Vietnam’s stock market continues to experience significant volatility, struggling to surpass the 1,700-point threshold. Persistent selling pressure has caused the VN-Index to retreat, reflecting investor uncertainty and lackluster capital inflows into most equity groups.

Amid this subdued market, shares of Halcom Vietnam (ticker: HID) stand out as a rare bright spot. HID has recorded an impressive 10 consecutive ceiling-hitting sessions over the past two months. Its share price surged from VND 3,120 (on September 29) to VND 6,740 (as of November 21 morning), marking a remarkable 115% gain in less than two months.

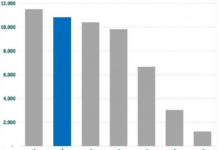

Historically, HID’s liquidity has been modest, averaging only a few tens of thousands of shares traded daily. However, the recent price rally has invigorated trading activity, with volumes now consistently exceeding 1 million units per session.

In response to the stock’s meteoric rise, Halcom Vietnam issued an official explanation.

Management attributed the surge primarily to robust Q2 FY2025 consolidated results (ending September 30, 2025). The company emphasized that price movements reflect objective market dynamics and supply-demand fundamentals. Investment decisions regarding HID shares remain beyond the company’s control, with no influence exerted over trading prices.

Founded in 2001, Halcom Vietnam initially focused on infrastructure development consulting. The company later diversified into water supply and renewable energy, operating notable projects like the Thuan Thanh Water Plant (Bac Ninh), the 21 MW Phuong Mai 3 Wind Farm, and a 35 MWp solar power project in Hau Giang.

For Q2 FY2025, Halcom Vietnam reported revenue of VND 209 billion, a 2.2-fold increase year-over-year. Net profit after tax reached VND 59 billion, the second-highest quarterly profit after the record VND 72 billion in Q4 2020.

In the first half of FY2025, net revenue totaled VND 330 billion, up 94% year-over-year. The company reported a H1 profit of nearly VND 25 billion, compared to a loss of VND 17 billion in the same period last year.

All Eyes on the Airline’s Stock

Today (November 20th) marks the expiration of November derivatives, with the trading session closing on a cautious note as investors adopted a wait-and-see approach. Amidst the subdued market, Vietjet Air’s stock (VJC) stood out, defying the trend with a remarkable surge to its ceiling price.

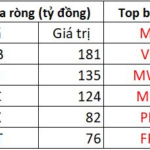

Foreign Investors Surprise the Market with a Buying Spree on November 20th, Targeting a Banking Stock After a Prolonged Selling Streak

Foreign investors have returned to the market with a net buy of VND 244 billion, marking a significant shift after 11 consecutive sessions of net selling.