Recent trading sessions have highlighted significant movements in the ABB stock of An Binh Commercial Joint Stock Bank (ABBank). Since the beginning of November, the stock has surged by nearly 14%, outperforming the broader banking sector.

Currently, ABBANK’s ABB stock is trading near 15,000 VND per share, doubling its value compared to the end of last year.

Notably, despite the strong rally, ABB’s valuation remains attractive. The bank’s book value per share exceeds 15,000 VND, resulting in a P/B ratio of less than 1—lower than the industry average. This makes ABB an appealing choice for investors seeking both value and growth, especially given the bank’s promising profit outlook.

ABBank Stock Performance

The surge in ABB’s stock price is not solely due to favorable market conditions but is also supported by significant improvements in its business fundamentals and a robust restructuring strategy.

In the first nine months of 2025, ABBANK’s pre-tax profit reached 2,319 billion VND, nearly 10 times higher than the same period in 2024. This makes ABBANK the fastest-growing bank in terms of profit within the industry.

The primary driver of this profit surge is the across-the-board improvement in key revenue streams. Net interest income rose by 54% to 3,380 billion VND, driven by credit expansion and well-managed funding costs. Net fee income from services increased by 133%, reflecting a rebound in transaction demand and the use of value-added products by customers.

Most notably, net income from other activities soared to 1,759 billion VND, a 13.5-fold increase year-on-year, primarily from the recovery of previously written-off debts and provision reversals.

While revenues surged, costs were kept in check. Operating expenses rose by only 8%, and provisioning costs decreased by 6% to 1,232 billion VND.

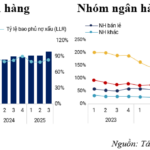

The reduction in provisions is not due to technical adjustments but reflects genuine improvements in asset quality. Non-performing loans (NPLs) decreased by 23%, from 3,691 billion VND to 2,830 billion VND, with the NPL ratio dropping from 3.74% to 2.63%. Additionally, the NPL coverage ratio increased from 30% to over 60%, indicating that ABBank is strengthening its risk buffer while effectively managing legacy debts.

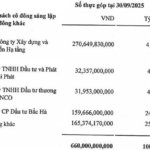

As of the end of September, ABBANK’s loan portfolio reached 107,573 billion VND, a 9.7% increase compared to the end of 2024. Customer deposits grew even more robustly, rising by 31% to 118,712 billion VND, making ABBANK the fastest-growing bank in terms of deposits in the system.

Total assets as of Q3 stood at 204,576 billion VND, a 16% increase year-to-date.

ABBANK’s leadership stated, “The positive business results in the first nine months demonstrate our unwavering commitment to balanced development, focusing on efficiency, sustainability, and creating value for customers, shareholders, and the community. The approval from the State Bank of Vietnam to increase our charter capital by over 3,600 billion VND is a significant milestone, enabling us to strengthen our financial capacity, expand operations, and develop new customer-centric products and services. This will further solidify our long-term partnership with customers and shareholders on the path to sustainable growth.“

Alongside impressive business results, the explosive performance of ABBANK’s stock has been accompanied by significant internal changes. On November 14, ABBANK announced a series of resolutions to strengthen its senior leadership team, aiming to enhance operational efficiency and governance. Mr. Vu Van Tien was appointed Chairman of the Board of Directors, and Mr. Dao Manh Khang became Vice Chairman. In his new role, Mr. Vu Van Tien will directly steer the bank’s strategic direction and lead all banking activities during this acceleration phase.

Simultaneously, ABBANK made changes to its senior management: Mr. Pham Duy Hieu stepped down as CEO at his own request but will continue to contribute as a member of strategic committees. Mr. Le Manh Hung, with over 23 years of banking experience and previously Director of the Wholesale Banking Division, was appointed Acting CEO effective November 14.

Analysts view these senior leadership changes as strategically significant, aligning with the bank’s direction announced at the 2025 Annual General Meeting: streamlining operations, emphasizing efficiency, and leveraging technology and digital transformation. This is expected to accelerate growth and improve operational quality starting in 2025.

In parallel with governance restructuring, ABBANK is preparing to enter a new phase of capital expansion. The State Bank of Vietnam has approved a 3,600 billion VND (35%) increase in charter capital. Of this, over 3,105 billion VND will come from a rights issue to existing shareholders, and more than 517 billion VND from an ESOP program. Upon completion, ABBANK’s charter capital will approach 14,000 billion VND, enhancing its lending capacity and investment in technology, personnel, and core competitiveness.

2025 is also a pivotal year for ABBANK as it innovates its operating model toward leaner and more efficient processes. The bank has continuously adjusted compensation policies, including salary increases, performance-based bonuses, employee loan benefits, and even car purchase vouchers. It has also launched the ABBELL program to enhance the management and leadership capabilities of its core team. This human-centric strategy is expected to lay the foundation for sustainable growth.

Furthermore, ABBANK is vigorously promoting its sustainable development strategy by establishing an ESG Sustainable Development Strategy Committee and partnering with major organizations to implement business initiatives aligned with social responsibility. This structured investment in ESG is anticipated to expand relationships with international financial institutions, secure low-cost funding, and enhance governance quality.

As the banking sector enters a new growth cycle, the combination of improved business performance and comprehensive restructuring is opening up new prospects for ABBANK. This explains why ABB stock has attracted significant investor interest in recent times.

Thác Bà Hydropower Announces Second Cash Dividend Payout for 2024

The Board of Directors of Bac Ha Hydropower Joint Stock Company (UPCoM: BHA) has approved the payment plan for the second cash dividend of 2024 to its shareholders.

Q3 Non-Performing Loan Coverage Ratio Continues to Improve

The non-performing loan coverage ratio of the banking system continued its recovery trend in Q3. Effective management of bad debts has provided banks with additional time to rebuild their buffers following the previous sharp decline. Each bank implements distinct provisioning policies based on its strategic direction, leading to varying approaches in provisioning across different groups.