Van Phu Real Estate Development JSC (stock code: VPI, HoSE) has announced that Van Phu – B&C JSC has successfully increased its charter capital from VND 6 billion to VND 1,866 billion through the issuance of 186 million shares.

Following this capital increase, VPI’s ownership in Van Phu – B&C has been diluted to 0.225%, meaning Van Phu – B&C is no longer a subsidiary of VPI.

Established in 2018 as Van Phu Homes JSC, the company initially had a charter capital of VND 6 billion, with VPI holding 70%. Other shareholders included Ms. Nguyen Dieu Tu (20%), Mr. Nguyen Hoang Ha (5%), and Mr. Nguyen Viet Bach (5%). Ms. Nguyen Dieu Tu served as the CEO.

The company’s registered business activities include real estate consulting, brokerage, and auction services. In November 2021, Van Phu Homes was renamed Van Phu – B&C.

In March 2023, Mr. To Nhu Thang was appointed Chairman of the Board of Directors and legal representative of Van Phu – B&C. Four months later, this position was transferred to Mr. Vu Thanh Tuan, Deputy General Director of VPI.

According to the announcement, Van Phu – B&C completed the issuance of 186 million shares on November 18, 2025. VPI likely did not exercise its pre-emptive rights, maintaining its ownership of 420,000 shares but reducing its stake to 0.225%. The post-issuance shareholder structure has not yet been disclosed.

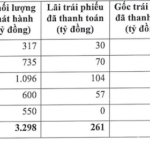

In recent developments, Van Phu submitted a report on its private bond issuance to the Hanoi Stock Exchange (HNX).

On October 31, 2025, Van Phu issued 1,350 bonds under the code VPI12503, with a face value of VND 100 million per bond, raising VND 135 billion. The bonds have a 3-year term, maturing on October 31, 2028, with a fixed interest rate of 10% per annum.

According to Resolution No. 2710-1/NQ-HĐQT dated October 27, 2025, Van Phu used VPI shares owned by Mr. To Nhu Toan, Chairman of the Board, and THG Holdings (an affiliate of Van Phu) as collateral for the bonds. The company also approved transactions with related parties, if any, for the bond issuance.

As per VPI’s 2025 Semi-Annual Corporate Governance Report, THG Holdings is an affiliate of Chairman To Nhu Toan, where he also serves as Chairman.

As of June 30, 2025, Chairman To Nhu Toan held 72.6 million VPI shares, equivalent to 22.68% of the company’s capital. Several individuals related to Mr. Toan also hold significant VPI shares.

Meanwhile, THG Holdings owns over 68 million VPI shares, representing 21.27% of the company.

In terms of business performance, Van Phu’s pre-tax and after-tax profits for Q3/2025 were VND 143 billion and VND 119 billion, respectively, up 16% and 8% year-on-year.

For the first nine months of 2025, the company reported after-tax profits of VND 262.9 billion, achieving over 75% of its full-year 2025 profit target.

As of September 30, the company’s inventory stood at VND 5,407 billion, an 83.5% increase from the beginning of the year, primarily due to increased investment in three projects: Vlasta – Thuy Nguyen (Hai Phong), TT39-40 Van Phu New Urban Area (Hanoi), a project in Phu Thuan Ward (former District 7, Ho Chi Minh City), and other developments.

Quảng Ninh Issues Ultimatum to Nearly Two-Decade-Delayed Real Estate Project

Mr. Vu Van Dien, Standing Vice Chairman of the Quang Ninh Provincial People’s Committee, has taken direct charge, mandating all parties to finalize financial and technical procedures promptly. This ensures the swift issuance of Land Use Right Certificates to residents, bringing an end to the nearly two-decade-long stagnation of the investment project for the construction and infrastructure development of the New Urban Area North of Cau Bang Bridge.

Which Real Estate Sector Saw the Biggest Price Surge in the Last Decade?

From 2015 to 2025, central Ho Chi Minh City’s real estate prices surged across all segments, though growth rates varied significantly. Land plots led the charge with a staggering 384% increase (from VND 25 million to VND 121 million per square meter), followed by apartments at 197% (VND 31 million to VND 92 million), private houses at 168% (VND 56 million to VND 150 million), and storefront properties at 134% (VND 92 million to VND 215 million).

The Journey of IPA’s Newly Issued VND 1.4 Trillion Bond Series

IPA has successfully raised over VND 1.4 trillion through the issuance of “triple-zero” bonds with a fixed interest rate of 9.5% per annum over a 5-year term. The proceeds will be utilized to acquire newly issued shares of a subsidiary, which will subsequently employ the funds to purchase multiple additional subsidiaries.