Illustrative Image

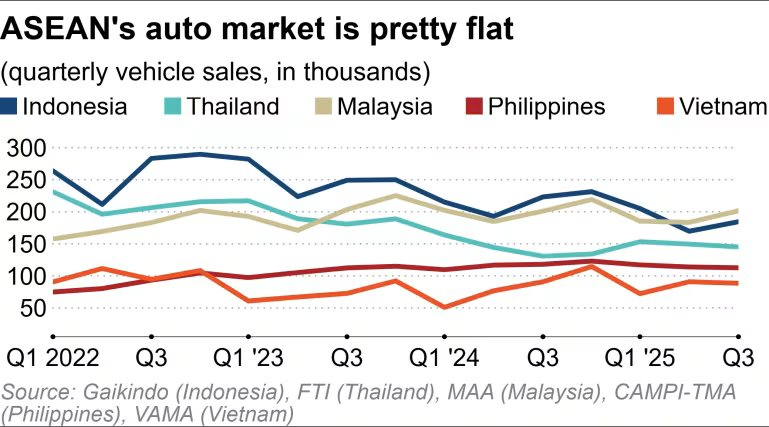

According to Nikkei Asia, Malaysia’s car sales in Q3/2025 surpassed Indonesia’s for the second consecutive quarter, marking a significant shift in Southeast Asia’s automotive market. Aggregated data from Nikkei across the region’s five largest markets—Indonesia, Malaysia, Thailand, the Philippines, and Vietnam—shows total sales from July to September reached 731,963 units, down 4% year-on-year but up 4% from the previous quarter. Since the start of 2024, only Q4/2024 exceeded 800,000 units, indicating slowing demand.

While Indonesia—historically ASEAN’s largest auto market—saw sales drop 17% to 184,403 units, Malaysia recorded a 3% increase to 201,588 units, driven by a stable economy and 5.2% GDP growth in Q3. This marks Malaysia’s second consecutive quarter outpacing Indonesia, reflecting shifts in purchasing power and consumer trends.

Overview of Southeast Asian Auto Sales. Source: Nikkei

Indonesia, long a stronghold for Japanese automakers with a 90% market share, is seeing declining sales in this segment. Toyota, the longtime leader, saw a 26% drop in Q3 sales, while Daihatsu fell 24%. Mitsubishi Motors and Suzuki were rare Japanese brands with slight growth. Despite maintaining overall market dominance, consumer preferences in Indonesia are shifting rapidly.

For the first time, a Chinese electric vehicle—the BYD Atto 1—outpaced Toyota’s Innova and Avanza as the top-selling model in October. This milestone underscores a market turning point. Consumers are switching to EVs due to lower operating costs, cheaper annual taxes, and Jakarta’s odd-even license plate policy exemptions. An East Jakarta customer shared she switched from a Mitsubishi gasoline car to a Wuling AirEV for “much lower running costs, simpler tax procedures, and daily commuting convenience.”

Falling consumer demand significantly impacted Astra International, Indonesia’s Toyota and Lexus distributor. Astra’s October sales dropped 20% year-on-year, with market share shrinking to 47% from 56% a year earlier.

Malaysia’s market remains dominated by local brands Perodua and Proton, with 289,210 and 125,120 units sold in the first 10 months of 2025, respectively, capturing 41.6% and 18% market share. Notably, Chinese brands like Chery and BYD are surging. Chery sold 25,631 units, up 78.2% year-on-year, while BYD delivered 10,165 EVs, a 56.5% increase.

According to a Chery dealership representative in Petaling Jaya, locally assembled SUVs like Tiggo, Omoda, and Jaecoo are directly competing with Toyota Corolla Cross and Honda HR-V. The shift from sedans to SUVs is evident. A Kuala Lumpur customer switched from a Honda sedan to a Jaecoo J7 for its stable quality, sleek design, and competitive pricing compared to Japanese counterparts.

In Vietnam, VAMA data shows Q3 new car sales reached 88,400 units, down 4%—the first decline since Q3/2024. However, VinFast made headlines with 38,195 global EV sales from January to September, mostly in its domestic market. In October, VinFast surpassed 20,000 units for the first time, dominating the top four market positions.

Alongside VinFast, Hyundai maintains around 5,000 monthly sales in Vietnam. Nikkei notes that combining these two brands’ sales could position Vietnam’s market on par with Thailand’s.

Thailand’s auto market grew 11% in Q3/2025 year-on-year after a sharp 2024 decline. However, household debt at 88.2% of GDP—the world’s seventh-highest—limits sustainable consumer recovery.

Source: Nikkei Asia