The initial public offering (IPO) details of Hoa Phat Agriculture Development Joint Stock Company (HPA) have become a focal point in the agricultural stock sector. Beyond the capital increase narrative, this IPO reveals the financial health of Hoa Phat Group’s agricultural division after a decade of establishment and growth.

10.7 TRILLION VND MARKET CAP – A LEADING LIVESTOCK COMPANY ON THE STOCK EXCHANGE

According to the announced plan, HPA is offering 30 million shares at 41,900 VND per share. At this price, Hoa Phat Agriculture’s market capitalization is 10.7 trillion VND.

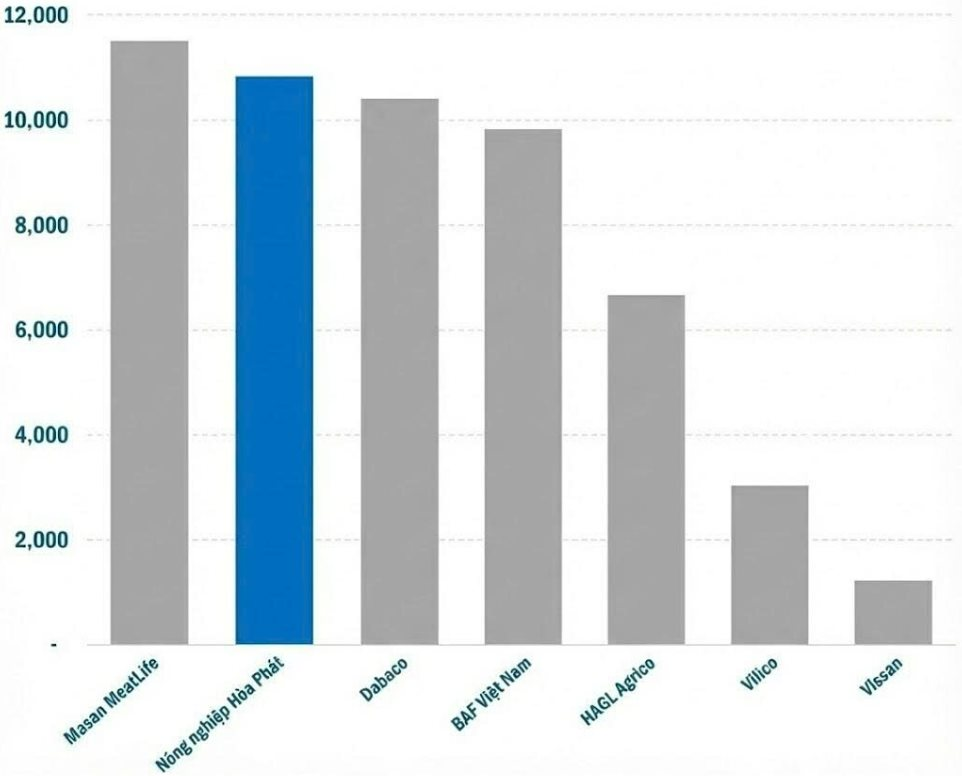

Compared to other listed livestock companies as of November 20, 2025, HPA emerges as a top player on the stock exchange.

Specifically, the 10.7 trillion VND valuation is second only to Masan MeatLife (11.5 trillion VND), surpassing Dabaco (DBC – nearly 10.4 trillion VND), BaF Vietnam (BAF – over 9.6 trillion VND), Vilico, and Vissan.

The IPO prospectus also provides insights into HPA’s operational efficiency compared to its competitors.

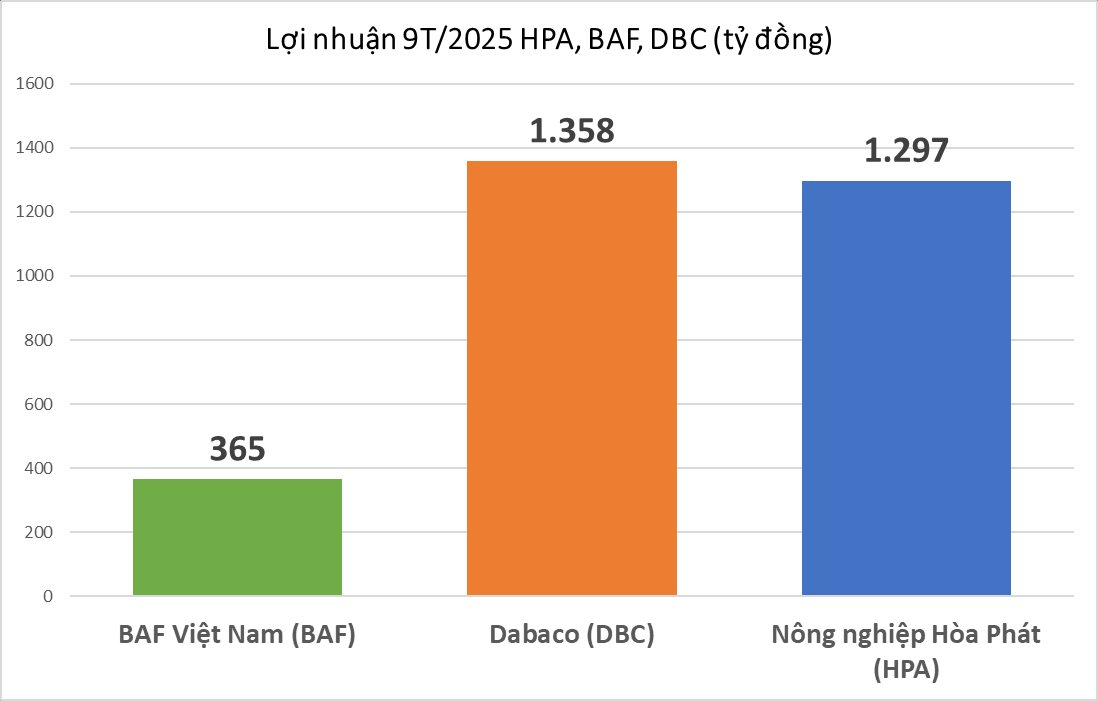

In the first nine months of 2025, Hoa Phat Agriculture reported net revenue of 6,259 billion VND, approximately half of Dabaco’s 12,271 billion VND.

However, Hoa Phat’s profit margin is significantly higher at 20.7%, compared to 11% for Dabaco, 10% for BAF, and 7% for Masan Meatlife.

HPA’s after-tax profit for the period reached 1,297 billion VND (an 88% increase year-over-year), closely trailing Dabaco’s 1,358 billion VND and 3.5 times higher than BaF Vietnam’s profit.

Additionally, Dabaco’s revenue and profit include contributions from its retail, hotel, and restaurant businesses.

DECODING TRAN DINH LONG’S SUCCESS IN PIG, CATTLE, AND POULTRY FARMING

What drives Hoa Phat Agriculture’s superior profitability?

Firstly, their choice of breeding stock.

While most livestock companies select sow breeds with a productivity of 22-25 piglets per sow per year, Hoa Phat started with purebred Danish L/Y/DU pigs, known for their high productivity but challenging to raise in Vietnam.

Hoa Phat invested in large-scale, modern, and synchronized farming facilities to create an optimal environment for these pigs. Over time, the Danish pigs adapted to the local climate, achieving a productivity of 31-32 piglets per sow per year, with some farms reaching 33-34 piglets.

For poultry and cattle, Hoa Phat also chose high-yield but demanding breeds like Hyline laying hens (USA) and Australian beef cattle.

Secondly, their approach to farm construction.

Hoa Phat rejects contract farming, focusing instead on self-invested and directly managed farms to ensure quality and control.

Their farm requirements are more stringent than industry standards. For instance, a 1,200-sow farm requires a minimum of 10 hectares, compared to 2-3 hectares for other farms a decade ago.

Their farm network across multiple provinces mitigates disease risks and optimizes logistics by locating farms near feed mills and consumer markets.

Thirdly, proactive risk management, avoiding speculation and short-term gains.

For inputs, they diversify raw material sources, use rolling contracts, and stagger purchases to average costs. For outputs, they avoid chasing peak prices and maintain stable herds for long-term investment. The company plans supply and demand in the medium to long term, keeping sow, poultry, and cattle numbers at optimal levels.

In mid-2017, when China halted pork imports, domestic pork prices plummeted to 15,000-17,000 VND/kg, causing significant losses for many farmers and companies, who reduced herd sizes or switched to poultry. Hoa Phat, however, maintained its operations, strengthened its closed-loop system, controlled costs, and standardized productivity.

This strategy allowed Hoa Phat to capitalize on stable herds when market prices rebounded.

Hoa Phat estimates HPA’s 2025 profit at 1,500 billion VND, with a projected P/E ratio at the IPO price of 7 times, lower than the industry average of 10-15 times.

The New Ace of Mr. Trần Đình Long: A Billion-Dollar Agriculture Company Valued Higher Than Dabaco and BAF Vietnam

At an offer price of VND 41,900 per share, Hoa Phat Agriculture is valued at nearly VND 10,700 billion pre-IPO.

2025 Q3 Banking Overview: Surging Profits, Credit Growth, Shrinking NIMs, and Intensifying Capital Raising Pressures

The banking sector is entering a robust growth phase, yet it faces significant challenges. While credit is accelerating and profitability is improving, the narrowing net interest margin (NIM) is sharply differentiating the competitive capabilities of individual banks.

VPS Appoints New CEO Post-IPO, Reveals Major Shareholders List

Following its high-profile IPO, VPS Securities promptly removed Mr. Nguyen Lam Dung from his position as CEO to comply with legal regulations for publicly traded companies. The post-IPO list of major shareholders has also been disclosed, revealing Saigon Capital as the largest stakeholder with 39.9% ownership, while Mr. Nguyen Lam Dung retains an 8.7% stake.