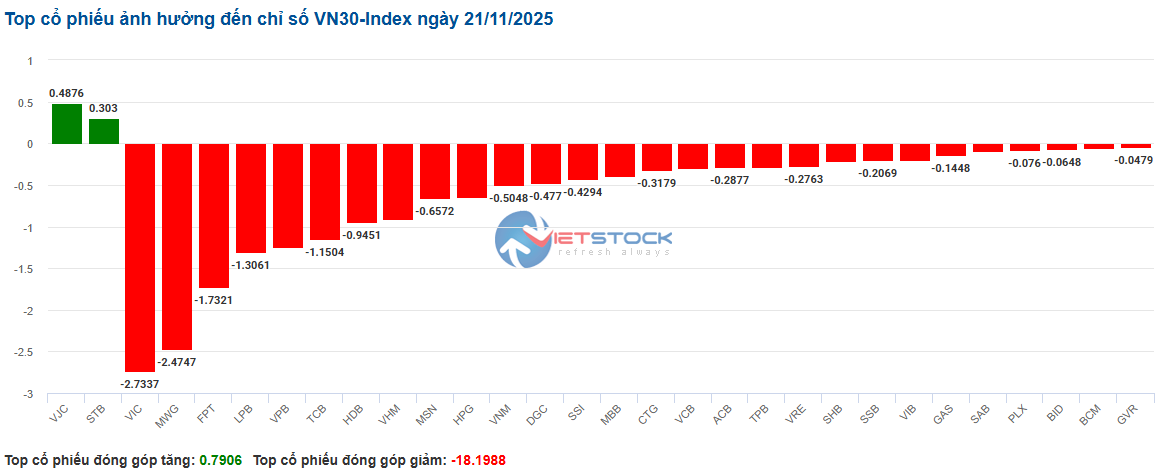

Stocks in the VN30 basket faced intense selling pressure, stripping over 18.1 points from the index. Notably, VIC, MWG, FPT, and LPB led the decline, contributing -2.73, -2.47, -1.73, and -1.3 points, respectively. Other significant losers included VPB, TCB, HDB, and VHM, all recording substantial drops.

Source: VietstockFinance

|

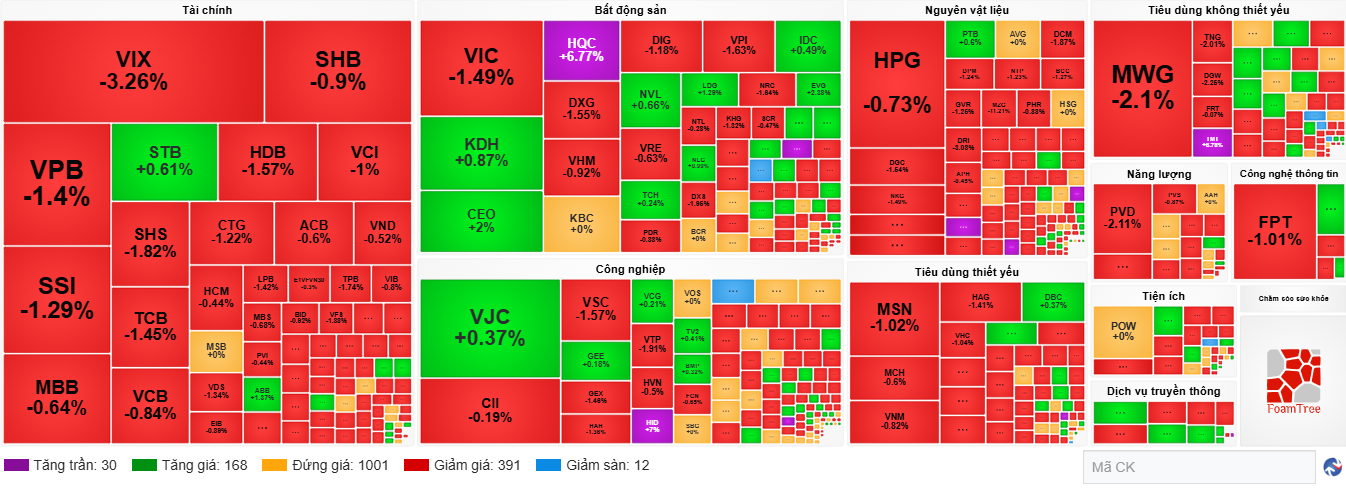

Capital flight from the financial sector has dragged down most stocks within this industry. Specifically, selling pressure was heaviest among brokerage firms, with VIX down 3.26%, SHS down 1.36%, and SSI down 1.29%. Banks also saw declines, including VPB (-1.58%), TCB (-1.45%), HDB (-1.57%), and SHB (-0.9%).

Real estate stocks were similarly divided, with selling pressure dominating. Notable decliners included VIC (-1.32%), DXG (-1.81%), DIG (-1.18%), and VRE (-0.63%). Meanwhile, modest gains were seen in KDH, CEO, KBC, IDC, and NVL, though these were insignificant.

Market polarization intensified compared to the opening session, with over 1,000 stocks trading and sellers firmly in control. Declining stocks outnumbered advancing ones 391 to 168.

Source: VietstockFinance

|

Opening: Broad Decline, VN-Index Sheds Over 8 Points

The morning session opened on a negative note, with red dominating across most sectors. The VN30 index was the hardest hit, as nearly all its constituent stocks declined.

Numerous VN30 stocks fell sharply, including FPT, VIC, VPB, MWG, HPG, and VHM. Only VJC and LPB managed to stay in the green.

Financial stocks continued their downward trend from previous sessions. Notable decliners included VPB (-1.23%), VIX (-1.83%), SSI (-1.44%), and HDB (-1.1%).

The materials and real estate sectors were equally bearish, led by industry heavyweights such as HPG (-0.37%), DGC (-0.82%), NKG (-0.85%), VIC (-0.53%), CEO (-0.4%), and VHM (-0.31%).

– 10:32 21/11/2025

Afternoon Technical Analysis, November 20th: Market Polarization Persists

The VN-Index remains locked in a tug-of-war near its 50-day SMA. Meanwhile, the HNX-Index is trending downward, marked by the emergence of a Three Black Crows candlestick pattern.

Market Pulse November 20: Foreign Investors Return to Net Buying Amid Low Liquidity Session

At the close of trading, the VN-Index climbed 6.99 points (+0.42%) to reach 1,655.99, while the HNX-Index dipped 0.8 points (-0.30%), settling at 264.23. Market breadth tilted toward decliners, with 370 stocks falling and 298 advancing. The VN30 basket showed a balanced performance, featuring 13 decliners, 12 gainers, and 5 unchanged.

Vietstock Daily 21/11/2025: Cautious Sentiment Prevails?

The VN-Index remains in a tug-of-war along the middle line of the Bollinger Bands, with trading volume below the 20-day average, signaling investor caution. Despite this, both the Stochastic Oscillator and MACD continue to hold bullish signals, painting a positive short-term outlook. For the recovery to solidify, the index must break above the 50-day SMA, supported by improved liquidity in upcoming sessions.

Foreign Investors Ease Sell-Off Pace, Counter-Trend with Nearly VND 400 Billion Buy-In on Blue-Chip Stock

Foreign investors narrowed their net selling streak, with a modest net sell of approximately VND 84 billion across the entire market today.