As new regulations on transitioning from lump-sum tax to revenue-based tax declaration take effect from January 1, 2026, many small traders and business households are scrambling to adapt. Adding to their concerns is the tax exemption threshold set at only VND 200 million per year.

Does Not Reflect Reality

Mr. Nguyen Minh Thanh, owner of a grocery store in Ho Chi Minh City, shared that for businesses like his, the VND 200 million annual revenue threshold is easily met within a few months. However, the actual profit margin is very low. He cited examples such as a box of noodles purchased for VND 80,000 and sold for VND 85,000, or a box of soft drinks bought for VND 150,000 and sold for VND 165,000. For individual items like fish sauce, salt, monosodium glutamate, or spices, the profit margin is even lower. If tax is calculated on revenue (VAT and personal income tax – PIT), it would result in a loss, considering additional expenses such as capital, rent, utilities, spoiled goods, and expired products. “Grocery businesses have high inventory levels but very low profit margins. Taxing based on a percentage of revenue would push small businesses into the risk of bankruptcy. I believe maintaining lump-sum tax or applying it to businesses with revenue up to VND 500-600 million would be more reasonable,” he said.

Similarly, Mr. Le Thanh Hai, a dried goods vendor at Nguyen Dinh Chieu Market (Ho Chi Minh City), stated that his family’s monthly revenue is about VND 150 million, totaling over VND 1.8 billion per year, but the actual profit is only around 6%-7%. After deducting rent, labor, and inventory losses, he is left with just over VND 120 million annually. “This equates to an income of about VND 10 million per month. Yet, salaried workers receive a deduction of VND 15.5 million per month before tax calculation, while we receive nothing. This is unfair,” Mr. Hai expressed.

Sharing the same concern, Ms. Tran Thi Minh, a small business owner in Thong Tay Hoi Ward, mentioned that her daily revenue ranges from VND 2-3 million, with a profit margin of only about 10%. If she factors in her own labor costs, she is left with almost no profit. “If I have to pay a 1.5% tax on revenue, it’s like working for free,” Ms. Minh said.

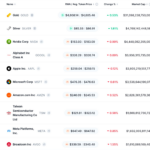

Many small traders and business households are perplexed by the upcoming tax revenue threshold. Photo: LE TINH

Another food service business owner mentioned that lump-sum tax has long been considered a fixed cost. Transitioning to revenue-based taxation with a 4.5% tax rate will significantly increase the burden. Meanwhile, with an annual revenue of VND 1 billion, the actual profit for the business owner is only about VND 15 million per month, excluding self-paid wages. “Therefore, when calculating tax as a percentage of revenue, it is necessary to raise the taxable threshold to align with business realities,” the owner emphasized.

Mr. Do Duy Thanh, an expert in the food and beverage (F&B) industry, believes that the taxable threshold should be based on the actual income of business households, typical profit margins by industry, and the current minimum living standards. For small businesses, especially in the F&B sector, after deducting costs for raw materials, labor, rent, utilities, and losses, the remaining amount is equivalent to the “labor income” of the business owner. If taxed when revenue is too low, actual income could fall below the minimum living requirements.

According to Mr. Thanh, in Ho Chi Minh City, a business household needs about VND 10-15 million per month to maintain a basic living standard. This corresponds to an F&B revenue of VND 600-800 million per year due to low profit margins of 12%-20%. The spa industry requires VND 500-700 million per year because of high labor and supply costs. Retail, with profit margins of only 3%-7%, needs revenue ranging from VND 800 million to VND 1 billion per year to ensure minimum income. Based on these realities, Mr. Thanh believes the current threshold of VND 200 million per year is too low and does not reflect urban costs and living standards. He suggests a suitable threshold of VND 500-700 million per year for F&B and spa industries, and VND 800 million to VND 1 billion per year for retail to ensure tax fairness and sustain livelihoods for millions of workers.

Raising the Taxable Threshold

According to Mr. Doan Minh Hong, Director of DVL Tax Accounting Services Company, Decision 3389/QD-BTC in 2025 approved the plan to transition the tax management model for business households. From 2026, lump-sum tax will be abolished, replaced by declaration and self-payment methods.

Specifically, business households with revenue below VND 200 million per year are tax-exempt; those with revenue from VND 200 million to below VND 3 billion per year will pay VAT and PIT directly at rates of 1.5%-10% depending on the industry; and those with revenue from VND 3 billion to below VND 50 billion per year will pay tax using the deduction method and 17% PIT on profits.

Mr. Hong believes these tax rates are still quite high, especially for the VND 3-50 billion revenue group, and suggests a temporary 3-5 year tax reduction policy to allow business households to invest in equipment, software, and accounting services, rather than allocating the budget for large-scale training support. “Reducing taxes during the transition period will motivate business households to voluntarily participate in the electronic tax system, enhancing transparency,” he said.

Mr. Nguyen Ngoc Tinh, Vice Chairman of the Ho Chi Minh City Tax Consultancy and Agency Association, noted that income from business households and salaried workers both stem from labor value creation. However, from 2026, salaried workers will receive a family circumstance deduction of VND 15.5 million per month, while business households will not. This creates an unfair tax policy between the two groups.

He proposed that the government conduct surveys in traditional markets and residential areas to determine average revenue, profit margins, and actual costs by industry. “Many households with VND 1 billion in annual revenue have profits of only VND 100-150 million, which, when divided among 2-3 family workers, leaves each person with just a few million per month. Without family circumstance deductions like salaried workers, this is clearly disadvantageous,” Mr. Tinh analyzed.

From an economic expert’s perspective, Dr. Nguyen Quoc Viet (University of Economics – Vietnam National University, Hanoi) pointed out that the key issue lies not in the tax rate but in the taxable threshold and compliance costs. According to Dr. Viet, the minimum taxable revenue should be raised to VND 500 million to VND 1 billion per year, equivalent to the exemption levels in many regional countries. A reasonable threshold would reassure business households to declare honestly, prevent “revenue evasion,” and limit the risk of price increases due to additional VAT. “If the taxable threshold is too low, business households will fear tax audits and seek ways to evade taxes. However, with an appropriate threshold, they will cooperate better, contributing to market price stability and supporting low-income earners,” Dr. Viet emphasized.

Must Fully Assess Real-World Impact

On the afternoon of November 19, during the discussion on the draft Law on Personal Income Tax (amended), Delegate Hoang Van Cuong (Hanoi delegation) stated that the VND 200 million annual tax exemption threshold is unrealistic. He provided an example: a business household buys a box of milk for VND 900,000 and sells it for VND 1 million, making a profit of VND 100,000 per box. Selling 200 boxes generates VND 200 million in revenue, but the profit is only VND 20 million. “Taxing this VND 20 million profit is unreasonable, while a salaried worker receives a family circumstance deduction of VND 186 million per year, plus VND 260 million for dependents. This means a milk seller would need VND 2.6 billion in revenue to match this deduction,” Mr. Cuong analyzed.

He proposed that for retail and agency groups, the starting point should be VND 1.5 billion; for service groups, VND 500 million; and for other production and business sectors, at least VND 1 billion. He cited the example of a hairdresser: with VND 200 million in annual revenue, the income is only about VND 150 million, yet they are still taxed, which is unfair.

Delegate Nguyen Van Chi (Nghe An delegation) also expressed concern. She believes the draft should carefully assess the impact, especially as business households transition from lump-sum tax to revenue-based declaration from 2026. According to Ms. Chi, business households currently do not participate in social insurance, have no pensions, and must bear all operational costs and market risks.

She analyzed: the VND 200 million annual threshold equates to VND 16 million in monthly revenue. With an average profit margin of about 10%, the actual income is only VND 1.6 million per month, yet they must pay personal income tax. In contrast, salaried workers pay tax only when their income exceeds VND 15.5 million per month, not to mention deductions for dependents. Ms. Chi considers this a clear inequality.

Additionally, transitioning from lump-sum tax to declaration will certainly increase actual revenue compared to previous lump-sum levels, significantly raising taxable amounts. While the draft law reduces taxes for salaried workers and some high-income groups, business households receive no corresponding relief mechanisms.

Given these discrepancies, Delegate Nguyen Van Chi urged the drafting agency to more thoroughly assess the real-world impact, adjust the taxable revenue threshold, and implement deduction policies to ensure fairness between salaried workers and business households, avoiding additional burdens amid rising living and production costs.

(To be continued)

Tax Authority Responds to Criticism Over Confusing Rental Property Tax Regulations

Residents highlight that the current tax regulations for individuals leasing property lack clarity, making it challenging to distinguish between property rental activities and residential services.

From Presumptive to Declaration: What Do Business Households Need to Prepare?

“VPBank, in collaboration with the Vietnam Tax Consulting Association (VTCA) and MISA Joint Stock Company, hosted a workshop titled “Transitioning from Tax Registration to Tax Declaration: What Do Business Households Need to Prepare?”. The event was graced by the presence of tax authorities, finance and accounting experts, media representatives, and nearly 5,000 business households who joined online.”

Accelerating New Store Openings, WinCommerce Profitable for the Fourth Consecutive Quarter

WinCommerce continues to thrive and profit for the fourth consecutive quarter, attributing its success to a robust expansion strategy targeting rural areas. By proactively embracing modern consumer trends and catering to the challenges faced by traditional channels, WinCommerce has effectively positioned itself at the forefront of the industry.