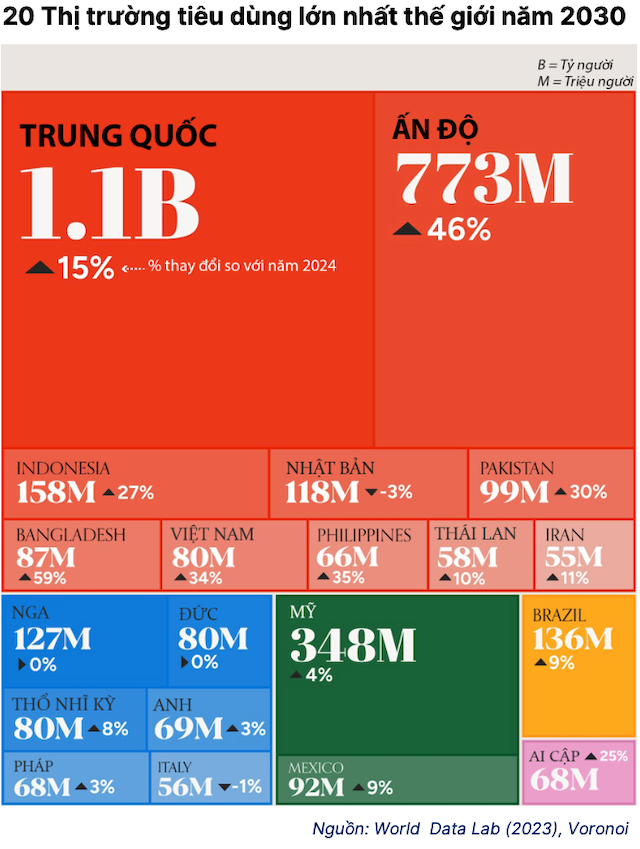

At the recent IR Talk on Vietnam’s retail industry, Mr. Nguyen Minh Hanh, Director of the SHS Analysis Center, revealed that Vietnam’s personal consumption growth surpasses that of Thailand, Indonesia, and the Philippines. In the first nine months alone, total retail sales reached 5.2 trillion VND, a 9.6% increase year-on-year. By 2030, the retail market is projected to grow by 77% from the 2025 figure of 309 billion USD, propelling Vietnam into the top 7 global consumer markets.

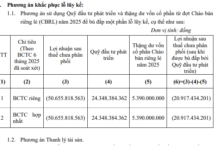

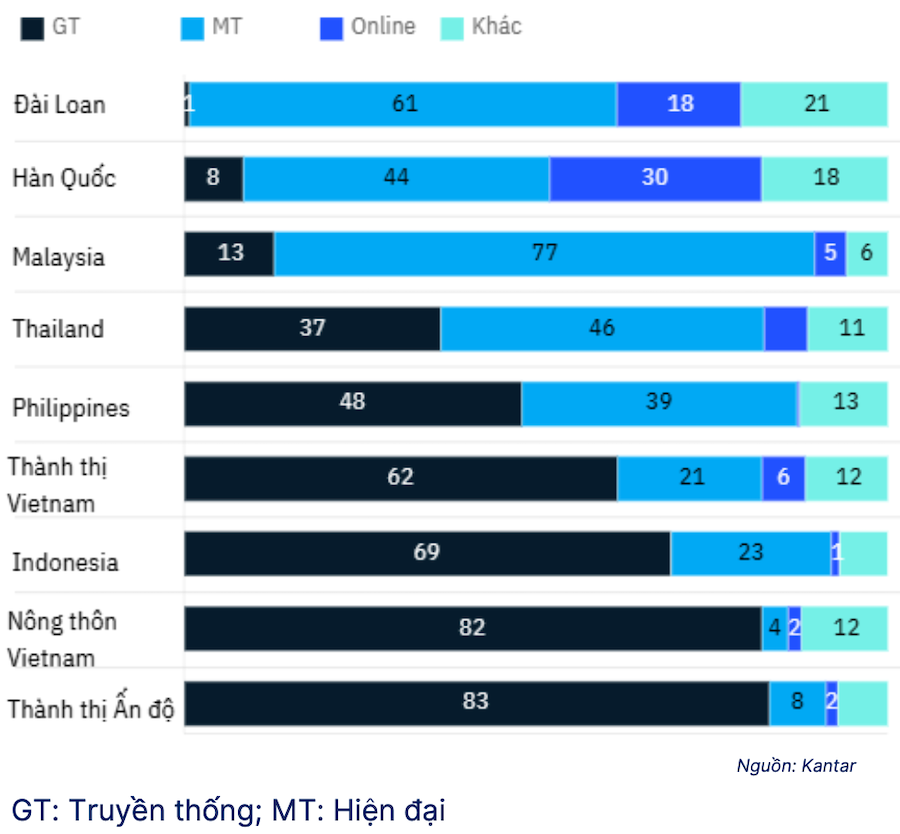

The Fast-Moving Consumer Goods (FMCG) sector, which reflects household spending habits with its high consumption frequency, currently stands at 60-70 billion USD. However, modern trade (MT) channels in urban areas account for only 21%, significantly lower than the regional average of 55%. In rural areas, traditional trade (GT) dominates at 82%, with MT at a mere 6%.

|

Retail Distribution Channels in Vietnam

|

Source: SHS

|

As the market reaches approximately 550 billion USD, the MT share is expected to rise to 35%. SHS experts attribute this growth to 80 million consumers, rapidly increasing incomes, and shifting shopping habits among Gen Z, who make up 40% of the consumer base. With the world’s 14th largest population and the 7th youngest consumer base, Vietnam boasts significant growth potential.

Source: SHS

|

Vietnam’s Retail Cycle Mirrors Regional Trends

Mr. Hanh observes that Vietnam’s retail development follows the cycles of Thailand, Indonesia, the Philippines, and India: prolonged fragmentation, model standardization, and breakthrough by capable chains. Vietnam is currently in the third phase, where rapid expansion and operational efficiency determine a company’s success.

FMCG, a traditional sector, has models similar to global standards. Differentiation arises from standardization speed, reasonable investment costs, low break-even points, and streamlined operations.

Vietnam’s modern retail landscape is highly fragmented. “Modern store density is low at 81 stores per million people, compared to 173 in Indonesia and 136 in Thailand,” notes Mr. Hanh. While urban areas have seen significant growth, suburban and rural regions remain prime growth areas due to low MT penetration.

Additionally, the elimination of presumptive taxes for individual businesses and mandatory invoicing for all transactions will rapidly reduce traditional trade, which currently handles 70% of fresh produce. This shift will boost demand for transparent, convenient shopping, potentially pushing MT to 35% before 2030 and even 50% by 2030.

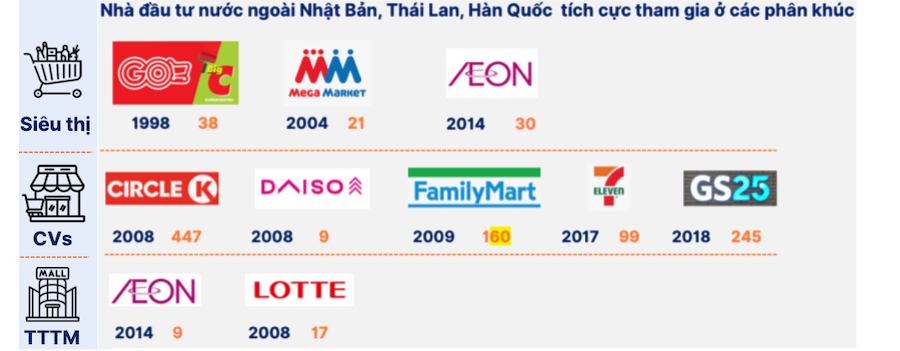

According to SHS, domestic investors dominate Vietnam’s MT market with 62% of revenue (2023) and 87.1% of stores (2022). While foreign companies focus on shopping malls and 24/7 convenience stores, local businesses prefer mini-supermarkets and mid-sized supermarkets, which align with consumer behavior and offer lower investment costs for faster expansion.

|

Source: SHS

|

Given the fragmented modern retail market, no single company dominates, and “the race is still on,” says Mr. Hanh.

In 2022, Mega Market led MT revenue with 24.8% of the nearly 9.8 billion USD market. By 2025, WinMart topped supermarket numbers with 128 stores, followed by Coopmart with 98. WinMart also led convenience stores with 4,229 locations. SHS identifies six success factors for top Asian retail chains: parent company support, extensive network and scale, unique value propositions, robust business foundations, strong branding, exclusive market access and local understanding, and omnichannel platforms.

For instance, Thailand’s 7-Eleven holds 19% market share, with two other chains at 6%, totaling nearly 50%. By 2025, 7-Eleven’s 17,000 stores in Thailand will outnumber all of Vietnam’s modern stores combined.

Indonesia’s Alfamart operates 20,120 mini-supermarkets, each 100-150 m² with 3,800 SKUs, similar to Vietnam’s small-scale, fast-expanding model focused on essential consumer needs. The Philippines also emphasizes small, diverse outlets for essential goods.

Domestic Companies Accelerate Standardization for Expansion

Vietnam’s retail market remains undecided. Low modern store density, rapidly changing consumer behavior, increasing operational standardization pressure, and high expansion and profitability demands characterize the sector. Internationally, markets typically consolidate to 2-3 leading chains with 30-40% market share, a trend Vietnam is likely to follow, predicts SHS.

Phan Nguyen Trong Huy, CFO of WinCommerce, reports operating over 4,200 mini-supermarkets and 128 large supermarkets, with revenue rising from 27 trillion VND (2019) to 30.055 trillion VND (2023) and an expected 39 trillion VND by 2025. Operating profit is projected to turn positive, reaching nearly 1 trillion VND this year. Standardized 80-150 m² stores with 1,500-2,000 SKUs have reduced investment and operating costs by 30%, increasing gross margin by 7%. New store costs average 800-900 million VND, with payback in under 3 years.

Warehouse-processed goods have increased to 60%, shelf availability to 90%, and logistics costs have dropped by 11%. Cash cycle improvements from +16 days (2019) to 0 days (2024) and a target of -7 days (2025) align with efficient global retail chains’ negative working capital models, enabling early cash flow and rapid reinvestment. With 4,500 stores by 2025, EBIT margins are expected to reach 2.7%, reflecting scale-driven operational efficiency, according to company representatives.

– 21:45 24/11/2025

What Enables Masan Consumer to Sustain Superior Profitability Across Economic Cycles?

In a volatile global economy, Masan Consumer (UPCoM: MCH) consistently delivers exceptional profitability, ranking among the top FMCG companies in the region with the highest profit margins. In 2025, the company was recognized by S&P Global as one of the world’s leading sustainable consumer goods enterprises.

“Transforming Rural Retail: WinCommerce’s Double-Digit Growth Strategy”

The Vietnamese retail industry is undergoing a rapid evolution, with a significant shift from traditional (GT) to modern trade (MT) channels. This transformation is driven by consumers who prioritize convenient shopping experiences, quality products, and enhanced services. As consumers increasingly demand a seamless blend of physical and digital retail, the industry is responding with innovative solutions to meet their needs. This dynamic shift towards modern trade presents a pivotal opportunity for retailers to adapt and thrive in a rapidly changing market.

The Surprising Truth About Ho Chi Minh City’s Prime Real Estate: Rent Prices Surpass Those in Seoul, South Korea’s Capital.

The prime real estate in Hanoi’s city center boasts competitive rental rates of 96.4 USD/m2, while Ho Chi Minh City offers a slightly higher rate of 151 USD/m2. These prices are a bargain when compared to neighboring markets, offering a great opportunity for businesses looking to establish themselves in these vibrant cities.