PC1 Group Corporation (Stock Code: PC1, HoSE) has recently submitted a report detailing the outcomes of its share issuance aimed at increasing equity capital from shareholders’ equity.

As of the issuance closure on November 13, 2025, PC1 successfully issued over 53.6 million bonus shares to 14,233 shareholders. The remaining 2,914.6 fractional shares will be canceled.

The share allocation ratio was set at 100:15, meaning for every 100 shares held, shareholders received 15 additional shares. The transfer of these shares is scheduled for December 2025.

The total issuance value, based on the par value, amounts to nearly VND 536.5 billion. This capital was sourced from the surplus equity as per the audited 2024 financial statements of the parent company.

Illustrative image

Post-issuance, PC1’s outstanding shares will rise from over 357.6 million to nearly 411.3 million, increasing its chartered capital from over VND 3,576 billion to nearly VND 4,113 billion.

In related news, Ms. Trịnh Khánh Linh, daughter of Mr. Trịnh Văn Tuấn, Chairman of PC1’s Board of Directors, has registered to purchase 4 million PC1 shares. The transaction is expected to occur between November 20, 2025, and December 18, 2025, via order matching and/or negotiated deals.

If successful, Ms. Trịnh Khánh Linh’s ownership will increase from 0% to 1.118% of the capital, making her a shareholder in PC1 Group.

Based on the closing price of PC1 shares on November 20, 2025, at VND 22,200 per share, Ms. Trịnh Khánh Linh is estimated to invest approximately VND 88.8 billion to acquire the registered shares.

Regarding business performance, in the first nine months of 2025, PC1 recorded a net revenue of over VND 8,073 billion, a 7% increase compared to the same period in 2024. Its post-tax profit reached over VND 704 billion, up by nearly 22%.

For 2025, PC1 aims to achieve a consolidated post-tax profit of VND 836 billion. By the end of the third quarter, PC1 has already accomplished more than 84% of its targeted post-tax profit.

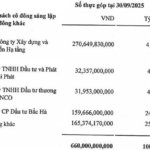

As of September 30, 2025, PC1’s total assets grew by 12.1% year-to-date to nearly VND 23,534 billion. Fixed assets account for 41% of total assets, amounting to nearly VND 9,683 billion, while inventory stands at nearly VND 2,178 billion.

On the liabilities side, total payables reached over VND 15,183 billion, a 14% increase year-to-date. Short-term loans constitute 30% of total liabilities at over VND 4,532 billion, while long-term loans and issued bonds make up 48% at over VND 7,380 billion.

Bank Profits Surge 10x, Stock Prices Double Since Year’s Start

ABB Bank’s stock (ABB) has surged an impressive 100% since the beginning of the year, making it one of the top-performing bank stocks in the market. This remarkable rally coincides with the bank’s strong nine-month financial results and a strengthened management team. These positive developments are expected to propel ABBANK into a new phase of accelerated growth.

F88 Recognized by Deloitte as “Vietnam Best Managed Companies 2025”

On November 19, 2025, F88 Company was honored by Deloitte, one of the world’s leading audit and consulting firms, at the prestigious “Vietnam Best Managed Companies 2025 – Best-Managed Vietnamese Enterprises” program.