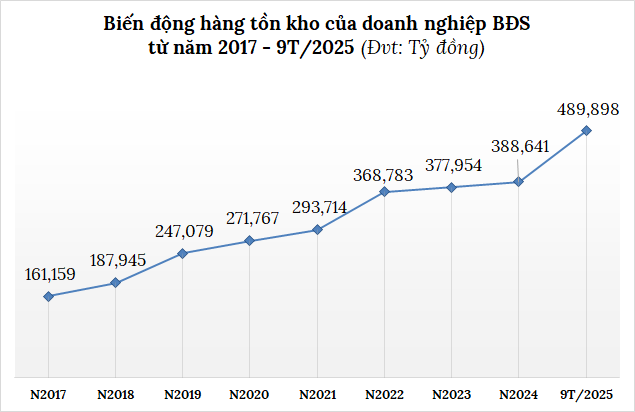

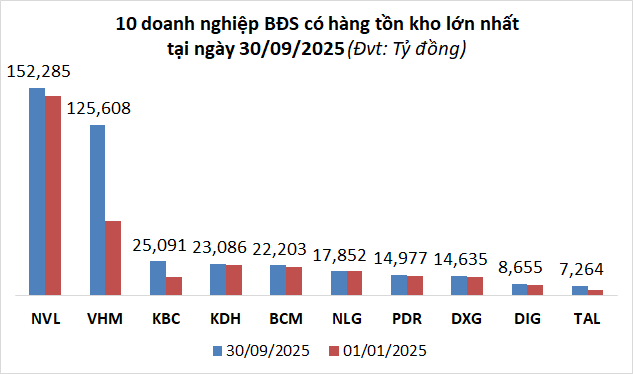

According to VietstockFinance, by the end of Q3/2025, the total inventory value of 104 real estate companies (listed on HOSE, HNX, and UPCoM) surged to nearly VND 499 trillion, a 26% increase from the beginning of the year.

Source: VietstockFinance

|

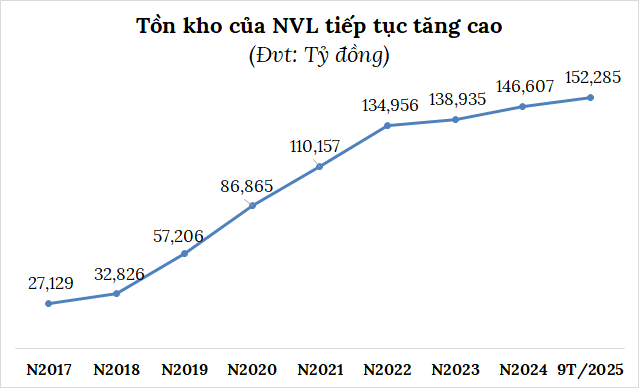

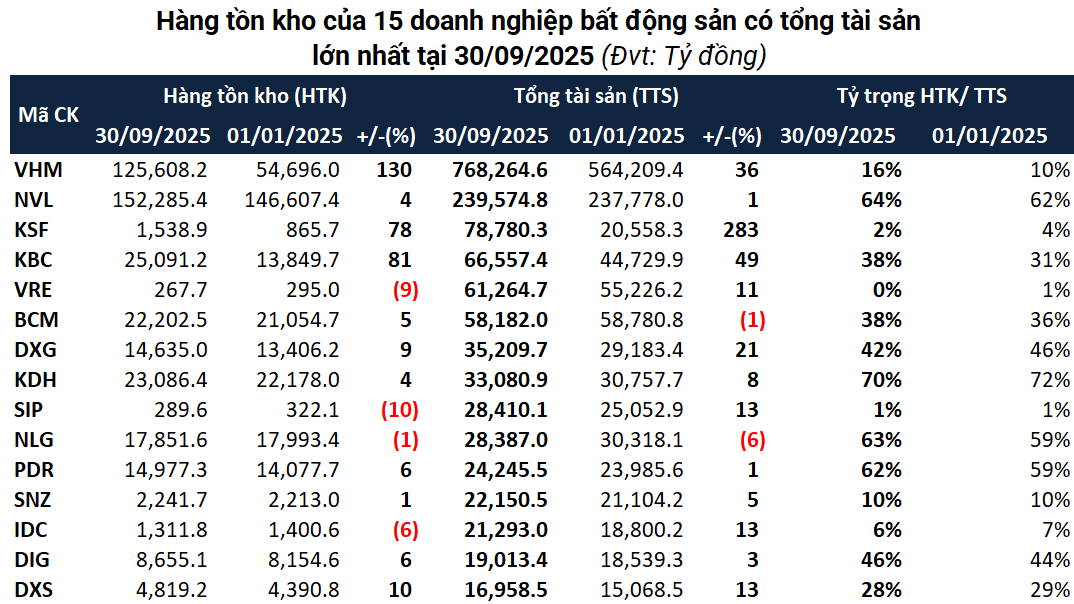

Novaland (HOSE: NVL) continues to lead the inventory rankings with nearly VND 152.3 trillion, a 4% increase from the start of the year, accounting for 31% of the entire sector. The majority of this inventory, over VND 145 trillion, is in properties under construction, with the remaining VND 7.3 trillion in completed properties.

Although not detailed, much of this value is likely concentrated in major projects such as NovaWorld Phan Thiết, NovaWorld Hồ Tràm, and Aqua City. As of September 30, 2025, Novaland has used this inventory as collateral for loans totaling over VND 61.7 trillion, while its total financial debt stands at nearly VND 64.3 trillion, up by VND 2.6 trillion from the beginning of the year.

Source: VietstockFinance

|

Vinhomes (HOSE: VHM) saw its inventory skyrocket to a record high of over VND 125.6 trillion, 2.3 times higher than at the beginning of the year. The majority, VND 97.2 trillion, is in properties under construction, 2.5 times higher, due to the accelerated development of large-scale projects, notably the 2,870-hectare Vinhomes Green Paradise Cần Giờ, which began construction in April 2025. By the end of September, Vinhomes’ unrecorded sales reached a historic high of VND 223.9 trillion.

Vingroup launches Cần Giờ’s mega seaside tourism urban area

VHM’s unrecorded sales hit a record high of VND 223.9 trillion by the end of September

| VHM records highest inventory by the end of Q3/2025 |

Industrial zone developers see significant inventory growth

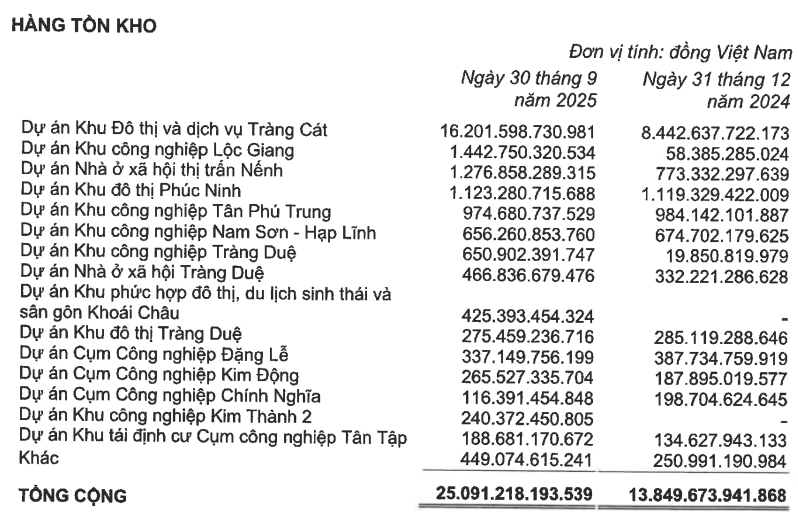

Among industrial real estate firms, Kinh Bắc (HOSE: KBC) topped the list for the first time with an inventory of over VND 25 trillion, an 81% increase. This is primarily due to the Tràng Cát urban and service project, which rose 92% to over VND 16.2 trillion, and the Lộc Giang industrial park, which surged 25 times to over VND 1.4 trillion.

Source: KBC

|

Becamex IDC (HOSE: BCM) followed with an inventory of over VND 22.2 trillion, a 5% increase, mainly from infrastructure construction, land clearance, and land use rights.

Other companies with inventories exceeding VND 10 trillion include Nhà Khang Điền (HOSE: KDH) at nearly VND 23.1 trillion (up 4%), Nam Long (HOSE: NLG) at over VND 17.8 trillion (down 1%), Phát Đạt (HOSE: PDR) at nearly VND 15 trillion (up 6%), and Đất Xanh Group (HOSE: DXG) at over VND 14.6 trillion (up 9%).

Source: VietstockFinance

|

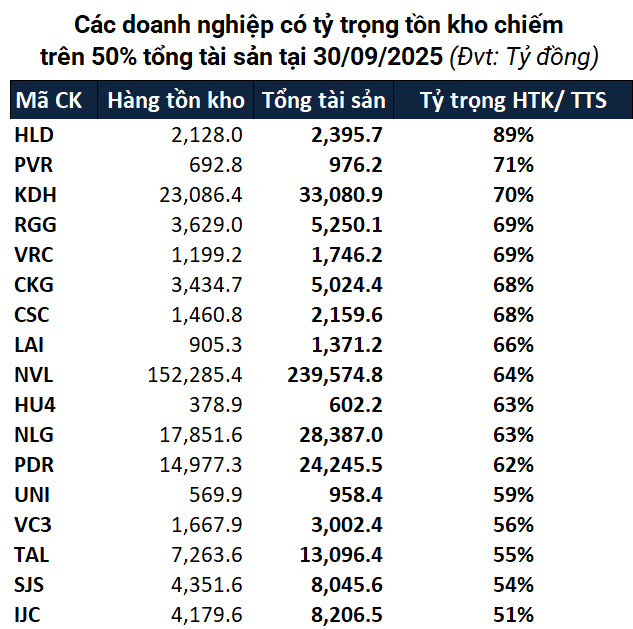

Many companies have inventories exceeding half of their assets

By the end of Q3, 17 real estate companies had inventories accounting for over 50% of their total assets, mostly in the residential segment.

Leading the list is HUDLAND Real Estate (HNX: HLD), with inventories making up 89% of total assets, amounting to over VND 2.1 trillion, a 16% increase from the beginning of the year.

Regal Group (UPCoM: RGG) has an inventory of over VND 3.6 trillion, up 4%, accounting for 69% of its capital. Taseco Real Estate (HOSE: TAL) stands at 55%, equivalent to nearly VND 7.3 trillion, up 78%. SJ Group (HOSE: SJS) also falls into this category with nearly VND 4.4 trillion in inventory, making up 54% of total assets, up 4%.

Source: VietstockFinance

|

In terms of total assets, the two giants, VHM and NVL, account for 57% of the sector’s total inventory, amounting to nearly VND 278 trillion, a 38% increase from the beginning of the year. Industrial real estate firms, including BCM and KBC, make up 10% of the sector, equivalent to nearly VND 47.3 trillion, up 35% from the beginning of the year.

Source: VietstockFinance

|

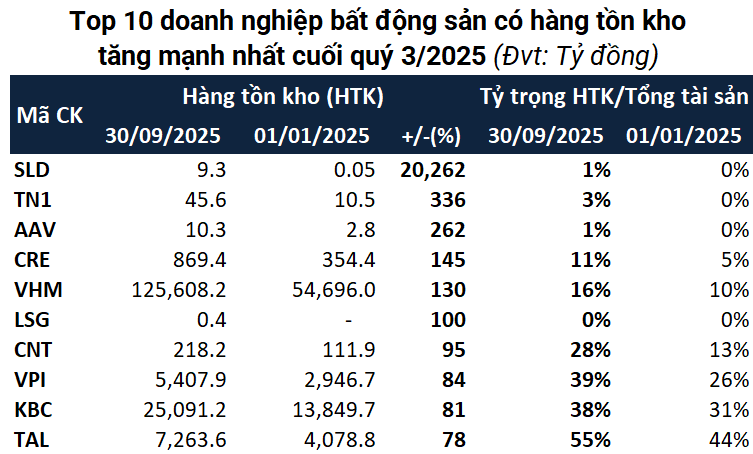

Additionally, some companies experienced significant inventory fluctuations. Among those with increases, Sacom Real Estate (UPCoM: SLD) saw its inventory surge to over VND 9 billion, more than 200 times higher than at the beginning of the year, due to rising costs of ongoing projects. Văn Phú Real Estate (HOSE: VPI) reported an inventory of over VND 5.4 trillion, up 84%, with costs for the Vlasta Thủy Nguyên project increasing by 82% to over VND 3.6 trillion.

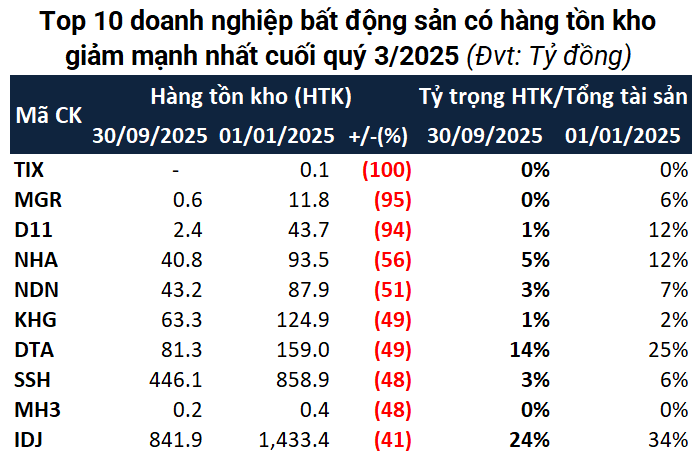

Conversely, among those with decreases, Nam Hà Nội Housing and Urban Development Corporation (HOSE: NHA) saw its inventory drop by 56% to nearly VND 41 billion, due to reduced costs for ongoing projects.

Source: VietstockFinance

|

Inventory rises in housing, falls in land plots

The Ministry of Construction reported that Q3 saw over 136,600 real estate transactions nationwide, 87% of the previous quarter and 97% of the same period in 2024. Of these, 32,100 were apartment and private house transactions, down 16% year-on-year.

Real estate inventory across projects totaled over 26,700 units/plots, including 6,300 apartments, 12,300 private houses, and nearly 8,100 land plots. Compared to Q2/2025, apartment and private house inventories rose by 37%, while land plots decreased by 31%.

– 08:00 20/11/2025

Unbelievable Deal: Purchase Premium Durian Export Profiles for Just Hundreds of Millions VND!

Police have identified service providers offering export procedures, including regional planting code registration, cadmium and gold testing, at prices ranging from 140 to 200 million VND.

Nationwide Distribution of New Gasoline Variant Set to Begin June 1, 2026, Sealing the Fate of RON92

Unleash the power of E10 fuel. This innovative blend, a harmonious fusion of 10% ethanol and 90% gasoline, is revolutionizing the way we drive. E10 fuel offers a cleaner, more sustainable alternative, reducing emissions and contributing to a greener future. Experience enhanced engine performance and efficiency with every fill-up, as E10 fuel optimizes combustion and maximizes power output. Make the switch to E10 and join the movement towards a more environmentally conscious and high-performing driving experience.

Global Logistics Leader Expands Investment Partnership in Vietnam

On the morning of November 18, 2025, in Hanoi, Mr. Vincent Clerc, Global CEO of A.P. Moller Maersk (Denmark), along with a high-level leadership delegation, visited and held discussions at Hateco Group, a company actively investing in logistics infrastructure in Vietnam.