Last week, the VN-Index kicked off with a bullish gap, sparking optimism before the market entered prolonged sideways sessions between 1,645 and 1,660 points. Caution dominated early trading days as buying momentum failed to sustain a breakout. Overall liquidity remained 40% below the 20-week average, indicating investors stayed on the sidelines following the rebound from the 1,580 support level.

The week’s highlight came in the final session. After a lackluster morning pushed the index near the 1,635 MA10 level, strong buying pressure emerged in the afternoon. Broad-based demand, particularly in Vingroup, select banking stocks, and aviation shares, fueled a late rally. The index closed near session highs, preserving the 1,640 support. The hammer candlestick pattern suggests buyers remain active.

For the week of November 17-21, the VN-Index gained 19.47 points (+1.19%). Real estate, seafood, and aviation stocks led the gains, while telecom, securities, and consumer staples faced selling pressure.

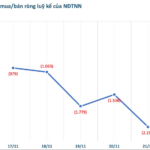

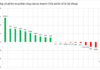

Foreign investors continued net selling, totaling nearly VND 1.9 trillion. VIX (VND 879 billion), MBB (VND 641 billion), and VCI (VND 512 billion) saw the heaviest outflows.

The VN-Index rebounded over 19 points this week.

According to CSI Securities experts, the VN-Index stood out positively last week, despite negative performances in regional markets like Nikkei 225 (-2.40%), Hang Seng (-2.38%), and KOSPI (-3.79%). Expectations of a December Fed rate cut have diminished, pressuring global equities.

While the index recovered, matched volume remained 42.7% below the 20-week average. CSI analysts see no clear trend reversal yet. However, this presents opportunities for investors to accumulate positions near support levels, gradually increasing exposure as liquidity confirms market direction.

Vietcombank Securities (VCBS) analysts noted the VN-Index’s 19-point recovery boosted market sentiment. Notably, buying concentrated in large-caps and stocks with unique growth narratives rather than broad participation.

VCBS recommends holding existing positions in trending stocks to maximize gains. For new trades or short-term plays, follow speculative money flows into sectors like real estate, chemicals, and construction, which have attracted liquidity recently.

Regarding low liquidity, Le Tran Khang, Senior Analyst at Phu Hung Securities (PHS), cautioned that caution prevails. The rebound lacks conviction, and the index may retest the 1,630-1,660 range. A breach below 1,625 would threaten the recovery trend.

Moderate-risk investors should remain sidelined until the resistance test confirms. Improved liquidity and consensus breakouts would strengthen participation signals.

High-risk traders must exercise caution to avoid price traps. Maintain stop-loss discipline. Sectors testing support levels include energy, exports, utilities, and real estate.

Unveiling the Hidden Buying Power in Investment Fund Transactions

During the week of November 17–21, 2025, investment funds predominantly shifted towards selling activities as the VN-Index fluctuated between 1,620 and 1,650 points, coinciding with the expiration of the VN30 futures contract. Trading volumes from these funds remained relatively low, with individual orders ranging from tens to hundreds of thousands of shares.

Navigating Day Trading: Essential Strategies for Investors to Avoid Losses in the Stock Market

As the stock market anticipates the implementation of T+0 settlement, liquidity is surging, offering investors ample opportunities. However, this heightened activity also necessitates robust defensive strategies to mitigate potential risks.