Illustrative image

In 2019, Peruvian entrepreneur Luis Zwiebach flew over 4,000 miles to California to test-drive Tesla’s Model 3 sedan. With no official Tesla importer in Peru and complex import procedures, he opted to purchase a Tesla from a previous importer.

“The car wouldn’t charge due to a lack of grounding. We grabbed a fork, stuck it in the ground, and the car started charging,” he recalled.

This seemingly humorous anecdote highlights the early challenges of electric vehicles (EVs) in Peru. However, the landscape has significantly evolved. While Tesla has yet to open a showroom in the country, Chinese brands like BYD, Geely, and GWM have gained strong traction, offering prices approximately 60% lower than Tesla. Traditional automakers such as Toyota, Kia, and Hyundai have also joined the race.

According to the Peruvian Automotive Association, 135,394 new vehicles were sold in the first nine months of the year, with 7,256 being hybrid or electric—a 44% increase year-over-year. Zwiebach notes that over two EVs are sold daily, prompting him to expand his business providing EV charging solutions, solar panels, and other renewable systems in Lima and Arequipa.

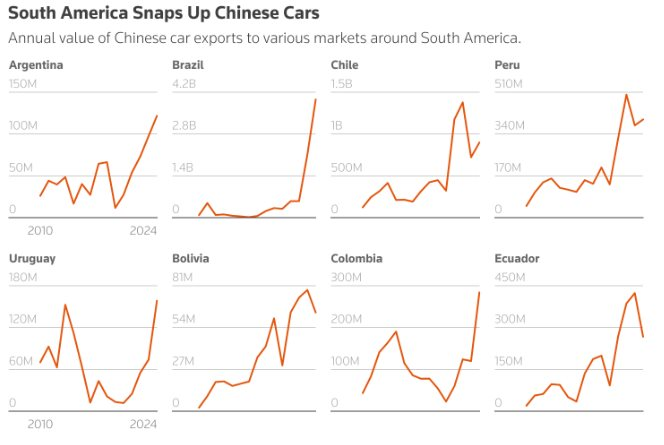

Chinese automakers are rapidly expanding across South America, leveraging their presence amid barriers in the U.S. and Europe. The Chancay Super Port, built by China north of Lima, has halved trans-Pacific shipping times, further enhancing their competitive edge.

In Peru alone, 3,057 vehicles were imported through Chancay in July, up from 839 in January. Brands like Chery and Geely operate over a dozen dealerships, while BYD plans to open its fourth Lima showroom by year-end.

South American countries are increasingly embracing Chinese electric vehicles.

Beyond Peru, Chinese manufacturers are using Chancay as a hub to distribute EVs, hybrids, and traditional vehicles to Chile, Ecuador, and Colombia. Cosco Shipping, the port operator, reports each vessel carries 800 to 1,200 vehicles.

In Uruguay, where EVs account for 28% of new registrations—the highest in the region—BYD ranks third in sales, behind Chevrolet and Hyundai. BYD’s BEVs start at $19,000. A local dealer remarked, “I can buy three Chinese pickups for the price of two traditional brand vehicles.”

The International Energy Agency’s 2025 Global EV Outlook reports that Latin America’s EV adoption doubled in 2024 to 4%, driven by government incentives and affordable Chinese models. In Chile, EVs comprised 10.6% of new registrations in September; Brazil reached 9.4% in August.

In Brazil, trade barriers have led Chinese companies to invest in local production. BYD began assembling EVs at a former Ford plant in Bahia in October, while GWM started production in August at a converted Mercedes-Benz facility. These plants are expected to export regionally by 2027 via trade agreements with Mexico, Chile, and Mercosur.

Despite robust growth, Peru’s EV adoption remains low compared to Europe (56%) and China (51%). Uneven charging infrastructure poses challenges for long-distance travel. “Driving the entire Peruvian coast from Tumbes to Tacna is difficult,” Zwiebach admitted. However, he emphasized EVs’ key advantages: lower operating costs and minimal maintenance requirements.

Source: Reuters

VinFast Shaping the Future of Electric Vehicles at Detik Leaders Forum 2025 in Indonesia

VinFast stands as the sole international electric vehicle manufacturer invited to Indonesia’s prestigious policy forum, where it will share insights and strategies to shape the nation’s electric vehicle industry.

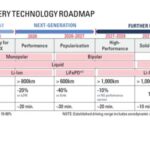

Toyota’s Game-Changing Battery Could Upend the EV Industry: Lasts Longer Than the Car, Retains 90% Capacity After 40 Years

Toyota is making waves with its groundbreaking announcement of a new solid-state battery boasting a remarkable 40-year lifespan and the ability to retain 90% of its capacity. If realized, this technology could revolutionize the entire electric vehicle market in the coming decade.