U.S. Stocks Rebound as Investors Await Nvidia’s Earnings Report

In response to investor anticipation, Nvidia has projected a fourth-quarter revenue of $65 billion, surpassing Wall Street’s estimate of $61.66 billion. This optimistic forecast is driven by the surging demand for AI technologies, offering a critical signal to the market amid concerns over tech valuations.

Nvidia’s bullish outlook lifted market sentiment, with the chipmaker’s shares rising approximately 3% ahead of its earnings release. Analysts predict continued outperformance, supported by a $500 billion order backlog extending to 2026. On Wall Street, the S&P 500 gained 0.38% to 6,642.16, the Nasdaq advanced 0.59% to 22,564.23, and the Dow Jones edged up 0.1% to 46,138.77. Alphabet led the Big Tech rally, climbing 3% on optimism surrounding its newly launched Gemini 3 AI platform.

European markets painted a contrasting picture. London’s FTSE 100 fell 0.5% to 9,507.41, Paris’s CAC 40 dipped 0.2% to 7,953.77, and Frankfurt’s DAX slipped 0.1% to 23,162.92.

David Morrison, Senior Market Analyst at Trade Nation, noted that selling pressure has eased since earlier in the week, but investors remain cautious about increasing risk exposure ahead of Nvidia’s earnings announcement.

November has been challenging for investors, with growing concerns that this year’s tech-driven rally may have overextended. The “Magnificent Seven”—Amazon, Meta, Alphabet, Nvidia, Apple, Microsoft, and Tesla—have propelled markets to record highs, but fears persist that any weakness in their earnings could burst the AI bubble. Investors worry that the hundreds of billions poured into AI may be excessive.

On November 19, markets also digested the Federal Reserve’s October meeting minutes, which indicated officials favor holding rates steady in December. This stance could disappoint former President Donald Trump, who expressed a desire to “fire” Fed Chair Jerome Powell earlier that day.

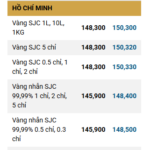

Exclusive Gold Sale: November 20th – Massive Discounts on Gold Bars & Rings

Domestic and global gold prices experienced a synchronized decline during the trading session on November 20th.

Silver Prices Surge 4% Consecutively, Breaking the 56 Million VND/kg Barrier

Silver prices today have surged both domestically and globally, marking a significant uptick in value across markets.