.

Source: VietstockFinance

|

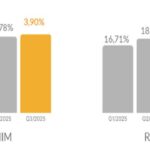

HTG has consistently distributed cash dividends for the past 12 years, reaching a peak of 40% in 2022 and 2024. During these years, the company recorded revenues exceeding VND 5,000 billion and net profits surpassing VND 200 billion. Notably, in 2024, HTG achieved a record net profit of VND 281 billion.

| HTG’s Financial Performance Over the Years |

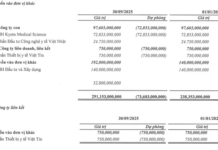

In the first nine months of 2025, Hoa Tho reported revenues of over VND 4,105 billion and a net profit of nearly VND 264 billion, marking a 9% and 40% increase, respectively, compared to the same period last year. These figures represent the highest nine-month performance in the company’s history, achieving 81% of the annual revenue target and 73% of the profit goal.

Source: VietstockFinance

|

Holding over 60% of HTG‘s shares, Vietnam National Textile and Garment Group (UPCoM: VGT) is expected to receive nearly VND 56 billion in dividends from this payout.

– 4:58 PM, November 19, 2025

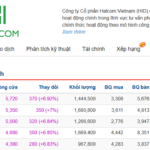

HOSE Demands Explanation from HID as Stock Hits Upper Limit for Five Consecutive Sessions

The Ho Chi Minh City Stock Exchange (HOSE) has requested Halcom Vietnam JSC (HOSE: HID) to clarify the reasons behind the consecutive ceiling price increases of HID shares over five sessions from November 11 to 17.

Automotive Company to Finalize Shareholder List for 30% Cash Dividend Tomorrow

The ex-dividend date is set for November 18th, with the dividend payment expected to be disbursed on December 5th.