The State Securities Commission of Vietnam (SSC) has recently granted the Public Offering Registration Certificate to SSI Securities Corporation (stock code: SSI). According to the approved plan, SSI will issue up to 415.6 million shares to existing shareholders at a ratio of 5:1 (for every 5 shares held, shareholders can purchase 1 new share).

The offering price is set at VND 15,000 per share, potentially raising up to VND 6,234 billion. The mobilized capital is expected to be allocated for margin lending, investment in bonds, deposit certificates, and other securities.

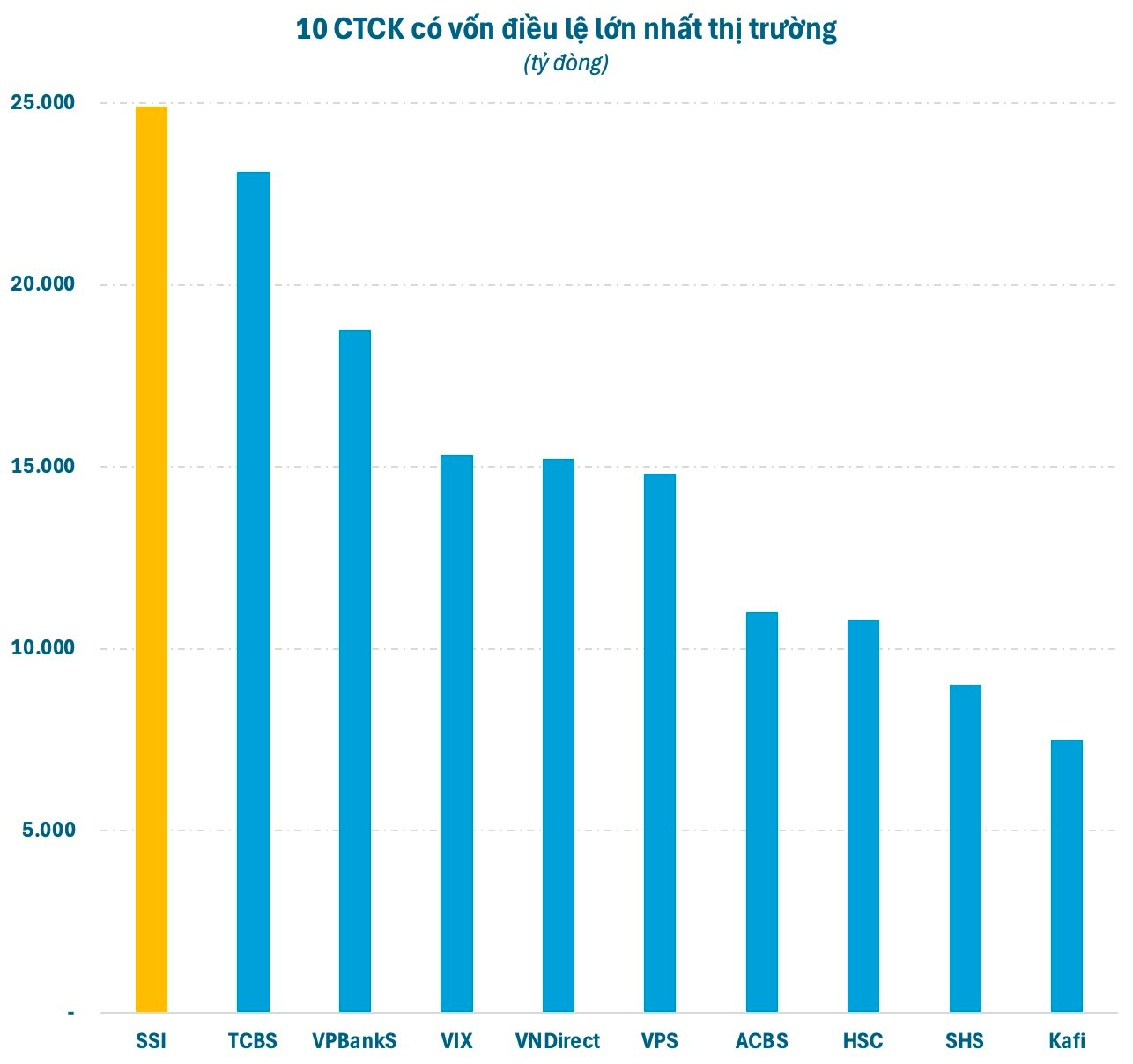

If the offering to existing shareholders is successful, SSI’s chartered capital will increase to VND 24,900 billion. This would position SSI ahead of Techcom Securities (TCBS – stock code: TCX), reclaiming the top spot in terms of chartered capital within the securities industry.

SSI’s move comes amid an intensifying capital expansion race within Vietnam’s securities sector. Beyond high-profile IPOs from TCBS, VPBankS, and VPS, several leading securities firms are aggressively increasing their capital. Notably, HDBS plans to raise its capital from nearly VND 1,500 billion to VND 11,000 billion.

Stronger capital positions enable securities companies to increase margin limits, expand proprietary trading, enhance investment banking services, and invest in technology to meet higher market standards as Vietnam aims for an upgrade in its market classification.

Returning to SSI, in the first nine months of the year, the company recorded operating revenue of VND 9,329 billion, a 48% increase compared to the same period in 2024. Pre-tax profit reached VND 4,080 billion, up 37% year-on-year. Notably, SSI’s market share of trading value on HoSE has risen for five consecutive quarters, reaching its highest level since late 2020, ranking second only to VPS.

In other developments, SSI recently announced a board resolution to acquire 15 million shares of SSI Digital Technology JSC (SSI Digital) through a private placement at a par value of VND 10,000 per share, totaling VND 150 billion. The specific implementation details will be announced by SSI Digital at a later date.

VietinBank Offers 19.6 Million Saigon Port Shares for Sale at Starting Price of VND 29,208 Each

This marks one of the largest divestment initiatives by Vietnam’s commercial banking system in Q4/2025, addressing legacy assets from non-performing loans as directed by the Government and the State Bank of Vietnam.

What is Vinh Hoan’s Subsidiary Planning to Do with Nearly VND 465 Billion in Capital Raising?

Sa Giang Import-Export is offering over 7.1 million shares to its shareholders at a price of VND 65,000 per share, aiming to raise nearly VND 464.6 billion. The proceeds will be used to contribute capital to Hoan Ngoc Agricultural Products and Food.