At the close of the session on November 21, the USD Index (DXY) surged by 0.91 points compared to the previous week, reaching 100.11 points—its highest level in nearly five months.

A delayed report from the U.S. Department of Labor, due to a government shutdown, revealed that the economy added 119,000 jobs in September 2025, more than double the forecasted 50,000. This data reinforces the Federal Reserve’s view that the labor market, while slowing, remains stable. As a result, expectations for a rate cut in December 2025 have diminished, bolstering the strength of the U.S. dollar.

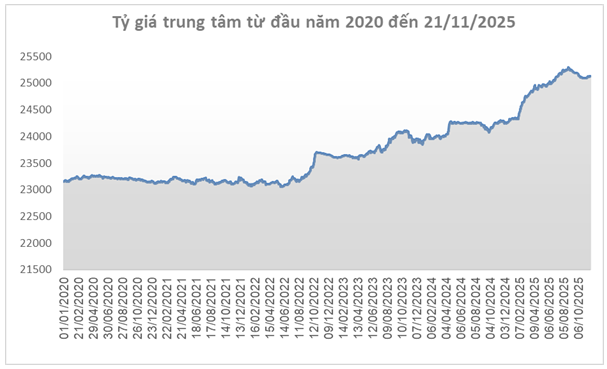

Source: SBV

|

Global developments have influenced domestic exchange rates. On November 21, the State Bank of Vietnam set the central exchange rate at 25,136 VND/USD, a 14-dong increase from the previous week and marking three consecutive weeks of growth. With a ±5% band, commercial banks are permitted to trade within the range of 23,879 – 26,393 VND/USD.

At the Foreign Exchange Management Department, the reference exchange rate was listed at 23,930 – 26,342 VND/USD (buy – sell), both rising by 14 dong over the week.

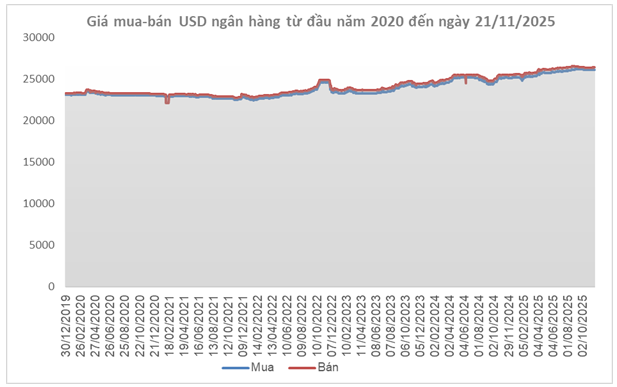

Source: VCB

|

Among banks, Vietcombank reported a closing rate of 26,142 – 26,392 VND/USD (buy – sell), a 14-dong increase in both directions.

Source: VietstockFinance

|

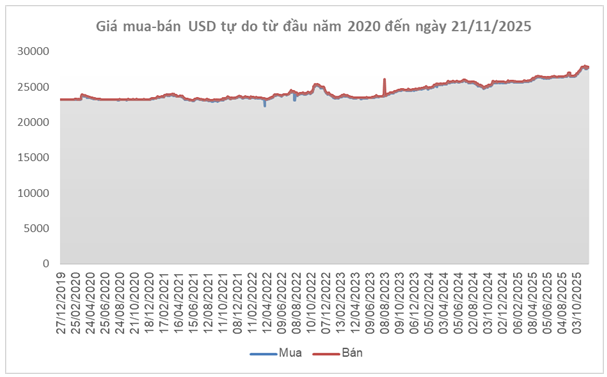

Conversely, in the free market, the USD price dipped slightly, trading at 27,700 – 27,800 VND/USD (buy – sell), down by 70 dong and 100 dong, respectively, from the previous week.

– 16:28 23/11/2025

Exclusive Gold Sale: November 20th – Massive Discounts on Gold Bars & Rings

Domestic and global gold prices experienced a synchronized decline during the trading session on November 20th.