After three consecutive recovery sessions, today’s trading session witnessed widespread selling pressure across multiple sectors, particularly in banking, real estate, and securities—the groups with the most significant influence on market dynamics.

The banking sector took center stage in the correction, with VPB, VCB, and TCB emerging as the top three negatively impacting stocks. Other banking stocks like MBB, MSB, and SHB also declined, reflecting a clear cautious sentiment among leading stocks. Bucking the trend within the banking group, HDB emerged as the most positive driver, though it wasn’t enough to counterbalance the selling pressure.

Red dominates the VN30 group.

In the securities sector, profit-taking pressure intensified. SSI, VND, and VIX saw broad declines, with VIX and VND losing nearly 4%. Red also dominated real estate stocks, as DXG, CEO, GEX, NVL, and others fell after a previous recovery. VIC was a rare bright spot, but its modest gain wasn’t enough to offset the sector’s overall trend.

Speculative and mid-cap stocks declined more sharply than the broader market. HAG dropped 6.4% amid heightened short-term profit-taking pressure.

Conversely, some sectors maintained their upward momentum. HPG continued to attract strong inflows, becoming the focal point of the steel group as it sustained its rally and saw consistent net buying by foreign investors over multiple sessions.

The fertilizer and chemical sectors also outperformed the market, with DCM, DPM, and DBC posting gains, though their contribution to the market was modest. VNM returned to positive territory, while HDB stood out in the banking group with a nearly 3% increase, providing significant support in a market where liquidity remained concentrated in select stocks.

At the close of trading, the VN-Index fell 10.92 points (0.66%) to 1,649 points. The HNX-Index dropped 2.33 points (0.87%) to 265.03 points, and the UPCoM-Index declined 0.36 points (0.3%) to 119.64 points.

Liquidity on HoSE exceeded 23.5 trillion VND. Foreign investors net sold nearly 720 billion VND, primarily in DGC, VND, MWG, and MBB.

Q3 Non-Performing Loan Coverage Ratio Continues to Improve

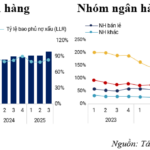

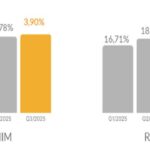

The non-performing loan coverage ratio of the banking system continued its recovery trend in Q3. Effective management of bad debts has provided banks with additional time to rebuild their buffers following the previous sharp decline. Each bank implements distinct provisioning policies based on its strategic direction, leading to varying approaches in provisioning across different groups.

Over Half a Billion USD Vanishes from the World’s Largest Bitcoin Fund

According to data from Farside Investors, investors withdrew a net $523 million from BlackRock’s iShares Bitcoin Trust (IBIT) on November 18th. This marks the largest single-day outflow since the fund’s inception.

Empowering Financial Growth: Banks Leading the Nation’s Development Journey

Credit recovery is robust and projected to sustain its strong growth trajectory, driven by substantial capital demand from the retail sector and businesses, as well as the ripple effects of public investment. This momentum is poised to significantly contribute to achieving the ambitious GDP growth target of 8% by 2025.