Market liquidity decreased compared to the previous session, with the order-matching trading volume of the VN-Index reaching over 522 million shares, equivalent to a value of more than 15.4 trillion VND; the HNX-Index reached over 41 million shares, equivalent to a value of over 846 billion VND.

The VN-Index opened the afternoon session positively as buyers maintained their dominance, pushing the index close to 1,675 points. However, selling pressure persisted, curbing the VN-Index‘s upward momentum and closing it in the green. In terms of influence, VIC, VHM, VNM, and VPL were the most positively impactful stocks on the VN-Index, contributing over 15 points. Conversely, STB, HPG, GAS, and TCB faced selling pressure, subtracting nearly 2 points from the index.

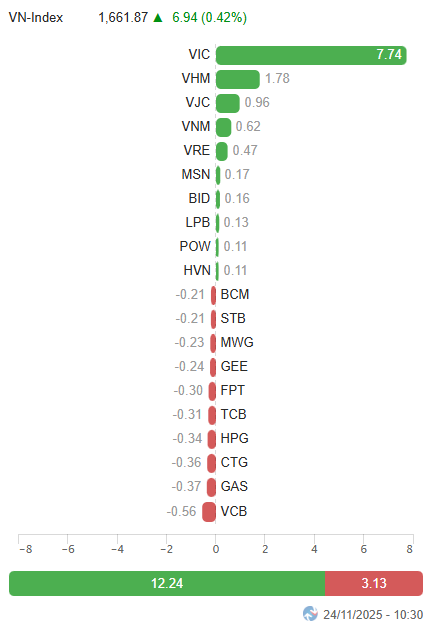

| Top 10 stocks impacting the VN-Index on November 24, 2025 (in points) |

In contrast, the HNX-Index showed a rather pessimistic trend, negatively impacted by stocks like IDC (-2.91%), HUT (-2.29%), PTI (-9.5%), and KSV (-1.33%).

| Top 10 stocks impacting the HNX-Index on November 24, 2025 (in points) |

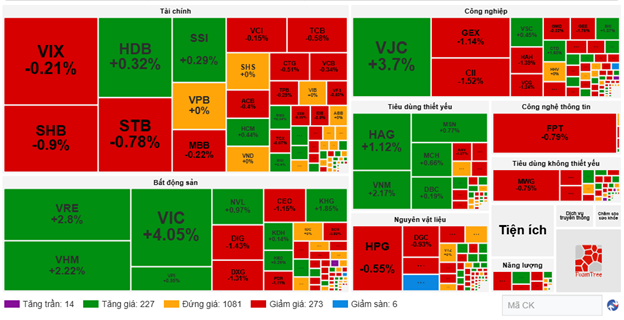

At the close, the market saw a slight increase with mixed sector performance. Specifically, the real estate sector led the gains with a 2.85% increase, primarily driven by VIC (+4.27%), VHM (+3.42%), VRE (+6.99%), NVL (+2.6%), and KBC (+0.14%). Essential consumer goods and non-essential consumer goods followed with gains of 1.17% and 0.96%, respectively. Conversely, the energy sector recorded the largest decline, down 0.96%, mainly due to BSR (-1.58%), PVS (-1.78%), and PLX (-0.29%).

In terms of foreign trading, foreign investors continued to net sell over 1.159 trillion VND on the HOSE, focusing on VRE (288.25 billion), VHM (151.24 billion), STB (119.96 billion), and VIC (119.79 billion). On the HNX, foreign investors net sold over 32 billion VND, concentrated in CEO (22.78 billion), PVS (15.15 billion), HUT (2.43 billion), and PVI (2.08 billion).

| Foreign net buying and selling trends |

Morning Session: Blue-chip stocks support the index, VNM and VJC shine

Led by blue-chip stocks, the VN-Index maintained its green trend in the final morning session, temporarily halting at 1,667.09 points, up 0.73%. Meanwhile, the HNX-Index fluctuated below the reference level, reaching 262.49 points, down 0.24%.

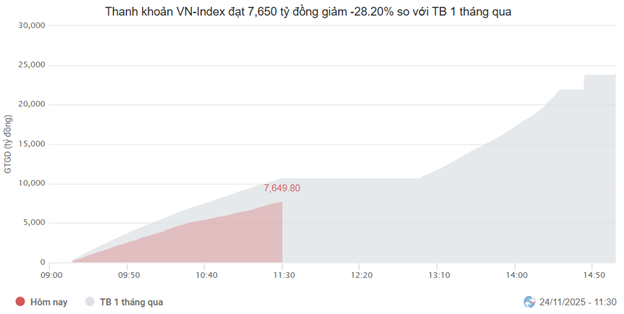

Investors remained cautious amid the morning’s blue-chip movements. Trading value on the HOSE only reached over 7.6 trillion VND, down about 13% from the previous session and 28% from the one-month average. Even the trading value on the HNX was only about half of the one-month average at the same time, at 417 billion VND.

Source: VietstockFinance

|

Vingroup’s major stocks cooled somewhat from their morning highs, partly due to strong profit-taking pressure from foreign investors. VRE, VIC, and VHM were among the top stocks net sold by foreign investors this morning.

| Top 10 stocks with the strongest foreign net buying and selling in the morning session of November 24, 2025 |

Meanwhile, VJC (+4.06%) and VNM (+5.01%) surged impressively in the final morning session, helping to anchor the index around 1,665 points. These were also the two stocks actively net bought by foreign investors amid increasing selling pressure from this group. In total, foreign investors net sold over 804 billion VND across all three exchanges in the morning session of November 24.

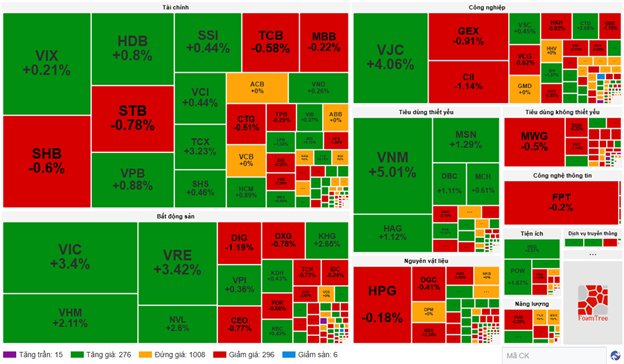

Sector indices continued to fluctuate within a narrow range, except for real estate and essential consumer goods. No sector index saw gains or losses exceeding 0.5%. Market breadth remained balanced, with 291 gainers (15 at the ceiling) and 302 decliners (6 at the floor).

Source: VietstockFinance

|

10:30 AM: Market shifts to a state of divergence

Support from a few major stocks helped the index expand its gains, with the VN-Index surpassing 1,670 points at times. However, the upward momentum gradually narrowed as trading volume failed to respond significantly. As of 10:30 AM, the VN-Index traded around 1,663 points. Meanwhile, the HNX-Index turned red, falling below 263 points.

The VIC stock alone contributed nearly 8 points to the VN-Index, while VHM and VRE added over 2 points. It’s clear that the index’s gains were primarily driven by Vingroup stocks.

Source: VietstockFinance

|

In the broader market, the widespread green seen earlier shifted to a state of clear divergence. Market liquidity also failed to improve in line with the index’s positivity, with trading value down over 7% from the previous session.

Within the VN30 basket, aside from the three Vingroup stocks, only VNM rose 2%, while the rest fluctuated around the reference level. Notably, STB, GAS, TPB, and BCM adjusted downward by over 1%.

Beyond real estate, the essential consumer goods sector performed positively, driven by VNM (+2.17%), MSN (+0.65%), MCH (+0.8%), HAG (+1.12%), MML (+6.16%), and DBC (+0.56%).

Other sectors fluctuated within a narrow range. The early gains in the financial sector also shifted to a state of clear divergence. Securities stocks started strong but significantly narrowed their gains mid-morning, while banking and insurance stocks saw an increase in red, notably VCB, CTG, MBB, STB, SHB, EIB, BVH, and BMI.

Source: VietstockFinance

|

Market Open: Green dominates early session

The market opened the week’s first trading session positively, with green dominating. As of 9:30 AM, the VN-Index rose over 8 points, trading around 1,663 points, while the HNX-Index surpassed 264 points.

Widespread green among large-cap stocks helped stabilize investor sentiment. The financial sector, particularly securities stocks, became an early focus of trading volume. Stocks like SSI, VIX, HCM, SHS, MBS, and VND attracted strong demand and quickly rose over 1% right after the opening. This is a positive signal as liquidity is expected to improve.

Similarly, the real estate sector was well-led by NVL, VIC, VHM, VRE, KHG, KSF, and SJS.

Additionally, some notable early highlights in other sectors included VNM, DBC, HAG, MML, CTD, VSC, and DPG.

– 15:32 24/11/2025