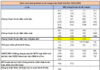

According to data from Phu Quy Jewelry Corporation, silver prices have declined today, with 999 silver bars priced at 1,953,000 VND per tael (buy) and 2,013,000 VND per tael (sell). Over the past week, silver bar prices have dropped by nearly 3%.

Meanwhile, 1kg 999 silver bars are priced at 52,079,870 VND (buy) and 53,679,866 VND (sell), as of 09:20 on November 20.

In the global market, silver is trading at 50.9 USD per ounce.

Silver remains stable around 51 USD per ounce as the market digests the minutes from the Fed’s October meeting, which revealed significant divisions. While many officials still anticipate rate cuts at some point, a substantial group has signaled that a December move is uncertain. The withdrawal of near-term easing expectations has bolstered the dollar, dampening some momentum in metal prices. Meanwhile, prolonged macro and geopolitical risks continue to support safe-haven demand.

Fundamental physical factors remain supportive, with technical momentum from last month’s breach of the 52 USD level encouraging buyers. Steady physical buying in Asia is sustaining demand, even as spot liquidity shows signs of improvement.

With attention shifting to the delayed U.S. jobs report and subsequent Fed commentary, silver’s next move will hinge on whether upcoming data reinstates expectations for aggressive cuts or confirms the Fed’s more cautious trajectory.