Recently, VPBank announced the auction of a petrol station rest stop in Thanh Lâm commune, Ninh Bình, which includes a 10-story building, a petrol station, and a 3-story service block housing a restaurant and operations center. The starting bid is set at nearly 41 billion VND.

The petrol station rest stop in Thanh Lâm commune, Ninh Bình, is up for auction by the bank at nearly 41 billion VND.

VietinBank has announced the auction of land use rights in Zone C of the new urban area An Vân Dương, Chiếc Bi village, Phú Thượng commune, Phú Vang district, Thua Thien Hue province (now Mỹ Thượng ward, Hue City), with a starting price of over 225 billion VND.

Agribank Branch 9 has announced the auction of three mortgaged properties in Ho Chi Minh City with a total starting price of 220 billion VND. Additionally, the branch is auctioning 17 other land use rights in Minh Thạnh commune, Ho Chi Minh City (formerly part of Binh Duong), covering a total area of over 132 hectares, with a starting price of nearly 690 billion VND.

BIDV Hoc Mon Branch has announced the auction of collateral assets, including land use rights and attached assets, located at 90B National Highway 22, Trung Mỹ Tây ward, Ho Chi Minh City. The starting bid for this auction is nearly 149 billion VND.

BIDV Hue Branch has announced the auction of the entire debt of a customer group comprising Thanh Trang Co., Ltd., Viet Trang Beverage One Member Co., Ltd., and Hoang Lan One Member Co., Ltd. The debt includes principal, interest, and associated costs.

To secure the loan, the customer group mortgaged several properties in Hue, including land plots at 29 Doi Cung (517 sqm), 72-74 Ben Nghe (275 sqm), and 47 Xuan Thuy (110 sqm). Additionally, the collateral includes a car owned by Thanh Trang Co., Ltd. The starting price for this debt is over 123 billion VND.

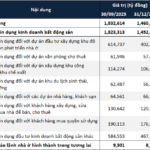

According to experts, banks are intensifying the liquidation of mortgaged assets at the end of the year to recover debts. Many assets have been successfully sold, leading to a significant increase in net profit from other activities for several banks in the first nine months of 2025 compared to the same period last year. Banks such as BIDV, BVBank, NamABank, NCB, Techcombank, TPBank, and Vietcombank have seen remarkable growth.

For instance, Techcombank’s net profit from other activities in the first nine months of 2025 reached 1.39 trillion VND, doubling from the previous year. TPBank’s profit also doubled to 440 billion VND, while BIDV’s profit increased twofold to 6.669 trillion VND. ABBank saw a 13-fold increase to 1.291 trillion VND, and Saigonbank’s profit ratio rose significantly from 12.15% to 19.56%.

Experts attribute this growth primarily to the recovery of the collateral market, especially in real estate. After a prolonged slump, improved liquidity and rising property prices have made it easier for banks to sell assets and recover higher values.

This year marks a period of intensified bad debt resolution for banks, addressing accumulated issues from previous years. Many debts, fully provisioned in earlier periods, are now being conclusively resolved, with every recovered amount recorded entirely as profit from other activities.

The third-quarter financial reports released by banks indicate that the industry’s on-balance-sheet bad debt increased by approximately 7 trillion VND to 274 trillion VND, with a bad debt ratio of 2.01%. However, this is not a cause for concern, as banks have proactively reduced risk management activities to around 21 trillion VND during the period.

Furthermore, banks have continued to strengthen provisioning, setting aside 34 trillion VND, which has slightly improved the industry’s bad debt coverage ratio (LLR) to 96%.

Smart Cash Flow: Relaxed Investing, Sustainable Returns with Homie City

The 2025 real estate market signals a return to cautious investment strategies, with investors prioritizing densely populated residential areas, transparent legal frameworks, and genuine demand. This shift explains why Homie City in Vạn Xuân, Phổ Yên (Thái Nguyên) has emerged as a standout choice in a highly fragmented market.

“Once Shunned for Its Cemetery Proximity, This House Now Commands Over $9,000 per Square Meter”

Amidst the soaring property prices in Hanoi, even apartments once shunned for their proximity to cemeteries are now fetching billions of dong, reflecting the city’s relentless real estate surge.

What Happens When Northeast Region Receives Investment Signals for Metro Lines and Highways Starting 2026?

Transportation infrastructure stands as a cornerstone for economic, industrial, and real estate value growth. Following recent consolidations, a wave of infrastructure investment is sweeping across Northeast Ho Chi Minh City, emerging as a powerful catalyst for regional connectivity and unlocking vast growth potential across multiple sectors.

Real Estate Firms’ Listed Debt Surges 37% Since Year-Start

In line with industry trends, numerous publicly traded real estate companies have increased their borrowing in the first nine months of 2025, strategically positioning themselves for the anticipated market recovery ahead.