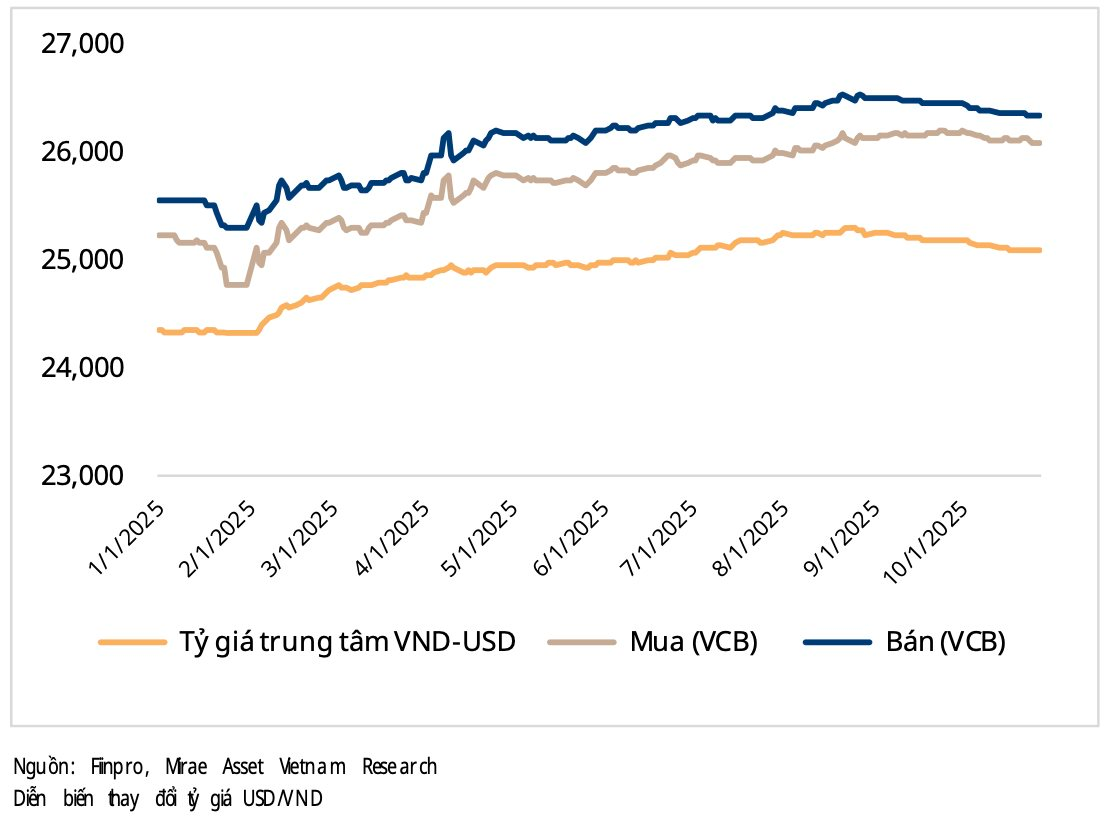

The central USD/VND exchange rate announced by the State Bank of Vietnam on November 14 reached 25,122 VND, nearing its historical peak. Compared to the beginning of the year, the central rate has increased by 3.2%, surpassing the 1.8% rise recorded in the same period in 2024.

According to a newly released analysis report, Mirae Asset attributes the surge in the exchange rate to the divergence between Vietnam’s monetary policy of lowering interest rates and the Federal Reserve’s stance of maintaining high rates, creating a significant gap.

“Headaches” Over Exchange Rates

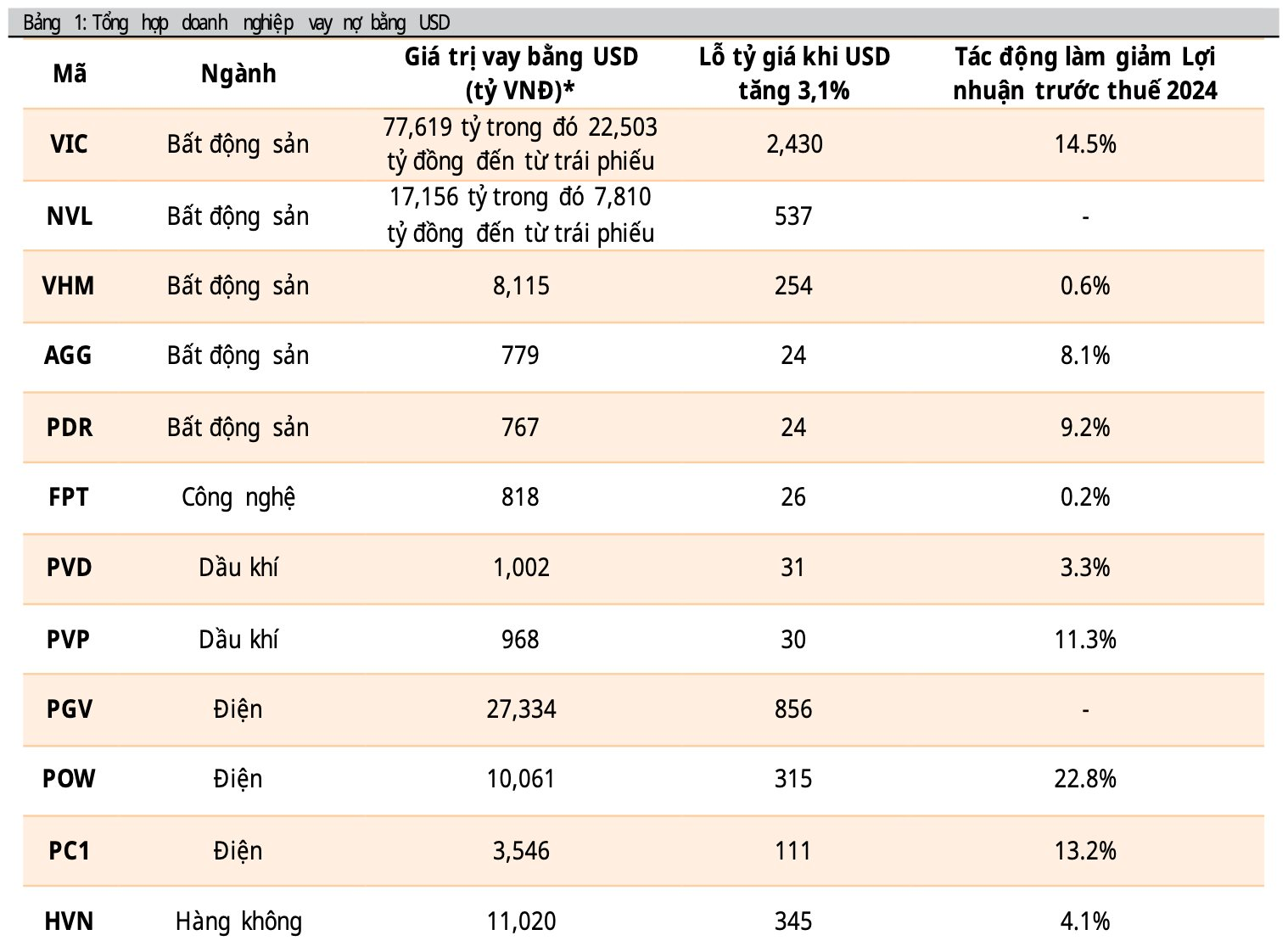

Mirae Asset highlights that companies with substantial USD-denominated debt will face losses due to exchange rate fluctuations. This, in turn, erodes the profits of businesses borrowing in USD.

However, the impact varies depending on a company’s internal operations, including its asset and liability structure in foreign currencies, USD revenue streams, and the timing of transactions. Some firms may offset losses by benefiting from exchange rate differentials in other currencies.

Billionaire Pham Nhat Vuong is among the most affected by the exchange rate fluctuations. Mirae Asset estimates that Vingroup (VIC) could incur an exchange rate loss of approximately 2,430 billion VND due to its total USD-denominated debt exceeding 77,600 billion VND, including 22,500 billion VND in bonds. Other Vingroup subsidiaries, such as Vinhomes (VHM) and Vinpearl (VPL), are also expected to face significant losses.

Additionally, Masan (MSN) may lose 1,045 billion VND due to USD debt of 33,370 billion VND. Novaland (NVL) is projected to lose around 537 billion VND with USD debt of 17,156 billion VND. Other affected companies include EVNGENCO3 (PGV), PV Power (POW), and Vietnam Airlines (HVN).

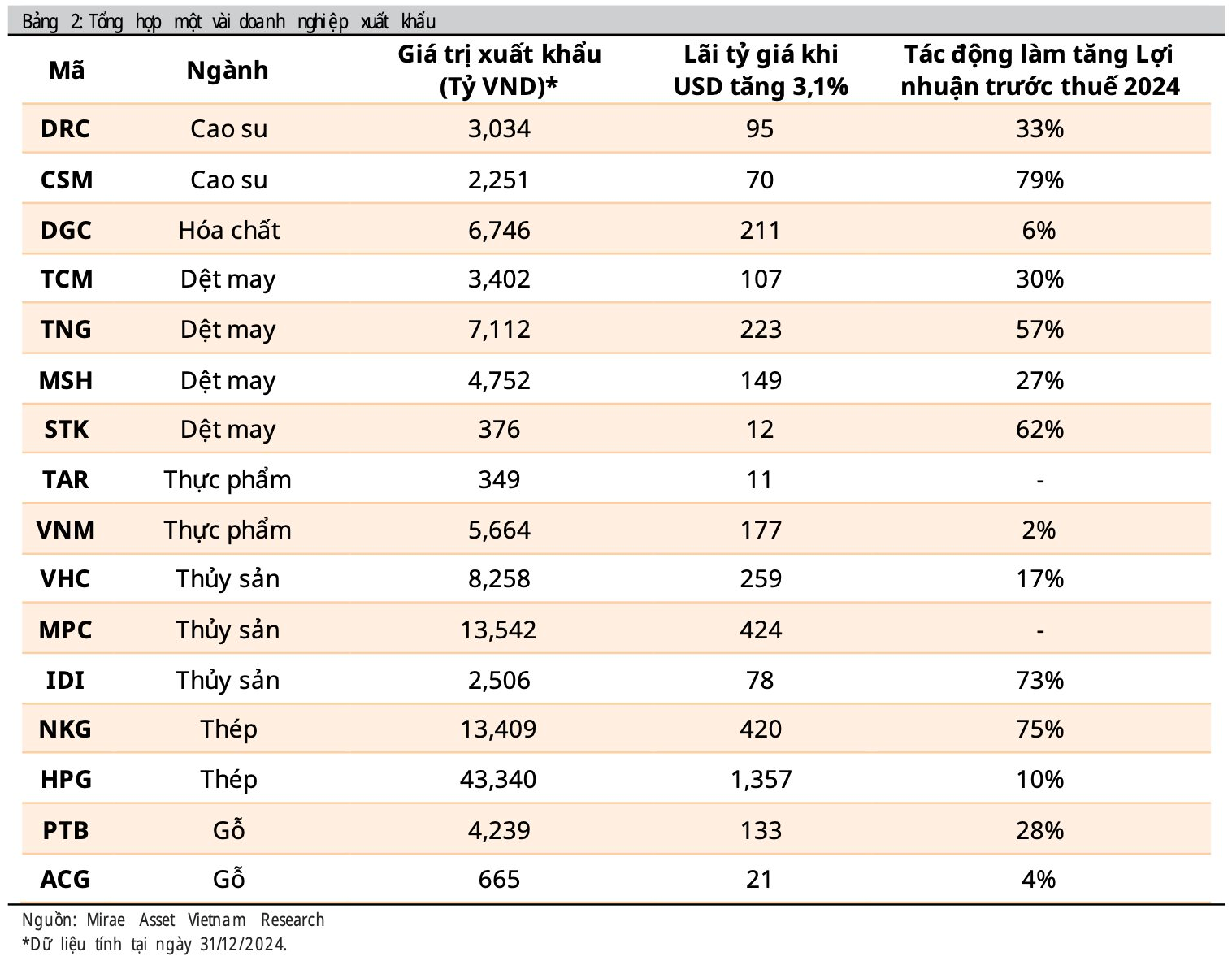

Moreover, import-dependent industries such as paper (DHC), plastics (BMP), chemicals (CSV), and food (VNM) may face negative impacts as input costs rise with the strengthening USD/VND exchange rate.

Many Companies “Quietly Rejoice”

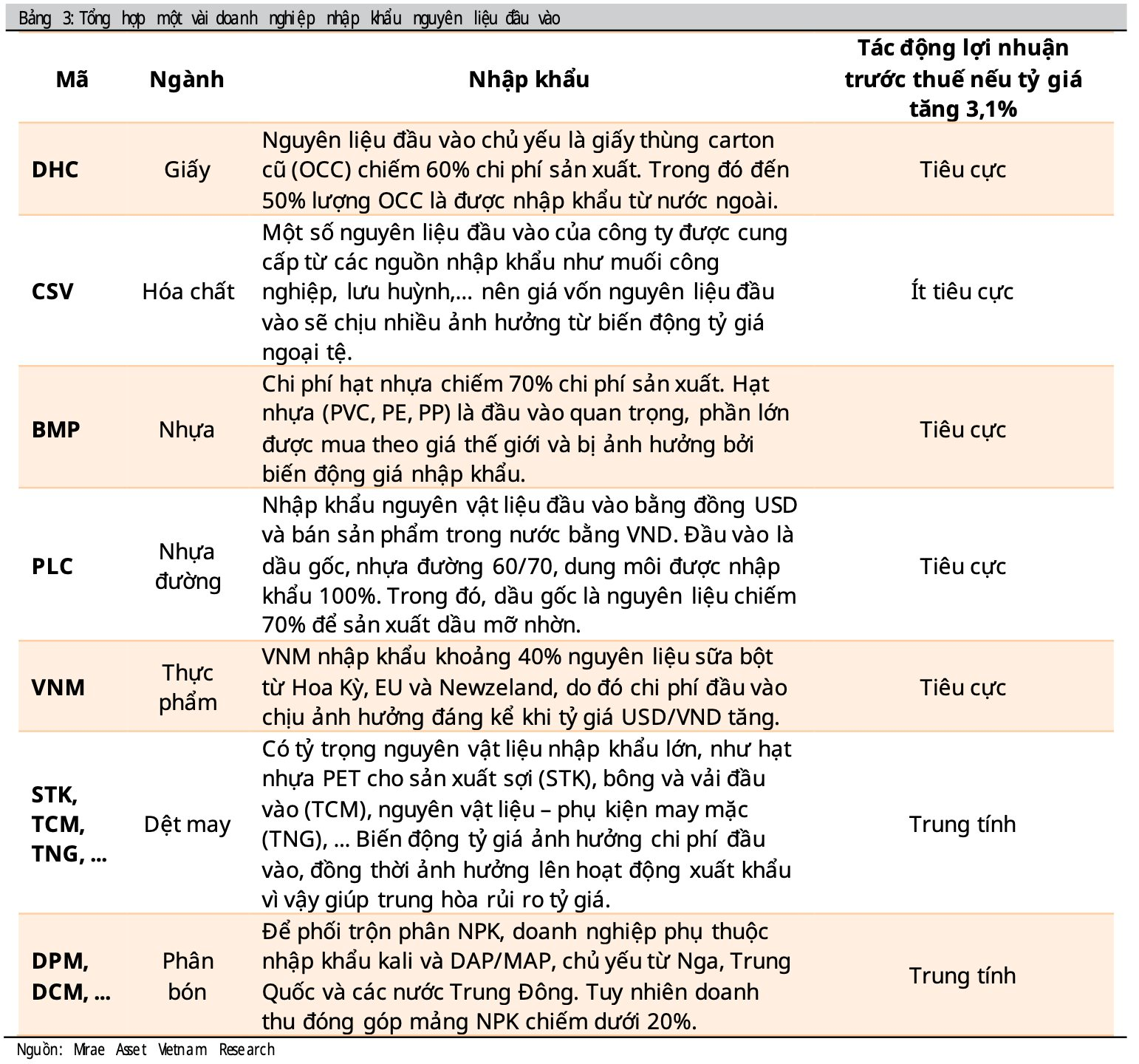

Conversely, Mirae Asset notes that export-oriented companies benefit from the rising USD/VND rate, particularly in sectors like steel, textiles, seafood, footwear, electronics, agriculture, rubber, and wood.

The steel industry, however, faces a dual impact due to both export revenue and USD-denominated debt. The effect depends on individual companies’ financial structures. Mirae Asset estimates that Hoa Phat (HPG), led by “Steel King” Tran Dinh Long, could gain 1,357 billion VND from exchange rate differentials with exports exceeding 43,300 billion VND. Another steel company, Nam Kim (NKG), is expected to profit around 420 billion VND.

The seafood sector, with its significant export revenue, also benefits from the stronger USD. Minh Phu Seafood (MPC) is estimated to gain approximately 424 billion VND. Rubber and tire companies like Danang Rubber (DRC) and Casumina (CSM), with low USD debt and strong export focus, also profit from the exchange rate shift.

The textile industry (MSH, TCM, TNG, STK…) faces a dual impact due to its reliance on imported raw materials for export production. As a result, exchange rate fluctuations have minimal effect on their business outcomes.

Food companies like Vinamilk (VNM), with primarily domestic revenue and limited USD exposure, are less sensitive to exchange rate changes. They may benefit slightly from exports or foreign currency holdings but face risks from rising import costs if the exchange rate fluctuates sharply.

In summary, these figures are based on Mirae Asset’s analysis and are for reference only. Accurately assessing the impact of exchange rates on businesses is challenging due to continuous changes in financial structures and market conditions. Additionally, some companies mitigate exchange rate risks using financial derivatives such as forward contracts, options, and swaps.

A Phenomenon That Troubles Many Billionaires, Yet Brings Quiet Joy to Steel Tycoon Trần Đình Long

The USD/VND exchange rate has seen a notable increase, reflecting significant shifts in the economic landscape. This upward trend underscores the dynamic interplay between the U.S. dollar and the Vietnamese đồng, influenced by global market conditions and local economic policies. As businesses and investors closely monitor these fluctuations, understanding the implications of this rise becomes crucial for strategic financial planning and decision-making.

A Fresh Perspective on Exchange Rates

The U.S. Federal Reserve’s (Fed) 0.25 percentage point rate cut has eased pressure on the Vietnamese dong’s exchange rate against the U.S. dollar, allowing Vietnam to maintain its accommodative monetary policy. However, a more fundamental solution is still required to address this issue effectively.

“The State Bank’s ‘Triple Pronged Attack’ to Curb Rising Exchange Rates”

Amidst the backdrop of a steadily rising USD/VND exchange rate in late August and early September, the State Bank of Vietnam has implemented a series of measures to cool down the market. However, upward pressure on the exchange rate remains significant, despite the near-certainty of a Fed rate cut at its September meeting.

Maintaining Exchange Rate Stability

“With the busiest season for trade fast approaching, businesses are yearning for stable exchange rates to ease their financial worries. As the markets gear up for the frenzied festive period, a consistent currency value could be the difference between a prosperous year-end and a stressful scramble for many companies.”