I. MARKET DYNAMICS OF WARRANT CERTIFICATES

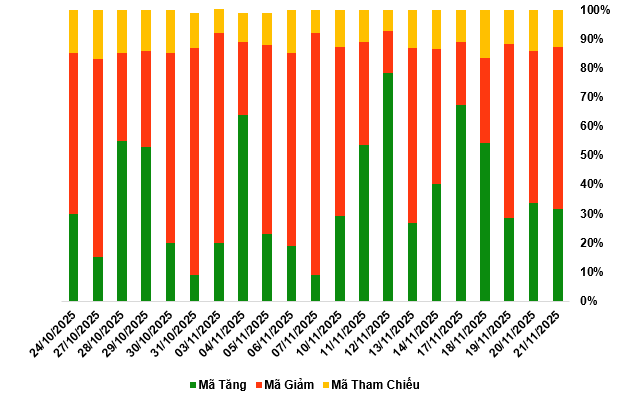

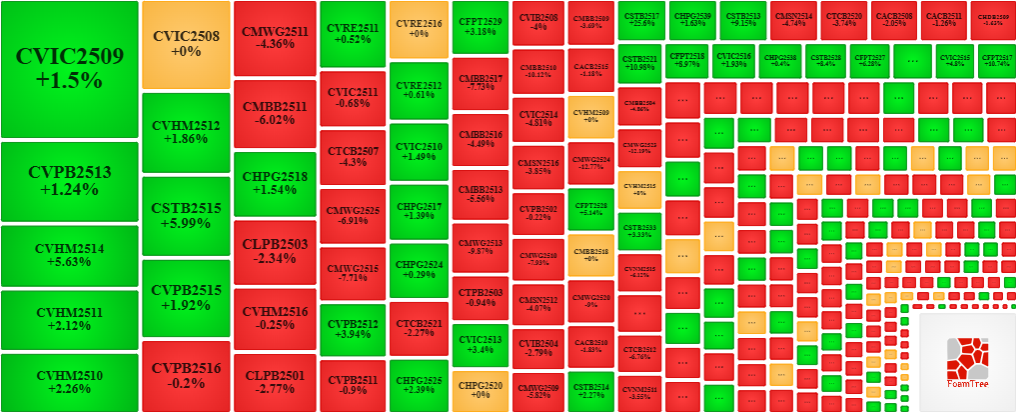

By the close of the trading session on November 21, 2025, the market recorded 91 advancing codes, 160 declining codes, and 37 unchanged codes.

Market Breadth Over the Last 20 Sessions. Unit: Percentage

Source: VietstockFinance

During the November 21, 2025 trading session, the market experienced significant divergence, with sellers continuing to dominate, leading to price declines in most warrant certificates. Notably, the major warrant codes in the declining group were CVPB2516, CMWG2511, CMBB2511, and CLPB2503.

Source: VietstockFinance

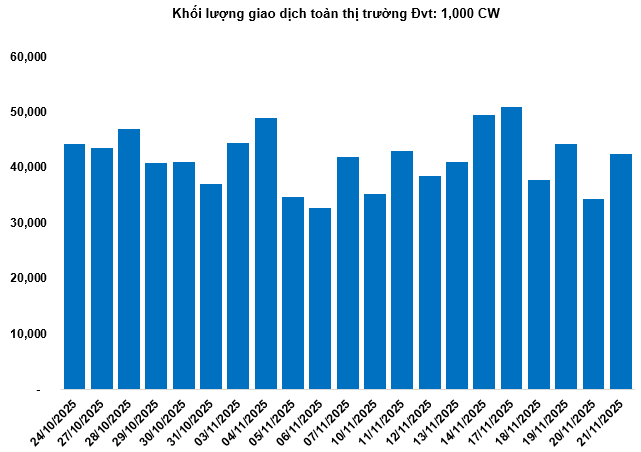

Total market trading volume on November 21 reached 42.51 million CW, up 23.73%; trading value reached 77.14 billion VND, up 9.61% compared to the November 20 session. Among these, CHPG2535 led the market in volume with 3.68 million CW; CMBB2518 led in trading value with 4.45 billion VND.

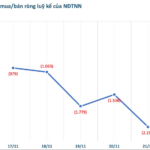

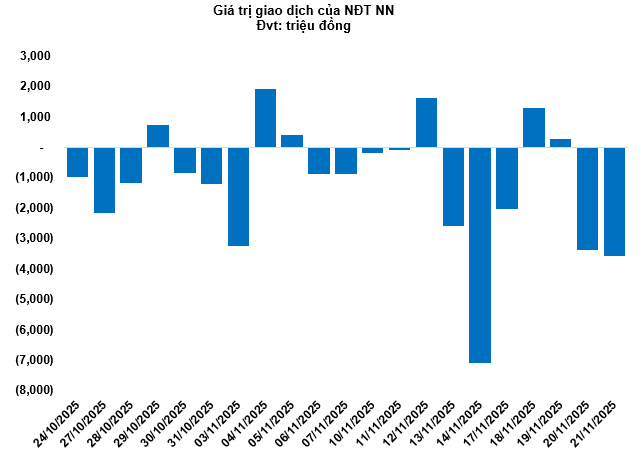

Foreign investors continued to net sell in the November 21 session, with a total net selling value of 3.57 billion VND. CHPG2535 and CVJC2506 were the two codes with the highest net selling. For the week, foreign investors net sold over 7.44 billion VND.

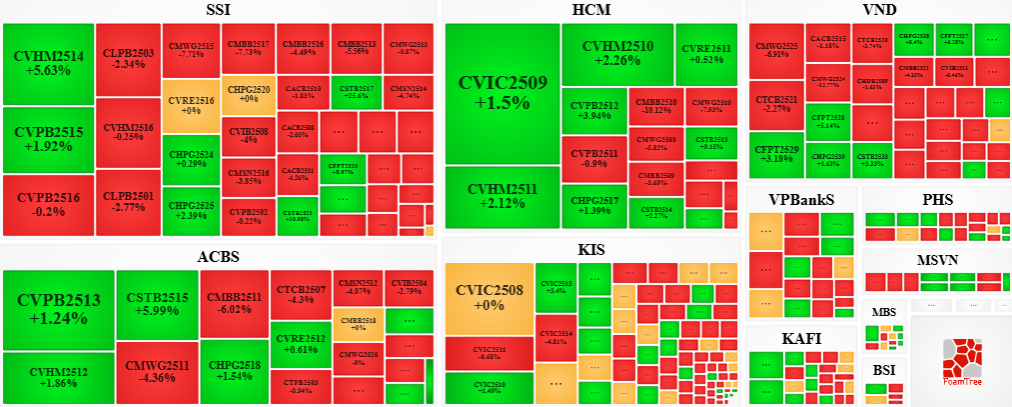

Securities companies SSI, ACBS, KIS, and HCM are currently the issuers with the most warrant certificates in the market.

Source: VietstockFinance

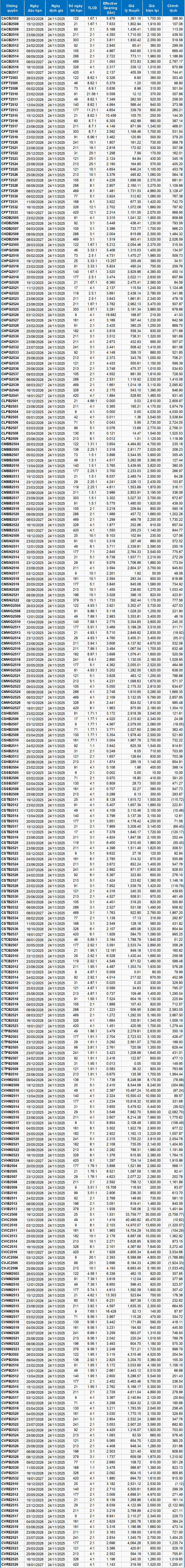

II. MARKET STATISTICS

Source: VietstockFinance

III. WARRANT VALUATION

Based on the valuation method appropriate for the starting date of November 24, 2025, the reasonable prices of the warrant certificates currently trading on the market are as follows:

Source: VietstockFinance

Note: The opportunity cost in the valuation model has been adjusted to suit the Vietnamese market. Specifically, the risk-free treasury bill rate (Government Treasury Bill) is replaced by the average deposit rate of major banks, with term adjustments suitable for each type of warrant certificate.

According to the above valuation, CVIC2508 and CVRE2515 are currently the two most attractively priced warrant certificates.

Warrant certificates with higher effective gearing will experience greater volatility in response to underlying securities. Currently, CHPG2526 and CVNM2516 are the two warrant certificates with the highest effective gearing ratios in the market.

Economic Analysis & Market Strategy Division, Vietstock Consulting Department

– 18:58 23/11/2025

Foreign Block Net Sells Trillions in Week 17-21/11, Countering 1.000 Billion Dong “Buy” of a Bluechip Stock

Foreign investors continued their net selling streak with significant pressure, except for a surprising net buying session on Thursday, which quickly reversed to net selling by the weekend’s close.

Stock Market Week 17-21/11/2025: Tug-of-War Continues

The VN-Index trimmed its losses in Friday’s session after retesting the Middle Band of the Bollinger Bands, a critical support level essential for sustaining its short-term recovery momentum. Amid cautious investor sentiment and limited demand breadth, the market is likely to remain volatile and range-bound in the upcoming sessions.