The Ministry of Finance has approved the project “Transitioning the Management Model and Methods for Tax Administration of Business Households upon the Abolition of Presumptive Tax,” which outlines the tax management framework for business households operating on e-commerce platforms, effective from January 1, 2026.

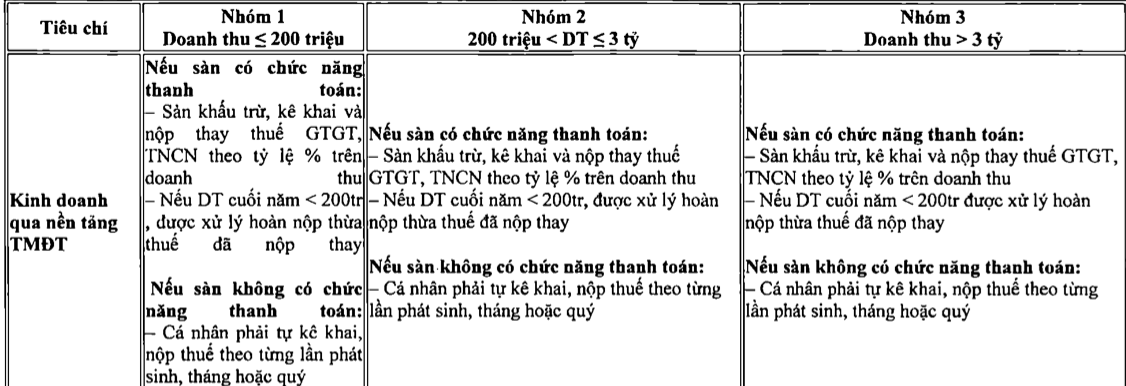

Tax management criteria for business households on e-commerce platforms, effective January 1, 2026.

If the e-commerce platform has a payment function, it will be responsible for withholding, declaring, and remitting value-added tax (VAT) and personal income tax on behalf of the business individual, based on a percentage of revenue. If the business household’s annual revenue is below 200 million VND, the tax paid on their behalf will be refunded as per regulations.

Conversely, if the e-commerce platform does not have a payment function, the business individual must self-declare and remit taxes for each transaction or on a monthly/quarterly basis.

However, individuals and business households selling on platforms like Facebook and Zalo, which do not have tax withholding functions, are concerned about the tax declaration requirement starting January 1, 2026. Sellers on platforms with tax withholding are also questioning the mandatory use of electronic invoices with codes or those generated from cash registers.

Mr. Nguyễn Ngọc Long, an e-commerce business owner in Thanh Xuân, Hanoi, who sells on Shopee and TikTok with annual revenue exceeding 3 billion VND, expressed his concern: “If an individual only operates on a platform with revenue over 3 billion VND, is issuing electronic invoices mandatory? I contacted the platform, but they stated they do not provide customer information to sellers, considering customers as belonging to the platform, not the sellers. This makes it impossible for sellers to issue invoices for each transaction.”

Concerns about e-commerce platforms remitting taxes on behalf of sellers and the need for sellers to issue invoices.

Addressing these concerns, Mr. Nguyễn Tiến Minh, Deputy Director of Hanoi Tax Department, stated that for transactions on platforms without tax withholding, business households must proactively declare taxes. “For transactions on these platforms, business households can identify their buyers as they are direct customers. Therefore, upon each transaction, business households must issue invoices as per regulations, ensuring compliance with invoice usage obligations,” Mr. Minh emphasized, encouraging the use of invoices to protect consumer rights.

Regarding the case of the business individual in Thanh Xuân, Hanoi, and similar models, the Hanoi Tax Department leadership stated that, in principle, issuing invoices protects consumer rights and demonstrates the seller’s responsibility. However, for businesses operating on e-commerce platforms where taxes have been withheld, current policies do not clearly mandate invoice issuance.

The tax authority acknowledged this issue and stated that it is under discussion to refine regulations. They are also working with e-commerce platforms to establish a unified handling approach.

Regarding tax management for individuals operating on e-commerce platforms, particularly YouTubers, TikTokers, and livestream actors with significant revenue, Mr. Nguyễn Tiến Minh noted that this group has distinct characteristics compared to traditional business households. The tax authority has developed a tailored approach. To date, individuals operating on digital platforms like YouTube, TikTok, or KOLs have become relatively familiar with the policies. The tax authority has observed improved self-declaration and increased compliance among this group.

The Hanoi Tax Department stressed that all entities, whether organizations, businesses, or individuals, regardless of size, fame, or scale, must comply with the law. Intentional tax evasion will result in severe legal consequences, directly impacting the business environment and causing losses to the state budget. The tax authority will rigorously address any intentional violations or tax evasion.

Recently, in Hanoi, several cases have been detected and handled by the tax authority in collaboration with relevant agencies, including TikTokers Vũ Nam Phương (Cún Bông) and Nguyễn Thị Thu Hường (Hycloset), as well as the Tung Dining restaurant system. The Hanoi Tax Department noted that several other cases are under further investigation by the police.

Tax Expert: Livestream Sellers Earning $3 Million in 17-Hour Streams but Declaring Only $40,000-$130,000 Annually—Full Revenue Disclosure Mandated

Experts emphasize that mandating the full disclosure of revenue is essential to ensure transparency and fairness in taxation.

“Deputy Director of the Tax Department: The More Transparent and Open Businesses Are, the Less Likely They Are to Face Administrative Violations”

Mr. Mai Sơn, Deputy Director of the Tax Department, emphasizes: “The more transparent and compliant business households are, the less likely they are to face administrative violations. With proper collaboration with tax authorities, those who adhere to regulations will not be subject to inspections. In practice, audits are only conducted when there is a perceived risk.”

Unlock Surplus Public Land and Assets for Business Lease: Ministry of Finance Initiative

The Ministry of Finance has announced plans to collaborate with relevant ministries, sectors, and local authorities to review and facilitate the leasing of surplus public assets, including land, factories, and infrastructure, to businesses. This initiative aims to optimize the utilization of underused public properties, providing enterprises with valuable resources to expand their operations.