|

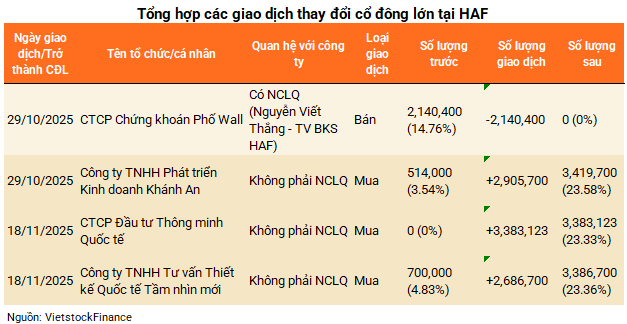

On November 18th, HAF welcomed two unrelated organizations as major shareholders. International Smart Investment Corporation acquired nearly 3.4 million shares, increasing its ownership from 0% to 23.33%. On the same day, New Vision International Consulting and Design Company purchased an additional 2.7 million shares, raising its stake from 4.83% to 23.36%.

All transactions by these two entities were conducted through agreements, totaling 131.6 billion VND, with an average price of 21,682 VND per share—approximately 3% higher than the closing price of 21,000 VND per share on the same day.

Previously, on October 29th, Khanh An Business Development Company acquired over 2.9 million HAF shares, increasing its ownership from 3.54% to 23.58%, becoming the largest shareholder. This agreement was valued at 71.2 billion VND, with an average price of 24,500 VND per share—7% higher than the closing price of 22,800 VND per share.

Conversely, Wall Street Securities Corporation (HNX: WSS) sold its entire 2.14 million HAF shares, representing 14.76% of the capital, and is no longer a shareholder. The transaction value was estimated at 52.4 billion VND, 21% lower than the initial investment of 66.3 billion VND recorded at the end of September 2025, according to WSS’s financial report.

Despite welcoming new major shareholders, HAF‘s stock price remained largely unresponsive following these large-scale agreement transactions. Since late October, the stock price has retreated to 21,000 VND per share and has been trading sideways, with liquidity nearly frozen.

The stock has declined by 20% in the past quarter but remains approximately 75% higher than its price a year ago. Average liquidity stands at only 808 shares per session. Earlier, HAF surpassed 28,000 VND per share in July, its highest level in nearly two years, yet it remains under warning due to three consecutive years of qualified audit opinions.

| HAF Stock Price Performance Over the Past Year |

The company owns prime urban land but faces core business challenges.

Hanoi Food (HAF) operates in multiple sectors, primarily focusing on retail and food services, dining, entertainment, short-term accommodations, and commercial property management. The company owns numerous business locations and assets in prime areas of Hanoi, including a 9-story building at 51 Le Dai Hanh, offices in Giang Vo and Truong Dinh, a bakery production facility in Tay Son, and a network of Haprofood supermarkets and convenience stores totaling over 1,500 square meters.

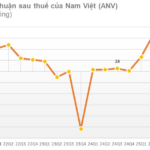

Despite its land advantages, HAF‘s food retail and service operations have struggled for years, with declining revenue and continuous losses since 2020. Many business locations have been closed, leases terminated, or contracts liquidated early.

In Q3 2025, the company reported a net loss of nearly 27 billion VND, significantly higher than the 2 billion VND loss in the same period last year, primarily due to revenue adjustments from contract liquidations at 112 Pho Hue (Hanoi). Accumulated losses by the end of September reached 117.5 billion VND, with equity capital at 108.6 billion VND, reflecting prolonged losses from 2020 to 2024.

| HAF’s Annual Business Results |

Amidst deteriorating business results and increasing shareholder volatility, HAF has announced an extraordinary General Meeting of Shareholders for January 2026, with the ex-dividend date set for December 11th. The meeting agenda has not yet been disclosed.

– 16:28 24/11/2025

PGBank Board Member Revises Share Purchase Plan

Board member Dinh Thanh Nghiep and his wife have not executed their registered purchase of PGB shares, citing a lack of personal demand at this time.

Oil & Gas Stock Surges 40% to One-Year High as Brokerages Forecast 44% CAGR Growth for 2026-2028

The positive growth in business results during Q3 2025 has been a key driver supporting the stock price performance.

Big Group Holdings: Unlocking 2025 Profits with Three Revolutionary Business Strategies to Boost Stock Valuation

By the end of 2025, Big Group Holdings JSC (UPCoM: BIG) is set to expand its three strategic pillars through its subsidiaries: Big Expo, Big Hotel, and Big Bro. This growth trajectory is projected to drive consolidated revenue above 500 billion VND and post-tax profit exceeding 20 billion VND. These positive developments have fueled a steady rise in BIG’s stock price over recent weeks.