I. MARKET ANALYSIS OF THE BASE STOCK MARKET ON NOVEMBER 24, 2025

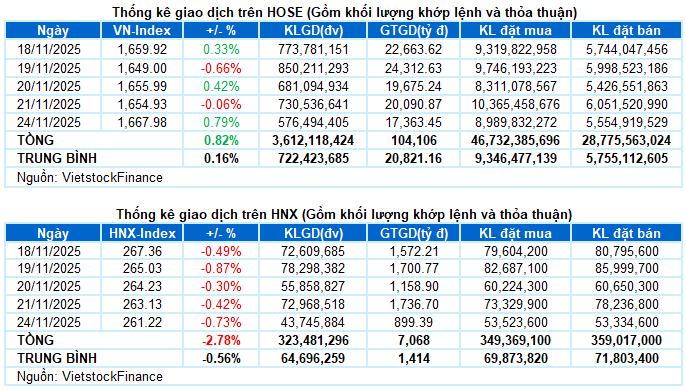

– Key indices showed mixed movements during the November 24 trading session. The VN-Index rose by 0.79%, reaching 1,667.98 points, while the HNX-Index declined by 0.73%, closing at 261.22 points.

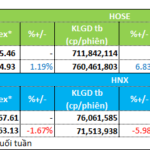

– Trading volume on the HOSE decreased by 21.6%, totaling just over 522 million units. The HNX also recorded only more than 41 million matched units, a 32.8% drop compared to the previous week’s session.

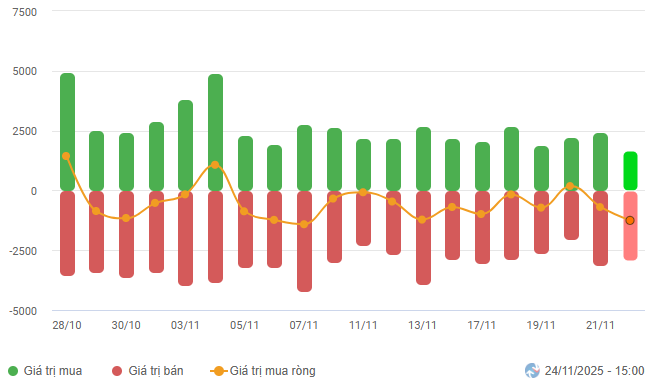

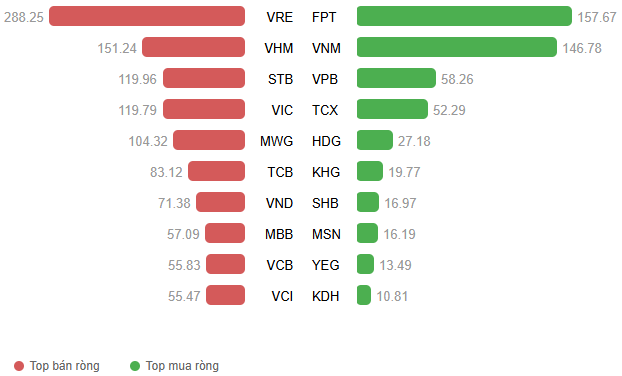

– Foreign investors increased net selling, with values exceeding VND 1.1 trillion on the HOSE and nearly VND 33 billion on the HNX.

Foreign Investors’ Trading Value on HOSE, HNX, and UPCOM by Date. Unit: Billion VND

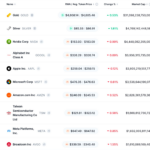

Net Trading Value by Stock Code. Unit: Billion VND

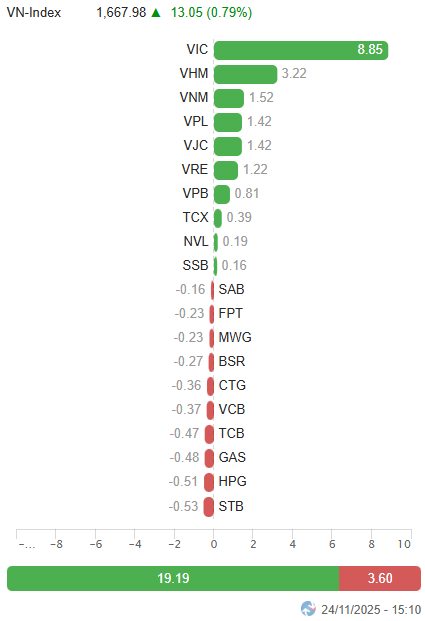

– The VN-Index started the new week positively, led by large-cap stocks, quickly surpassing the 1,670-point mark within the first hour of trading. However, the effort to pull the index higher wasn’t enough to stimulate more enthusiastic trading, as cautious liquidity prevented broader market gains. Apart from a few leading stocks like VIC, VHM, VRE, VNM, and VJC, the rest of the market remained fragmented, slowing the upward momentum by the end of the morning session. This pattern repeated in the afternoon session, with the leading group continuing to pull the index above 1,670 points again, but failing to sustain the gains until the close. The VN-Index ended the day with a 13-point increase (+0.79%), closing at 1,667.98 points.

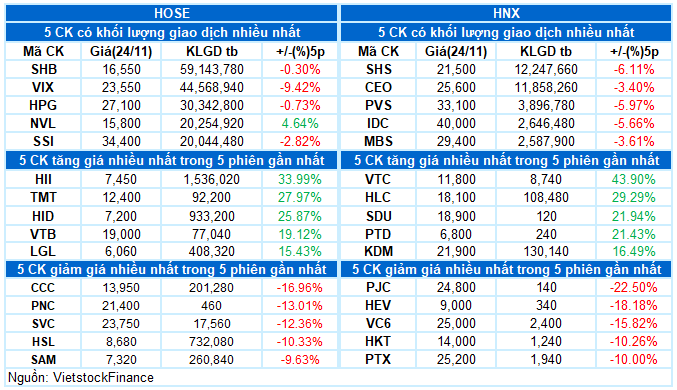

– Of the 13-point gain in the VN-Index, VIC alone contributed nearly 9 points. Other Vingroup stocks, including VHM, VRE, and VPL, added a combined total of nearly 6 points, while VNM and VJC each contributed approximately 1.5 points. On the downside, STB, HPG, GAS, and TCB were the most significant drags, subtracting 2 points from the index.

Top Stocks Influencing the Index. Unit: Points

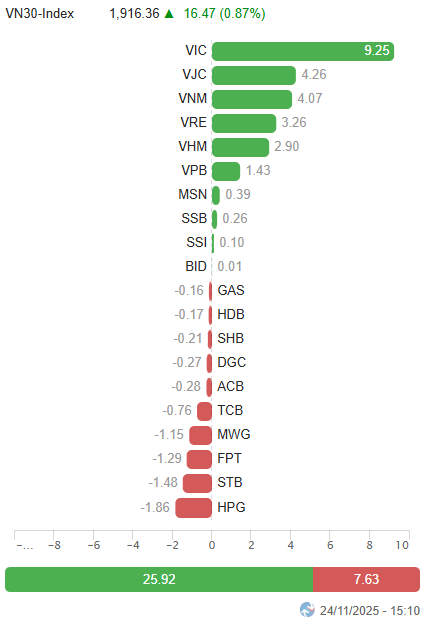

– The VN30-Index closed with a 16.47-point gain, reaching 1,916.36 points. In terms of breadth, declining stocks outnumbered advancing ones, with 18 stocks falling, 10 rising, and 2 remaining unchanged. The standout performer on the upside was VRE, followed by VJC, VNM, VIC, and VHM, all surging over 3%. Conversely, STB, GAS, SAB, and HPG saw notable declines of more than 1%. The remaining stocks experienced minor fluctuations around the reference level.

Sectoral divergence continued to dominate. The real estate sector led the market with a 2.85% gain, but aside from the Vingroup trio, only NVL (+2.6%) and KHG (+2.65%) stood out. Many other stocks, such as CEO, DXG, DIG, IDC, PDR, SCR, and HQC, saw significant adjustments.

The essential consumer goods sector also emerged as a notable bright spot, driven by strong contributions from VNM (+5.18%), HAG (+1.12%), MML (+6.16%), and OGC, which hit its ceiling.

Meanwhile, the energy sector was the laggard, with widespread declines. Notable performers included BSR (-1.58%), PVS (-1.78%), OIL (-0.94%), PVT (-0.83%), and POS (-2.6%). The materials sector also faced significant pressure, with stocks like HPG, HSG, DPM, AAA, DHC, and KSV adjusting more than 1%.

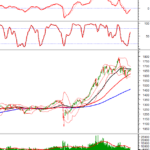

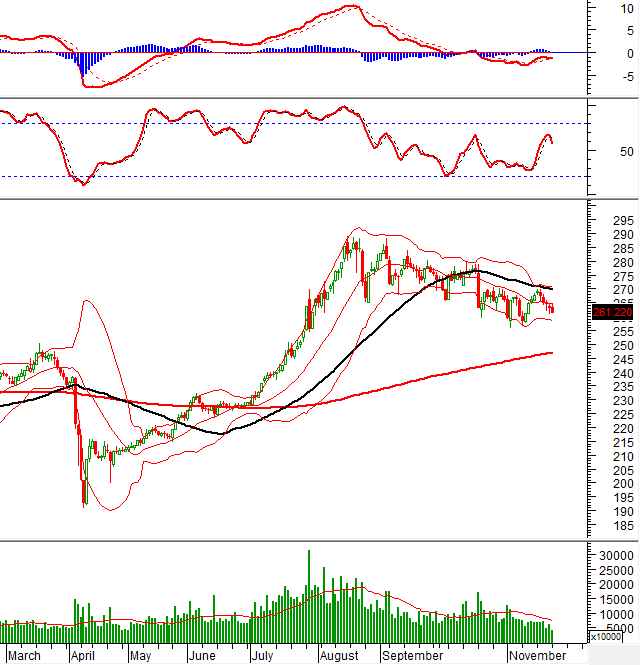

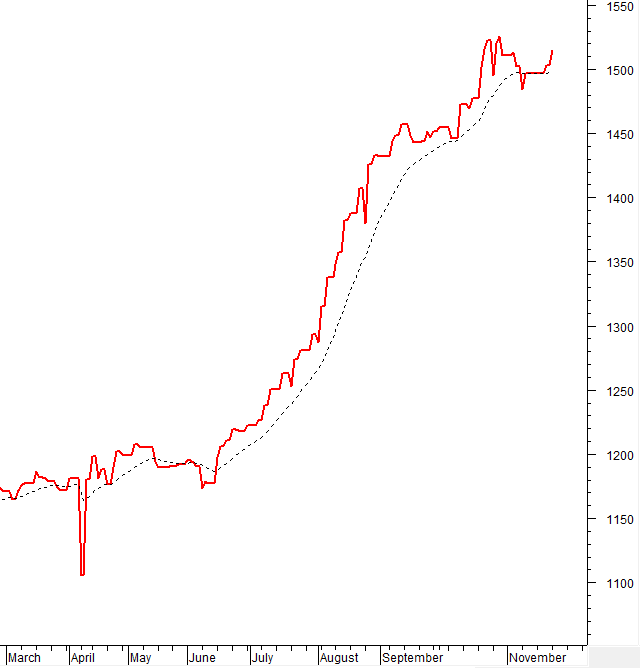

The VN-Index resumed its upward trend, approaching the 50-day SMA. The index needs to break through this level, accompanied by trading volume exceeding the 20-day average, to solidify the upward trend. The MACD indicator continued to rise after giving a buy signal. The short-term outlook will become more positive if this indicator crosses above the 0 threshold in the coming sessions.

II. TREND AND PRICE VOLATILITY ANALYSIS

VN-Index – Approaching the 50-day SMA

The VN-Index resumed its upward trend, approaching the 50-day SMA. The index needs to break through this level, accompanied by trading volume exceeding the 20-day average, to solidify the upward trend.

The MACD indicator continued to rise after giving a buy signal. The short-term outlook will become more positive if this indicator crosses above the 0 threshold in the coming sessions.

HNX-Index – Fifth Consecutive Session of Decline

The HNX-Index declined for the fifth consecutive session and is in a rather pessimistic state after failing to test the Middle Bollinger Band.

The Stochastic Oscillator has given a sell signal again. If the MACD also gives a similar signal in the coming sessions, the risk will increase significantly.

Capital Flow Analysis

Smart Money Movement: The Negative Volume Index of the VN-Index is currently above the 20-day EMA. If this state continues in the next session, the risk of a sudden drop (thrust down) will be limited.

Foreign Capital Movement: Foreign investors continued net selling in the November 24, 2025, trading session. If foreign investors maintain this action in the coming sessions, market volatility may occur.

III. MARKET STATISTICS FOR NOVEMBER 24, 2025

Economic Analysis & Market Strategy Department, Vietstock Advisory Division

– 17:09 November 24, 2025

Seafood & Food Stocks Lead the Week in Attracting Investment

Liquidity trends diverged between the Ho Chi Minh City Stock Exchange (HOSE) and the Hanoi Stock Exchange (HNX) during the trading week of November 17–21. Investor sentiment remained cautious, with a selective focus on specific sectors. Notably, the seafood and food stocks emerged as the week’s favorites, attracting significant capital inflows.

The Strategic Move by Chairmen of Bà Rịa – Vũng Tàu’s Top Two Real Estate Giants

Mr. Doan Huu Thuan, Chairman of the Board of Directors at Ba Ria – Vung Tau Housing Development JSC, plans to invest approximately VND 49 billion in acquiring over 492,000 HDC bonds. Meanwhile, Mr. Nguyen Hung Cuong, Chairman of DIC Corp’s Board of Directors, will purchase 6.7 million newly issued shares of DIG.

Where is the Stock Market’s Trading Focus Currently Directed?

The spotlight is now on sectors that have been attracting strong liquidity in recent sessions, including real estate, chemicals, and construction.