The Ho Chi Minh City Stock Exchange (HOSE) in Vietnam, where two significant listings from the financial sector were executed this year.

|

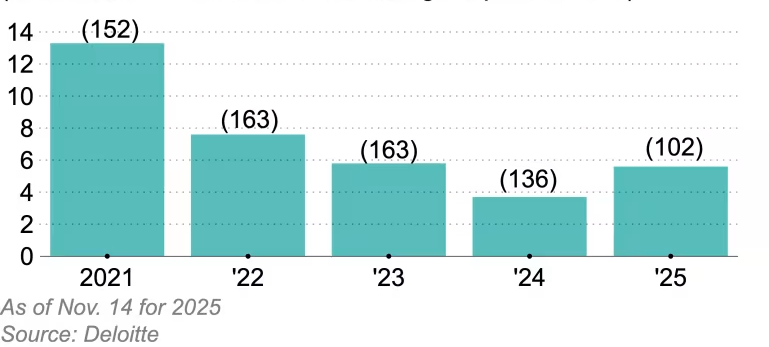

The 2025 Southeast Asia IPO Report, as of November 14, reveals that total funds raised by listed companies in Indonesia, Malaysia, the Philippines, Singapore, Thailand, and Vietnam reached $5.6 billion, a 53% increase compared to 2024, reversing the decline trend of recent years.

However, the number of IPOs to date stands at 102, lower than last year’s 136, although this figure may rise by year-end. Transaction volumes have notably decreased in Indonesia and Thailand.

“Fewer IPOs, but larger in scale,” noted Tay Hwee Ling, Southeast Asia Capital Markets Leader at Deloitte. The average transaction size has increased to approximately $65 million, up from $27 million last year.

The recovery in IPO fundraising reflects a shift towards “larger, higher-quality enterprises,” supported by regulatory reforms and improved market sentiment, according to Ms. Tay.

Singapore Leads with $1.6 Billion

Singapore emerged as the largest IPO market with 9 listings totaling $1.6 billion, including NTT DC REIT ($824 million) and Centurion Accommodation REIT ($597 million).

“Singapore’s recovery is driven by regulatory and market reforms, alongside large-cap listings, signaling renewed investor confidence and attracting regional and global funds,” said Ms. Tay.

A significant number of cross-border enterprises seeking capital in Singapore are expected to sustain this momentum into 2026, she added.

Vietnam Raises $1 Billion from Two Deals

Vietnam recorded two major financial listings, with Techcombank Securities ($525 million) and VPBank Securities ($484 million) collectively raising $1 billion.

Regarding Vietnam’s strong growth, Deloitte noted that the government is streamlining listing procedures to create a more efficient and investor-friendly environment, thereby boosting capital inflows.

Funds Raised from Southeast Asian IPOs

Unit: Billion USD (number of deals in parentheses)

Malaysia recorded 48 IPOs, raising $1.1 billion. Wong Kar Choon, Capital Markets Partner for Malaysia at Deloitte, highlighted the diversity of Malaysia’s IPO pipeline.

“Malaysia’s IPO pipeline is diverse, with a strong focus on consumer goods, industrial products, and energy, driven by government incentives and growing investor interest,” he stated.

Indonesia saw 24 IPOs totaling $921 million, led by the energy and resources sector with Merdeka Gold Resources ($279 million) and Chandra Daya Investasi ($144 million).

Other notable regional IPOs include the Thai subsidiary of Malaysian retailer Mr. D.I.Y. ($174 million) and Philippine water utility Maynilad Water Services ($583 million).

TCBS and VPBankS Among Top 10 Largest Southeast Asian IPOs

Unit: Million USD

Additionally, 27 Southeast Asian companies listed in the U.S. this year, raising $329 million, including the Philippines’ Hotel101 Global Holdings. Three others listed in Hong Kong, raising $588 million.

Several newly listed stocks in Southeast Asia have maintained prices above their IPO levels, with Merdeka Gold Resources closing at 3,780 Rupiah—31% higher than its IPO price.

2026 Outlook: Stable Yet Cautious

Deloitte anticipates stable IPO growth in 2026 as investors become more selective but remain supportive of companies with strong profitability, governance, and clear expansion strategies.

“As market conditions improve, IPO projects previously delayed due to pricing concerns may resume, helping companies address accumulated liquidity needs,” said Ms. Tay.

However, macroeconomic risks such as tariff policies and trade tensions persist.

“While larger listings are increasing, market sentiment remains cautious as businesses await favorable timing and pricing, leading to smaller, more strategic offerings,” she added.

– 11:32 19/11/2025

Southeast Asia’s Capital Markets: Vietnam’s Sole IPO Raises $37 Million in First Ten Months

As of November 15, 2024, Vietnam had only one IPO deal that raised approximately $37 million. In terms of the number of IPO deals and IPO market capitalization, Vietnam ranks behind Malaysia, Thailand, Indonesia, and Singapore, according to Deloitte.