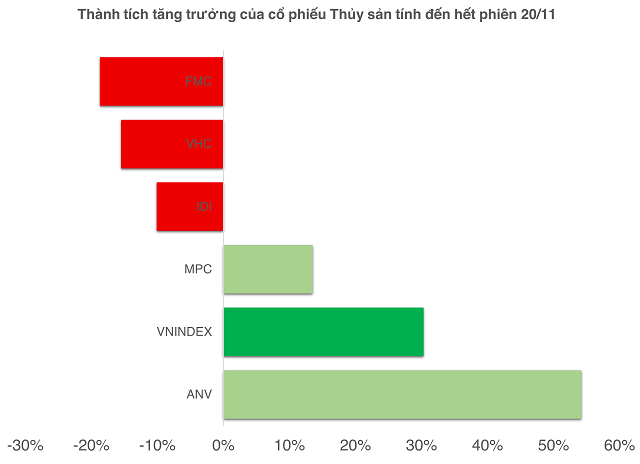

3 out of 5 growth stocks in the red, with ANV making its mark

2025 has proven to be a turbulent year for Vietnam’s import-export sector, particularly following the “Liberation Day Tariffs” in April, when U.S. trade policies underwent a sudden shift, likened to a “Tariff Liberation Day.”

While some goods saw reduced or eliminated tariffs, others faced higher rates, creating a significant shockwave for businesses reliant on the U.S. market and causing volatility in export-related stocks.

Seafood stocks were no exception. As of November 20, 4 out of 5 major industry players reported growth significantly below the VN-Index’s 30.3% rise.

Source: Author’s compilation

|

Three stocks are currently in negative territory: IDI (-10.1%), VHC (-15.5%), and FMC (-18.7%).

However, the picture isn’t entirely bleak.

Since late June 2025, ANV has emerged as a standout performer, surging 54.2% and reaching a historic high of 33,400 VND per share during the recent market upgrade wave.

According to Vietcap Securities, ANV proactively diversified its export markets to reduce dependency, while expanding its product portfolio with a focus on pangasius.

Pangasius exports now contribute 24.1% of revenue, becoming a key growth driver.

|

ANV Stock Performance

|

ANV reported 9-month revenue and after-tax profit of 4,832 billion VND and 748 billion VND, up 36% and 1,660% year-on-year, surpassing its full-year profit target by 71%.

These results highlight the resilience of seafood companies despite global trade uncertainties.

From tariff shocks to new opportunities

Agriseco Securities’ recent report praises the industry’s adaptability to U.S. policy changes.

Exports to the U.S. surged in early 2025 (January-May) as companies rushed orders before new tariffs took effect. However, exports slowed from June to August as the short-term order boom ended, with the market pausing to assess tariff negotiations.

Surprisingly, when the 20% retaliatory tariff was implemented on August 1, exports rebounded, reaching a 5-year high for the period.

With stable tariffs, 2026 U.S. export growth prospects look positive.

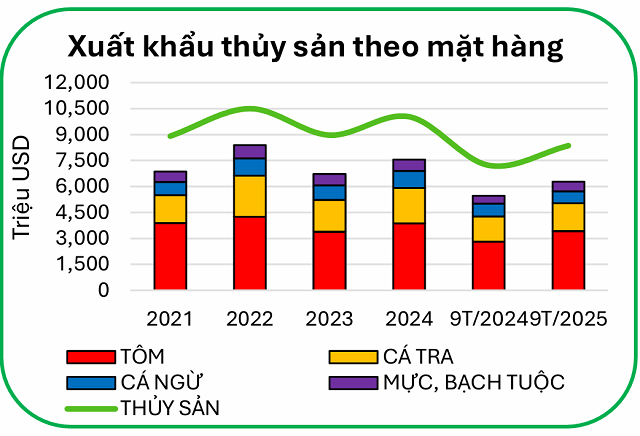

Broadly, the seafood sector saw strong 9-month recovery, with exports hitting $8.3 billion (up 16%). Shrimp and pangasius led with $3.4 billion (up 22%) and $1.6 billion (up 9%) respectively, accounting for 60% of total exports.

The U.S. grew 8%, while China surged 36% (driven by 72% shrimp order growth) and Japan rose 17%, maintaining stability across key products.

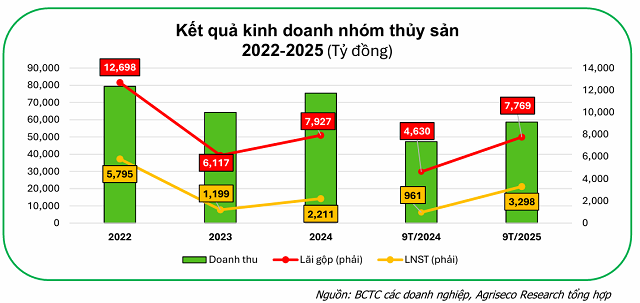

Agriseco notes that 22 listed companies saw profit recovery outpace revenue growth. While 9-month revenue rose 24% to 58,600 billion VND, gross and net profits jumped 68% and 243% respectively.

Pangasius firms improved margins through higher prices and cost control, led by Vinh Hoan and ANV’s pangasius expansion. Shrimp companies saw mixed results, with U.S.-focused players facing tariff pressure, while diversified firms performed better.

Despite 2025’s strong profit rebound, Agriseco warns of 2026 uncertainties: fluctuating global demand, rising feed costs, and higher domestic raw material prices could squeeze processing margins.

Companies with breeding autonomy and value chain control are better positioned. Those with diverse export markets, especially in the U.S., China, and Japan, will benefit from shifting demand dynamics.

Agriseco sees 2026 as a year of market rebalancing, favoring flexible firms with clear strategies and stable production capabilities.

– 12:00 21/11/2025