The trade fair stands as a pivotal event aimed at strengthening commercial cooperation between Vietnam and Laos, witnessed by leaders from the Vietnamese Ministry of Defense, MB’s management, the Bank of the Lao PDR, and representatives from hundreds of businesses from both nations. Under the theme “Connect – Cooperate – Develop,” the program focuses on promoting digital transformation in the banking and finance sector.

MB showcased a modern technology experience zone, attracting thousands of visitors. The booth was highly praised by leaders from the Vietnamese Ministry of Defense and representatives from the Bank of the Lao PDR for its digital service quality. They expressed their hope that MB would continue to innovate, making financial services more convenient for citizens and businesses in both countries.

Leaders from the Vietnamese Ministry of Defense and the Bank of the Lao PDR toured and highly appreciated the digital service quality.

MB Pioneers Multinational Financial Trends, Conquering Southeast Asia

In the context of deepening economic integration, Vietnamese and Lao communities living and working in both countries face challenges in accessing international financial services, such as high transaction costs and lengthy processing times for international money transfers.

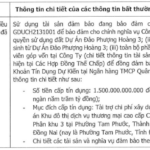

Mr. Phan Quốc Giang, a businessman investing in Laos, shared: “For Vietnamese businesses investing and expanding in Laos, the investment capital reached $322 million in the first 8 months of 2025, a sixfold increase compared to the same period last year. However, barriers in policies, workforce shortages, and limited financial infrastructure remain significant challenges. There is a pressing need for banks to pioneer suitable financial solutions.”

Understanding these challenges, MB has developed a comprehensive ecosystem of solutions, including 100% online eKYC account opening without visiting a branch, cross-border QR payments between Vietnam and Laos in local currencies (VND/LAK) with direct conversion to save costs, fast money transfers via Lapnet, online savings, online loan applications, utility bill payments, mobile top-ups, e-wallet services, and a 24/7 financial and utility ecosystem for individual customers, along with financial support services for businesses expanding in Laos.

MB provides convenient financial services for Vietnamese and Lao communities living, working, and studying in both countries.

Breakthrough Technology – Shaping the Future of Digital Finance

Building on MB’s success in Vietnam, MB Laos has consistently implemented comprehensive digital solutions tailored to local needs, offering seamless experiences for all customers.

A standout feature is the MB Laos App, equipped with dozens of pioneering features developed on an intelligent technology platform, compatible with iOS and Android, and optimized for all internet-connected devices. With its high-tech capabilities and user-friendly design, the app attracted a large number of visitors to the booth.

The experience zone recorded thousands of visitors and direct consultations, generating significant interest from businesses and individuals during the first two days of the event.

The most popular features include: eKYC online account opening licensed by the Bank of the Lao PDR, completed in just 3 minutes; 24/7 internal and interbank money transfers via Lapnet in Laos; payment of various utility bills; e-wallet top-ups and withdrawals; payments and transfers via Laos QR; payments at over 5,000 stores/businesses/MB Laos partners; cross-border QR payments between Vietnam-Laos, Laos-Cambodia, Laos-Thailand, and Laos-China, enabling unlimited connectivity.

Of particular interest was the 24/7 online savings service with attractive interest rates, flexible terms from 1 day to 36 months, and the option to withdraw funds early while still earning interest based on the actual deposit period.

The positive reception from the business community underscores MB’s role in the digital financial transformation journey in Laos and across Southeast Asia. With its modern and comprehensive service ecosystem, MB addresses practical challenges, providing convenient and secure financial experiences for Vietnamese and Lao communities living, working, and studying in both countries. This contributes to fostering sustainable bilateral economic cooperation and reinforces the effectiveness of MB’s international expansion strategy as one of the Big 5 banks.

Customers can download the MB Laos App from the App Store and Google Play or visit an MB Laos branch for direct consultation. For more information about MB Laos services, visit: mbbank.com.la

BIDV Card and Operations Center Director: QR Pay Overcomes Key Shortcomings of Traditional QR Money Transfers

The bank representative suggested that regulations should be considered to prohibit individual-to-individual transactions for goods payments, aiming to incentivize a shift toward QR code payments.

Securing Digital Financial Security for Millions of Vietnamese: MB’s Commitment

“Financial security is the cornerstone of successful digital transformation,” MB emphasizes, highlighting the critical importance of robust cybersecurity in an era where cyber threats are increasingly sophisticated.

MB Wins Four Prestigious Awards from Visa

Not only does this award recognize the success of MB Bank’s card services, but it also stands as a testament to the bank’s relentless efforts in implementing cashless payment solutions. By leveraging cutting-edge technology, MB Bank is committed to delivering a seamless and secure experience for its customers.