Thai Binh Cement JSC (HNX: TBX) has announced its receipt of a notice from the State Securities Commission (SSC) regarding the revocation of its public company status.

The Hanoi Stock Exchange (HNX) has also issued a warning about the potential delisting of TBX shares, as the company no longer meets the criteria to maintain its public company status under current regulations.

In October 2025, Thai Binh Cement held an extraordinary general meeting, seeking shareholder approval to withdraw from the stock market.

With a chartered capital of VND 15 billion, and including funds from reserves and additional capital, the total falls below the VND 30 billion minimum threshold mandated by regulations.

The shareholders unanimously agreed to relinquish public company status and delist from HNX. They also approved the company’s management of the shareholder registry via share registers and ownership certificates post-trading suspension. In cases where minority shareholders wish to transfer shares, the company may repurchase them.

While the leadership previously discussed plans to increase capital to over VND 30 billion, these plans remain unimplemented.

Thai Binh Cement, established in 1979 as Thai Binh Cement Enterprise, underwent corporatization in 2001 and listed on HNX in 2008. Its headquarters are located at 1 Duong Quach Dinh Bao, Thai Binh Ward, Hung Yen Province.

White cement, the company’s flagship product, once dominated the Northern market and was widely used in civil construction projects, from residential buildings to decorative tiles, terrazzo, and concrete blocks.

During its early listing years, TBX shares traded actively, peaking in 2011 at over five times their initial listing price.

Revenue reached approximately VND 85 billion in 2009–2010, with net profits nearing VND 6 billion. However, in recent years, annual net profits have dwindled to just a few hundred million dong.

In 2020, business results plummeted, with revenue dropping to around VND 20 billion and a loss of over VND 2 billion due to COVID-19 impacts and insufficient working capital, leading to scaled-down operations. Limited access to credit forced TBX to partner with external investors to sustain production, while facing increasing competition from imported white cement.

In Q3/2025, TBX reported revenue of approximately VND 4 billion and a net profit of VND 142 million; cumulative figures for the first nine months were VND 11 billion in revenue and VND 358 million in profit. As of September 30, 2025, total assets stood at around VND 26 billion, with no outstanding debt. The workforce numbered 52 employees as of June-end.

Thai Binh Cement is currently investing in a super-white quartz production project at Tien Hai Industrial Park (Hung Yen), slated for full operation by Q3/2026. The existing plant in Tien Phong Ward (former Thai Binh Province) is subject to relocation under new urban development plans.

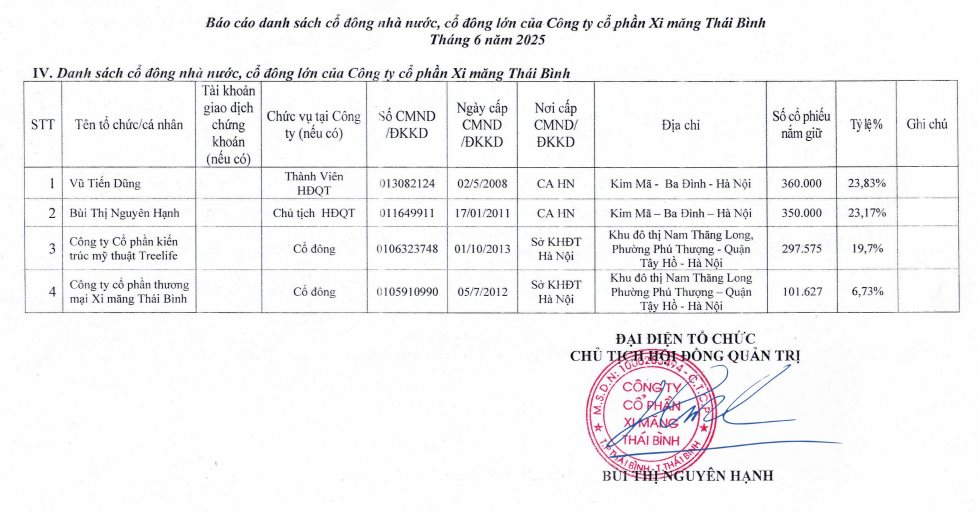

As of 2025, the shareholder structure shows Chairwoman Bui Thi Nguyen Hanh holding 23.17% of shares, and Board Member Vu Tien Dung owning 23.83%. Notable institutional shareholders include Treelife Architecture & Arts JSC (19.7%) and Thai Binh Cement Trading JSC (6.73%).

HNX-Index Declines in Both Value and Liquidity in October

In October 2025, the HNX-Index experienced significant volatility. Closing the month at 265.85 points, it marked a nearly 3% decline compared to the previous month. Liquidity also trended downward during this period.