Miliket’s 2-Shrimp Instant Noodles

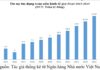

According to an official announcement, Vinataba will auction off a full lot of 960,000 shares, equivalent to 20% of Colusa – Miliket’s charter capital (stock code: CMN). The auction is scheduled for December 18, 2025, at the Hanoi Stock Exchange (HNX).

Vinataba has set the starting price at 119,500 VND per share. At this price, the auction lot is valued at a minimum of approximately 115 billion VND.

This move is part of the corporation’s restructuring plan for the 2021-2025 period, aimed at divesting from non-core investments and focusing resources on core business areas. Alongside Miliket, Vinataba is also initiating similar procedures at Lilama Real Estate JSC, Nada Beer JSC, and Northern Food JSC.

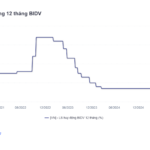

Despite a significant reduction in market share compared to its 1990s heyday, Colusa – Miliket has maintained stability through a cautious business strategy. A standout feature in the company’s financial report is its absolutely safe capital structure, characterized by zero financial debt and a robust cash flow that ensures consistent annual dividend payments.

Financial data highlights stability in core business operations. In 2024, the company recorded revenue of 740 billion VND and post-tax profit of 23 billion VND. This growth momentum continued in the first half of 2025, with revenue nearing 400 billion VND and post-tax profit of approximately 11 billion VND. The company’s gross profit margin has remained steady at 26-27%, a promising figure in the fiercely competitive fast-moving consumer goods sector.

Miliket’s appeal to investors also lies in its asset quality. As of June 30, 2025, the company’s total assets were recorded at 286 billion VND. Of this, cash and bank deposits amounted to 160 billion VND, representing 56% of total assets.

Additionally, the company manages and utilizes strategically located land assets. Notably, these include a 2-hectare plot on Kha Van Can Street (Ho Chi Minh City) with a lease term until 2065, and an 8,590 m² plot on To Vinh Dien Street (Thu Duc). Although much of this land is leased annually or undergoing legal completion, these assets remain significant commercial advantages when assessing the company’s long-term potential.

Currently, Colusa – Miliket has a charter capital of 48 billion VND, unchanged since its 2006 IPO. The company’s ownership structure is highly concentrated, with three major shareholders controlling nearly 86% of the charter capital.

Specifically, Southern Food Corporation (Vinafood II) is the largest shareholder with 30.7% ownership, followed by Mesa Trading and Services LLC at 20.08%, and Vinataba at 20% (the portion to be divested). With this structure, the entry of a new shareholder replacing Vinataba will be a critical variable potentially influencing the company’s future governance direction.

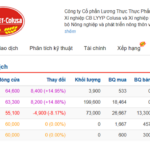

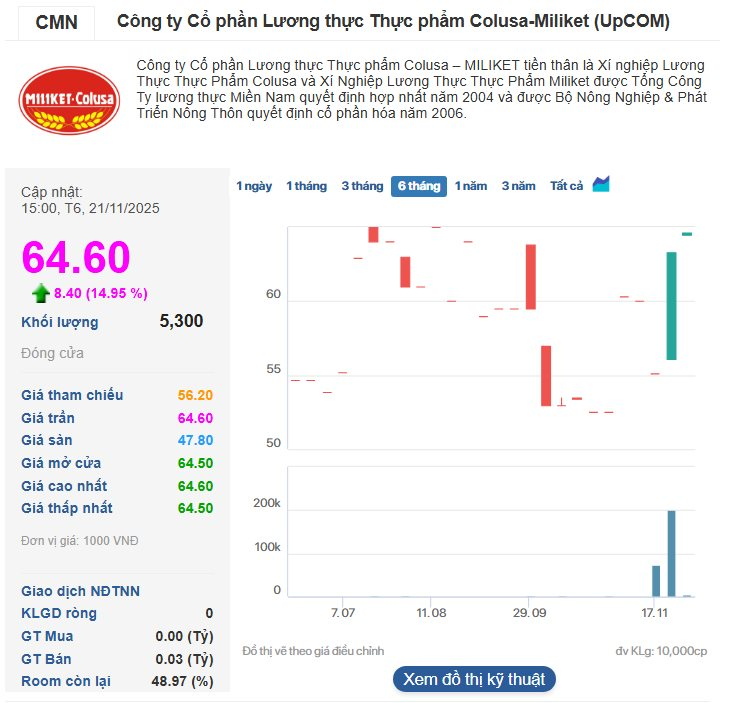

CMN Stock Price

In response to the divestment news, CMN shares on the UPCoM market experienced significant price and liquidity fluctuations last week. By the close of the November 21 session, CMN’s price surged by the maximum limit of 14.95%, ending at 64,600 VND per share. The previous day also saw a dramatic increase, with trading volume spiking to nearly 200,000 units.

Despite two consecutive days of strong gains, CMN’s current market price remains approximately 46% below the starting price of 119,500 VND per share announced by Vinataba.

Instant Noodles, Flashlights, and Dry Alcohol Are Flying Off the Shelves in Hanoi and Northern Vietnam

Amidst the chaos wreaked by Storm No. 3 and the subsequent floods, the demand for instant noodles, bottled water, bread, dry alcohol, and alcohol stoves has surged in Hanoi and several northern provinces. This crisis has brought to light the resilience and innovation of the people in these affected regions.

The Rise and Fall of Vietnamese Brands

In today’s fiercely competitive market, many venerable brands with a heritage spanning over half a century have faced challenges and had to adapt to stay relevant. Amidst economic integration, some have even faced obscurity and a decline in their stature. However, through it all, a number of iconic Vietnamese brands, belonging to a “golden generation”, have bravely embraced change and innovation to not just survive but thrive and rise again.