This strategic move also serves as a “strategic indicator,” shedding light on the development path that Phat Dat is pursuing during the real estate market’s restructuring phase.

Through this transaction, one can observe the blend of necessary caution and decisiveness of a company entering a new acceleration phase.

In a context where prime land in Ho Chi Minh City’s central areas is increasingly scarce and the market is entering a strong differentiation cycle, securing a valuable location like 239 Cach Mang Thang Tam (now in Ban Co Ward) not only demonstrates the ability to access strategic supply sources but also reflects the capability to select projects with high investment efficiency.

Many companies can acquire suburban projects, but few can own an urban core project with the potential for superior profit margins and sustainable growth. This alone highlights Phat Dat’s deepening focus on quality within its project portfolio.

Notably, this deal follows Phat Dat’s consecutive transfers of attractive projects. Letting go of these projects to acquire others indicates Phat Dat’s proactive acceleration with a clear strategic plan. Such capital reallocation decisions show that Phat Dat is not pursuing expansion at all costs but is concentrating resources to upgrade its portfolio into a structure that is both broad and deep, aligning with future market trends.

From a competitive advantage perspective, maintaining strength in satellite cities while adding a strategic focus on urban cores positions Phat Dat as one of the few companies capable of “standing firmly on two legs.” Suburban projects continue to generate substantial supply, meeting mass-market demand and providing a stable product line—a critical factor in a market with long lag times like real estate. Meanwhile, urban core projects enhance profit margins, improve asset quality, and elevate brand positioning. This balanced structure helps the company remain stable during market fluctuations.

Additionally, the willingness to exit attractive but non-strategic projects demonstrates Phat Dat’s shift to a “selective” development phase, prioritizing high efficiency and speed. In mature real estate markets, concentrating resources on a few high-value flagship projects often yields better results than spreading resources thinly. Phat Dat’s decision aligns with this international trend, indicating a focus on portfolio optimization rather than pure scale growth.

“Sustainable yet rapid development” is the criterion Phat Dat strives to build for itself and its stakeholders in this new phase.

From an investor’s perspective, this strategy has clear implications. A well-structured and upgraded portfolio reduces implementation risks—a significant factor affecting real estate companies’ stock prices in recent years. When a company strategically restructures its project portfolio, cash flow is optimized, investment cycles shorten, and capital turnover accelerates. This sends a positive signal to the capital market, particularly to investors reassessing the asset quality of listed companies.

Another benefit for Phat Dat’s investors is the enhancement of brand value. Successfully executed urban core projects often create a strong brand effect, repositioning the company from “mass development” to “value development.” This improves the company’s appeal to long-term investment funds and opens opportunities for valuation upgrades. For Vietnamese real estate companies, this is key to leading the upcoming recovery cycle.

Furthermore, the acquisition of 239 Cach Mang Thang Tam demonstrates Phat Dat’s foresight into the shifting dynamics of major cities. As the government intensifies urban renewal, develops compact residential areas, and promotes city center redevelopment, strategically located urban core projects will become the fastest-growing asset class. Moving early and in the right direction gives Phat Dat a competitive edge in a segment poised to lead the market from 2026 to 2030.

Overall, Phat Dat’s recent transactions represent a strategic subtraction, addition, and multiplication. The company subtracts non-core assets, adds breakthrough assets, and multiplies competitive advantages by maintaining dual strategic focuses. If the market enters a recovery cycle as expected, this structure will deliver long-term, stable benefits to investors.

Analyzing Phat Dat’s path through this transaction reveals a strategy akin to that of leading real estate developers in more advanced markets—a positive signal for both the market and investors.

Capital Flows Surge into High-Potential Suburban Real Estate Markets

In the final months of 2025, real estate investment capital is increasingly shifting towards suburban areas, driven by the pursuit of opportunities as planning and infrastructure in these regions experience robust development.

Swedish Technology Fuels Growth in Vietnam’s Nutritional Beverage Sector

The Functional Beverage (FSN) industry is experiencing explosive growth as consumers increasingly prioritize health and convenience. To meet rising expectations for quality and safety, Tetra Pak’s comprehensive aseptic processing and packaging solutions empower businesses to preserve nutritional value while optimizing costs.

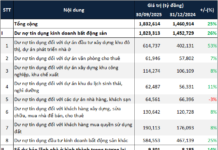

Phat Dat Acquires Dai Quang Minh’s 239 Cach Mang Thang 8 Project

Phat Dat Real Estate Development Corporation (HOSE: PDR) has announced an extraordinary disclosure regarding the acquisition of all shares held by Dai Quang Minh Real Estate Investment Corporation in AKYN Investment Trading Service Corporation. This strategic move is aimed at developing a VND 5.5 trillion apartment project.