Governor Nguyen Thi Hong: The State Bank of Vietnam (SBV) Zone 2 currently has the largest scale and number of credit institutions in the country, necessitating close management and proactive forecasting to advise the SBV and local authorities.

During the meeting, Mr. Vo Minh Tuan, Director of SBV Zone 2 Branch, reported on the organization and operations of the branch following the restructuring and streamlining of its apparatus. The SBV Zone 2 Branch oversees monetary and banking activities in Ho Chi Minh City and Dong Nai Province.

Mr. Nguyen Duc Lenh, Deputy Director of SBV Zone 2 Branch, highlighted that state management of monetary and banking activities in Dong Nai Province has closely followed key priorities. Notable tasks include addressing challenges faced by businesses, supporting socio-economic development, and effectively implementing national target programs for poverty reduction, particularly through the Vietnam Bank for Social Policies’ lending programs.

Regarding monetary market trends, Mr. Lenh noted that Dong Nai Province is considered more stable compared to other major urban areas. Capital mobilization by credit institutions has maintained positive growth, with four state-owned commercial bank branches dominating over 50% of total mobilized capital in the region. This has contributed to a more stable interest rate environment compared to other cities.

Moving forward, the SBV Zone 2 Branch plans to continue implementing the central bank’s policies, focusing on coordinating with relevant agencies to integrate social security data via VNeID, promote payment through bank accounts, and accelerate non-cash transactions.

In her concluding remarks, Governor Nguyen Thi Hong instructed the SBV Zone 2 Branch to ensure the smooth, safe, and efficient operation of credit institutions in the region following the administrative and organizational restructuring. She also emphasized the need for the branch to collaborate with SBV departments to effectively operate the new organizational model.

The Governor further urged the SBV Zone 2 Branch to closely monitor monetary market developments, promptly address emerging issues, and actively engage with the People’s Committees of Ho Chi Minh City and Dong Nai Province to stabilize the macroeconomy and foster socio-economic growth in the region.

Mr. Vo Minh Tuan acknowledged the Governor’s directives and stated that the leadership, staff, and employees of the SBV Zone 2 Branch would translate these instructions into specific solutions for implementation in Ho Chi Minh City and Dong Nai Province. This includes tailored approaches for each locality, aligned with the new development context of both regions.

Unifying the Expansion Plan for Phase 2 of the Nghi Son Refinery

The Prime Minister has tasked the National Industry-Energy Corporation with collaborating alongside Nghi Son Refinery and Petrochemical LLC and its investors to finalize the expansion plan for Phase 2 of the Nghi Son Refinery and Petrochemical Complex.

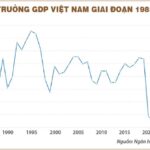

What Drives the 2026 Growth Objectives?

The National Assembly has approved an ambitious economic growth plan for 2026, targeting a record-breaking increase of 10% or higher. What are the key drivers that will propel this unprecedented growth?