This is the latest update from commercial banks. To avoid transaction disruptions, customers are advised to contact their bank’s branches or transaction offices to update their identification to the new chip-embedded Citizen Identity Card (CCCD).

This requirement is in compliance with the State Bank of Vietnam’s regulations outlined in Circular 17/2024/TT-NHNN and Circular 18/2024/TT-NHNN. Both circulars will take effect from July 1, 2024, with certain provisions effective from January 1, 2026.

Specifically, according to clause 5, point c of Article 17 in Circular 17, from January 1, 2026, customers can only withdraw money or conduct electronic payment transactions from their payment accounts after successfully verifying their identity documents and biometric data. This applies to both individual customers (or their representatives) and legal representatives of organizational customers.

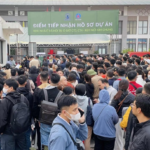

Banks will discontinue payment services, withdrawals, and card transactions across all channels for Vietnamese customers using passports as their primary identification. Photo: Anh Nguyễn. |

Biometric data must be stored in the encrypted information section of the CCCD or identity card, issued and authenticated by the Police Authority. Alternatively, it can be verified through the individual’s electronic identification account within the national electronic identification and authentication system.

The collected biometric data must match the encrypted information on the CCCD or identity card issued by the Police Authority. Verification can also be done through the individual’s electronic identification account.

For CCCDs without an encrypted information section, biometric data must be retrieved from the National Population Database.

Article 9, clause 2, and Article 12, clause 1 of Circular 18, effective from January 1, 2026, mandate that before entering into a card issuance and usage contract, the issuing organization must collect all necessary documents, information, and data for customer identification as per regulations.

For Vietnamese individual customers, the issuing organization requires one of the following identification documents: CCCD, identity card, electronic identification (via level 2 electronic identification account), or People’s Identity Card.

The processing of personal data, as outlined in Circular 18, or data provided by organizational customers, along with information sharing with third parties, is permitted for card services or to address suspected fraud, forgery, or legal violations.

Previously, according to clause 4 of Article 5 in Circular 48/2018/TT-NHNN (issued on December 31, 2018, and amended by Circular 11/2022/TT-NHNN), valid passports were accepted for customer verification in transactions such as savings withdrawals, balance inquiries, or over-the-counter procedures.

Tuân Nguyễn

– 7:32 PM, November 21, 2025

Skyrocketing Savings Rates: New Bank Disrupts the Market

Interest rates for terms ranging from 2 to 5 months at this bank have been increased to 4.75% per annum, the maximum rate permitted by the State Bank of Vietnam for deposits under 6 months.