Recently, Lam Dong Pharmaceutical Joint Stock Company (Ladophar, Stock Code: LDP, HNX) announced the documents for the Extraordinary General Meeting of Shareholders (EGM) scheduled for December 10, 2025.

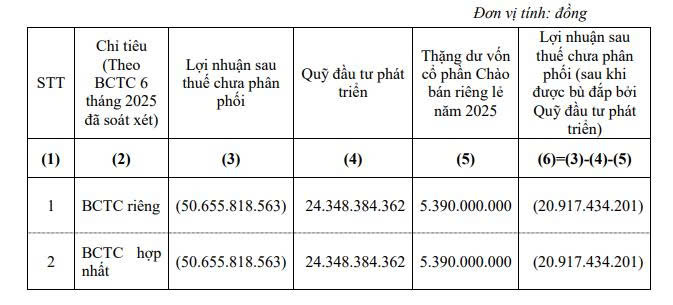

According to the audited financial statements for the first half of 2025, as of June 30, 2025, Ladophar reported an accumulated loss of nearly VND 50.7 billion. The company stated that based on its current business performance, it anticipates that this accumulated loss will take approximately 4-5 years to fully offset.

To address this, Ladophar will propose to shareholders the use of the development investment fund and capital surplus from the 2025 private placement to partially cover the accumulated loss, as detailed below:

Source: LDP

Additionally, the company plans to liquidate assets to further mitigate the accumulated loss.

During the EGM, Ladophar will also seek shareholder approval for a VND 300 billion credit limit. This includes VND 150 billion for working capital to support production and business activities, and VND 150 billion for medium to long-term investments.

Notably, Ladophar will propose a rights issue of nearly 9.4 million shares to existing shareholders at a ratio of 2:1, meaning for every 2 shares held, shareholders can purchase 1 new share.

With an offering price of VND 10,000 per share, Ladophar expects to raise over VND 93.6 billion. The proceeds will be allocated as follows: VND 90 billion to address investment shortfalls in the LDP CO2 plant and/or repay loans from individuals or organizations, and the remaining VND 3.6 billion to supplement working capital.

The issuance is planned for 2026, pending approval from the State Securities Commission (SSC) for the private placement.

If successful, Ladophar’s chartered capital will increase from nearly VND 187.3 billion to over VND 280.9 billion.

In other developments, Mr. Pham Trung Kien, Chairman of Ladophar’s Board of Directors, recently registered to sell 809,600 LDP shares to restructure his investment portfolio. The transaction is expected to take place between November 27, 2025, and December 25, 2025, through negotiated and/or order-matching methods.

If the transaction is completed, Mr. Kien’s ownership of LDP shares will decrease from 898,392 shares to 88,792 shares, reducing his stake from 4.8% to 0.47%.

VietinBank Securities Rebrands: New Name, New Identity

The extraordinary shareholders’ meeting of VietinBank Securities will approve the resignation of Ms. Bùi Thị Thanh Thúy from her position as a Board of Directors member and elect a new member to fill the vacancy. Additionally, the company aims to rebrand, including a name change and a refreshed corporate identity.

KIS Securities Finalizes Plan to Inject Hundreds of Billions into Proprietary Trading and Margin Lending

KIS Vietnam Securities Corporation (KIS Vietnam) has successfully obtained written approval from shareholders between November 5th and 15th. The outcome confirms the adjustment of certain details within the plan to offer over 78.9 million shares, as initially approved during the Extraordinary General Meeting of Shareholders on October 15th.