Earning VND 30 Million with Two Dependents? No Tax Required

On the afternoon of November 19th, Minister of Finance Nguyen Van Thang addressed National Assembly delegates’ concerns regarding the draft Law on Tax Administration and the amended Personal Income Tax Law.

Regarding the progressive tax brackets, the Minister stated that the proposal to maintain the current seven brackets would be carefully considered and incorporated.

Another critical issue, the family circumstance deduction, was highlighted by Minister Thang. Recently, the National Assembly Standing Committee approved a resolution adjusting the personal income tax deduction.

Minister of Finance Nguyen Van Thang addresses the National Assembly. Photo: Nhu Y

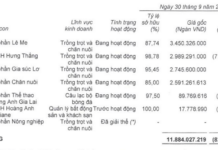

The resolution increases the deduction for taxpayers to VND 15.5 million per month and VND 6.2 million per month for each dependent. These adjustments are based on fluctuations in the consumer price index, average per capita income, and GDP growth.

“With these adjustments, individuals earning VND 17 million per month (with no dependents), VND 24 million per month (with one dependent), or VND 30 million per month (with two dependents) will not be subject to tax,” explained Minister Thang.

No “Tax on Tax” Scenario

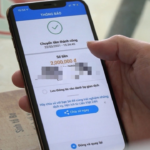

Addressing concerns about taxing gold bar transfers, the Minister assured that the issue had been thoroughly studied to prevent gold speculation and market pressure. He emphasized, “There will be no ‘tax on tax’ scenario,” and the government will determine the appropriate timing for implementation.

“The 0.1% tax rate aims to regulate behavior, curb speculation, and reduce pressure on the gold and foreign exchange markets—factors that can significantly harm citizens when gold prices are manipulated. This is one of several measures to stabilize the gold market,” Minister Nguyen Van Thang stressed.

Regarding real estate transfer taxes, the Minister noted that the draft law retains the current 2% tax rate on the transfer value of each transaction, a method proven to be simple, enforceable, and verifiable.

However, the Ministry has extensively studied the possibility of switching to a tax based on the profit margin. According to the Minister, there is currently insufficient basis for such a change. Future considerations may arise once real estate transaction prices become more transparent.

The Minister of Finance revealed that the government is considering a pilot government-run real estate trading platform. Implementation requires critical conditions, such as comprehensive digitized land data linked to the VneID system. This would enable authorities to accurately identify and tax real estate businesses.

Navigating Land Use Purpose Conversion: Key Considerations and Solutions

Delegates proposed that residential land conversion fees for households should be calculated based on the state-regulated price framework, rather than market rates.