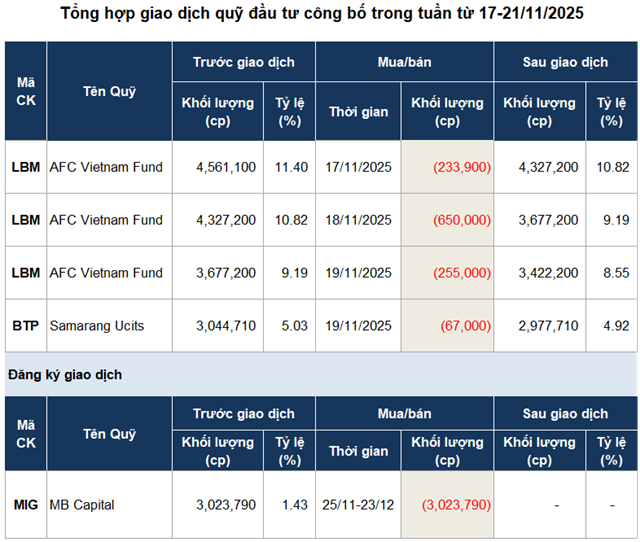

The AFC Vietnam Fund has notably offloaded shares of LBM (Lam Dong Minerals and Construction Materials JSC) in a series of transactions to rebalance its portfolio. The fund sold 233,900 shares on November 17, 650,000 shares on November 18, and 255,000 shares on November 19. Over these three sessions, AFC reduced its ownership in LBM from 11.4% to 8.55%, equivalent to nearly 3.4 million shares. Based on the closing prices during these sessions, the fund is estimated to have generated approximately VND 43 billion.

This divestment follows LBM‘s announcement of an interim cash dividend for 2025 at a rate of 25% (VND 2,500 per share). The ex-dividend date is scheduled for December 3, with payment on December 19, totaling around VND 100 billion. Notably, LBM doubled the dividend rate from the initial plan of 12.5% and significantly revised its 2025 business targets upward: consolidated revenue is expected to increase by 19% to VND 1,135 billion, and pre-tax profit by 91% to VND 172 billion.

| LBM’s 9-Month Business Results Over the Years |

The revised targets come after LBM surpassed its original 2025 plan within just six months and continued its strong performance in the first nine months of 2025, achieving record revenue of VND 880 billion (up 43% year-on-year). Net profit reached VND 106 billion, a 71% increase year-on-year and just VND 2 billion shy of its historical peak in 2023. Both revenue and profit for the nine months exceeded the full-year 2024 results, meeting 78% of the revised revenue target and 76% of the profit goal.

| LBM Stock Performance from 2021 to November 21, 2025 |

Amid this robust growth, LBM shares continued to surge. By the close of November 21, the stock price stood at VND 39,000 per share, up over 40% year-to-date and nearing its all-time high.

| BTP Stock Performance from 2024 to November 21, 2025 |

Similarly, Samarang Ucits sold 67,000 shares of BTP (Ba Ria Thermal Power JSC) on November 19, reducing its ownership to 4.92%, or nearly 3 million shares. At the day’s closing price, the transaction yielded approximately VND 670 million.

Samarang Ucits’ exit from major shareholder status coincides with BTP shares falling nearly 17% year-to-date, closing at VND 10,000 per share on November 21.

Source: VietstockFinance

|

– 07:28 23/11/2025

“Upcoming Dividend Payout: A 35% Total Yield from a Consistently Reliable Dividend-Paying Enterprise”

Since its listing on the Hanoi Stock Exchange (HNX) in 2019, the company has consistently maintained a robust cash dividend policy, delivering payouts as reliable as clockwork, with rates soaring into the double digits annually.

Dabaco Vietnam’s Deputy CEO Registers to Sell 80,000 Shares Amid 18% Market Price Decline

Previously, Mr. Tran Cong Nam, a member of the Board of Directors, sold 103,500 DBC shares, reducing his ownership from 218,513 shares (0.06% of the charter capital) to 115,013 shares (0.03% of the charter capital). The transaction was executed on October 23.