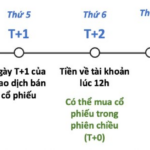

The event’s focal point was the market operation equation in the context of preparing for the implementation of T+0, extending trading hours, and helping investors adapt to a “latency-free” trading environment.

The market enters the “era of speed” – demanding new infrastructure and data standards.

At the event, Mr. Nguyễn Hoàng Giang, Chairman of DNSE’s Board of Directors, stated that the intraday trading era is defined by three factors: “Speed – Seamless – Sync” – order processing speed, transaction seamlessness, and real-time market data synchronization. Reducing information latency is crucial for securities companies’ systems, enabling investors to fully benefit from T+0 and minimize risks associated with high-speed trading.

Mr. Nguyễn Hoàng Giang, Chairman of DNSE’s Board of Directors, speaking at the event

|

“That’s why DNSE has focused on investing in technology systems over the past five years to be ready for the market’s technical foundation. Currently, DNSE’s transaction processing speed is 3.9 milliseconds,” said Mr. Giang.

Mr. Giang believes that T+0 and selling securities on hold will significantly change market operations and investor decision-making. Technology will be key to helping investors reduce risks from trading psychology and seize opportunities.

Infrastructure – Data – Open API: The trio unlocking high-speed trading

Discussing technology infrastructure preparation, the most critical factor in the new phase, Ms. Li Wen Wong – Senior Director of IBM LinuxONE and Linux on IBM Z, IBM Asia-Pacific Technology Division, emphasized that in the high-speed trading era, a robust and secure server system is vital for reducing latency and enhancing trading efficiency. DNSE is a pioneer in Vietnam, utilizing IBM’s solutions to ensure speed, availability, security, cost reduction, and a technology system approaching international standards.

Ms. Li Wen Wong – Senior Director of IBM LinuxONE and Linux on IBM Z, IBM Asia-Pacific Technology Division

|

Regarding optimizing user experience in the new era, Mr. Nguyễn Đức Bình – Director of DNSE Securities Technology, introduced DNSE’s new Open API solution at the event. DNSE has pioneered API connections with partners like Zalopay, FiinTrade, and Trading View, offering a “one-touch multi-platform” securities trading experience.

Mr. Nguyễn Đức Bình – Director of DNSE Securities Technology, introducing the new Open API solution

|

With DNSE’s new API product, active traders can create strategies using real-time market data with just 5-10 lines of code and integrate AI to optimize trading performance.

The API is specifically designed to maximize DNSE’s speed advantage, ensuring orders are updated to the Exchange fastest, with optimal security and compatibility with DNSE’s per-transaction lending management system.

DNSE also plans to launch a service directly connecting customers to its system (Co-location Host) for high-frequency traders, reducing transaction times to under 50 milliseconds per trade. This prepares for an environment of continuous intraday trading, rapid turnover, and increased intraday risk management needs.

Discussing data power and quantitative trading trends in the new context, Mr. Võ Duy Anh – Founder & CEO of AlgoTrade, stated: “When the market operates at millisecond speeds, investors cannot process all information manually for consistent decisions. Data, models, and algorithms will become increasingly central.”

Mr. Võ Duy Anh, Founder and CEO of AlgoTrade, discussing data and quantitative trading

|

Mr. Duy Anh predicts that 2026–2030 will be the ideal period for quantitative trading to flourish in Vietnam, as co-location services and expanded APIs become more prevalent.

During the discussion, speakers highlighted future technology trends like super apps, automated data-driven trading, and quantitative trading. Many investors inquired about opportunities, risks, and how newcomers and active traders can adapt to new trading solutions.

Notably, DNSE hosted its first-ever Derivatives Esport competition on stage, featuring top traders from the “Lướt sóng phái sinh” contest held over the past two years. This brought a vibrant atmosphere and a vivid demonstration of high-speed trading supported by advanced technology features.

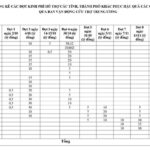

The investor with the nickname “Heo” achieved a perfect 100% win rate with 8 orders, totaling 12.87 profit points, and won the 100 million VND prize.

The investor nicknamed “Heo” achieved a perfect 100% win rate in the Derivatives Esport competition

|

With participation from esteemed speakers and hands-on technology experiences, DNSE Future Tech Summit provided comprehensive insights for investors to prepare for the high-speed trading era. Here, investor experiences are redefined through technology, data, and connectivity.

– 06:58 22/11/2025

The Future of Finance: OCB’s Open Banking Model Shines at A80 Expo

On August 28th, Orient Commercial Joint Stock Bank (OCB) proudly participated in the Vietnam’s Achievements Exhibition 2025, showcasing an array of cutting-edge digital financial products. Among these offerings was the standout feature of their Open Banking model, creating a comprehensive digital ecosystem tailored to meet the needs of both individual and business customers.

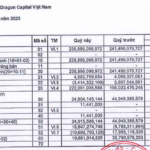

“Dragon Capital’s Performance in the First Half of 2025: A Comprehensive Overview”

In the first half of 2025, Dragon Capital Vietnam Fund Management JSC (DCVFM) recorded revenue of over VND 480 billion and post-tax profit of over VND 55 billion, down 12% and 60%, respectively, compared to the same period last year. In a recent development, DCVFM made headlines by appointing Le Anh Tuan as its new CEO, replacing Beat Schuerch.