The year 2025 marks a historic turning point for Vietnam’s stock market with a special milestone known as the upgrade. The market surged strongly alongside explosive liquidity, enabling securities companies (SCs) to reap significant profits across most of their core business segments.

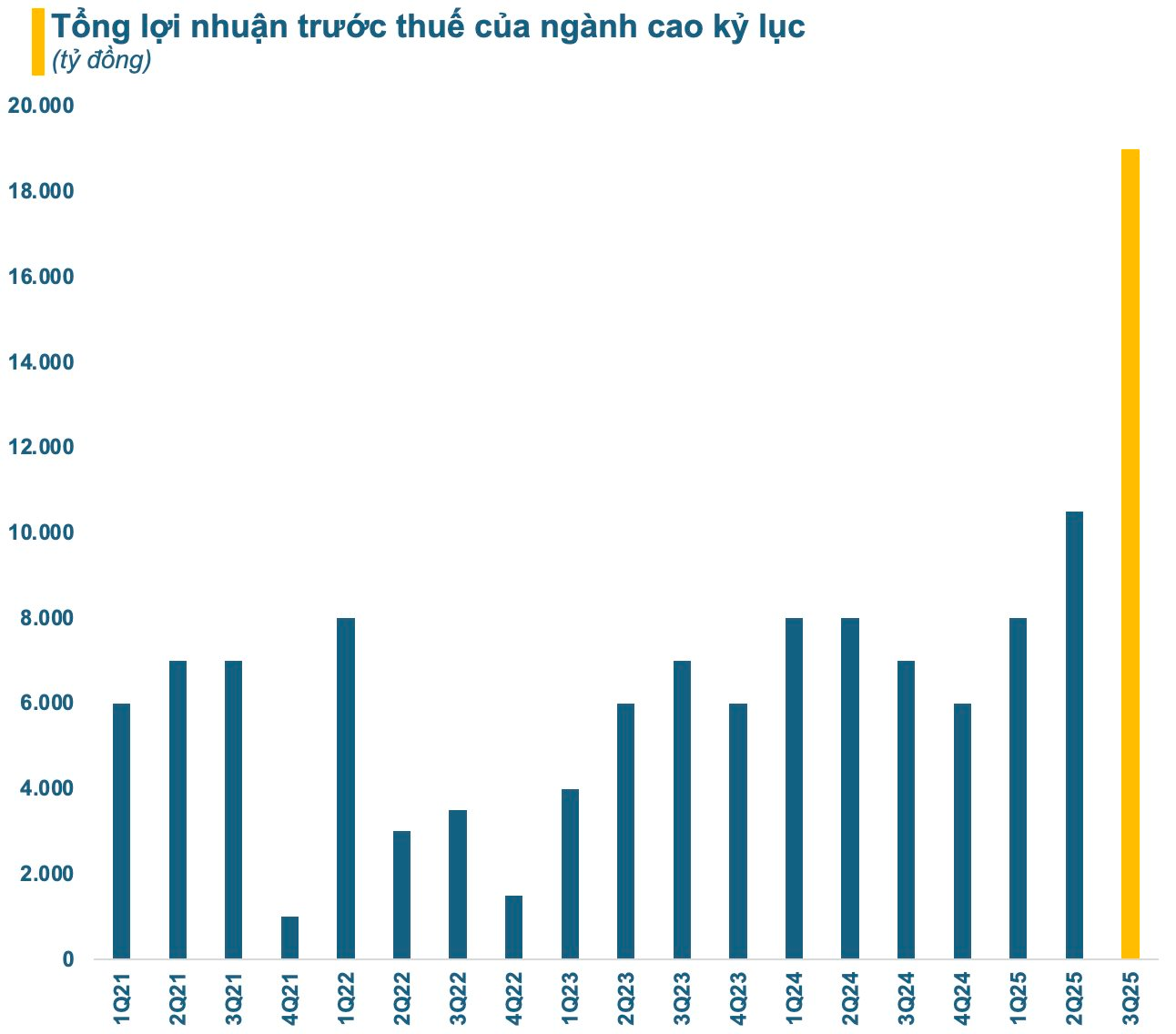

The total profit of the entire securities industry recorded its third consecutive quarter of growth compared to the previous quarter, reaching a record high of approximately VND 19,000 billion, a 171% increase from the same period last year. Accumulated over the first nine months, the total profit of SCs reached around VND 38,000 billion, a 65% increase compared to the same period in 2024, even surpassing the figure for the entire previous year.

In the third quarter alone, for the first time in history, six SCs recorded pre-tax profits exceeding VND 1,000 billion. The accumulated nine-month profits of many SCs such as TCBS, SSI, VNDirect, VPS, VPBankS, VIX, and others even surpassed the figures for the entire year of 2024. Some cases of explosive growth have exceeded the annual plans set after just three-quarters of the journey.

TCBS, SSI Lead in Scale and Margin Debt

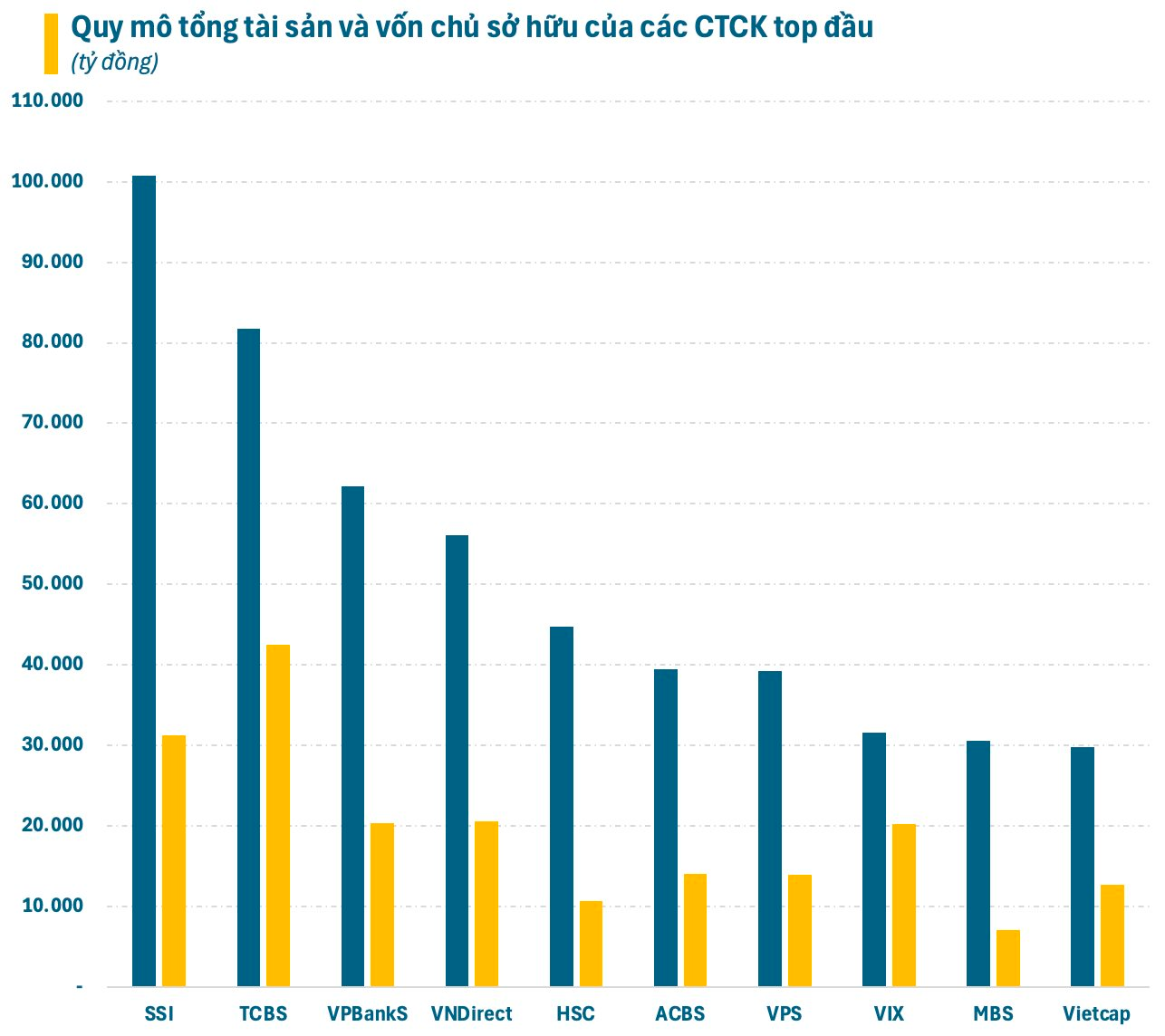

The favorable market conditions have enabled the expansion of various business segments, driving the growth in scale of SCs. As of the end of the third quarter of 2025, the top 10 SCs in terms of scale all had total assets of VND 30,000 billion or more. Notably, with strong growth since the beginning of the year, SSI became the first SC to record total assets exceeding VND 100,000 billion, far surpassing its competitors.

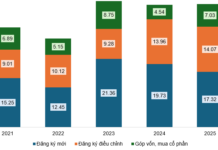

Additionally, breakthrough profits have contributed to strengthening the capital capacity of SCs, alongside the widespread capital increase activities in recent times. As a result, the total equity of the SC group at the end of the third quarter reached VND 308,000 billion, an increase of VND 43,000 billion compared to the end of 2024 and the highest level ever recorded.

As of the end of the third quarter, the top 10 SCs with the largest capital capacity all recorded equity of over VND 10,000 billion. Notably, five SCs including TCBS, SSI, VNDirect, VPBankS, and VIX had equity exceeding VND 20,000 billion. In particular, TCBS became the first SC in history with equity surpassing VND 40,000 billion.

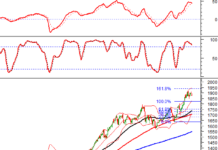

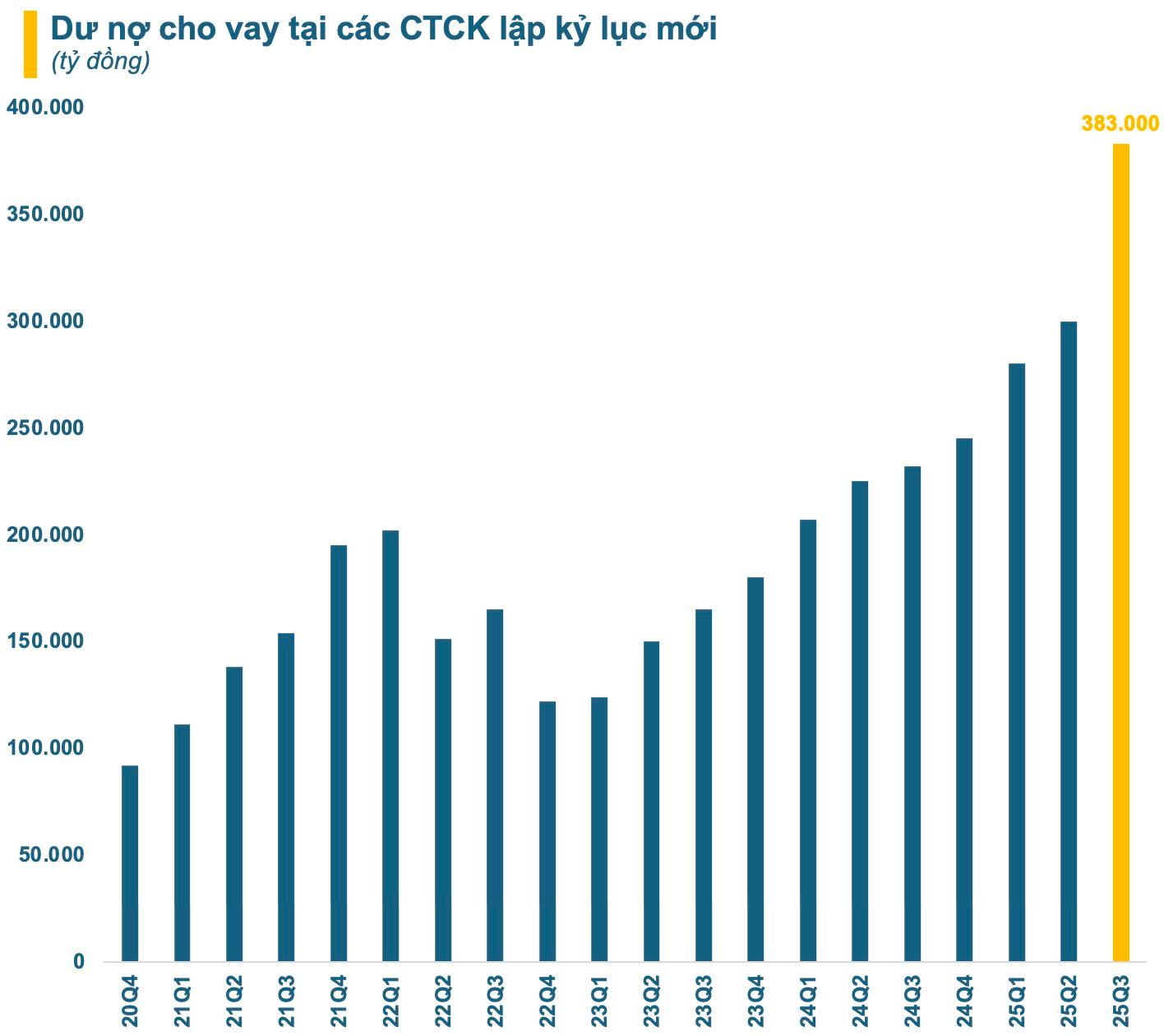

Abundant capital has enabled SCs to meet the unprecedentedly high demand for margin lending, while also improving investment efficiency and service quality. According to statistics, as of the end of the third quarter of 2025, the outstanding loans at SCs were estimated at around VND 383,000 billion, an increase of over VND 138,000 billion compared to the end of the previous year. Of this, margin debt was estimated at approximately VND 370,000 billion, a record high.

As of the end of the third quarter, the entire market had 13 SCs recording outstanding loans of over VND 10,000 billion, with TCBS being the first SC in history to have outstanding loans exceeding VND 40,000 billion. SSI also significantly expanded its lending activities, increasing its outstanding loans to over VND 39,000 billion, closely following TCBS. Additionally, ACBS and VIX were notable names with their outstanding loans surging, entering the top 10.

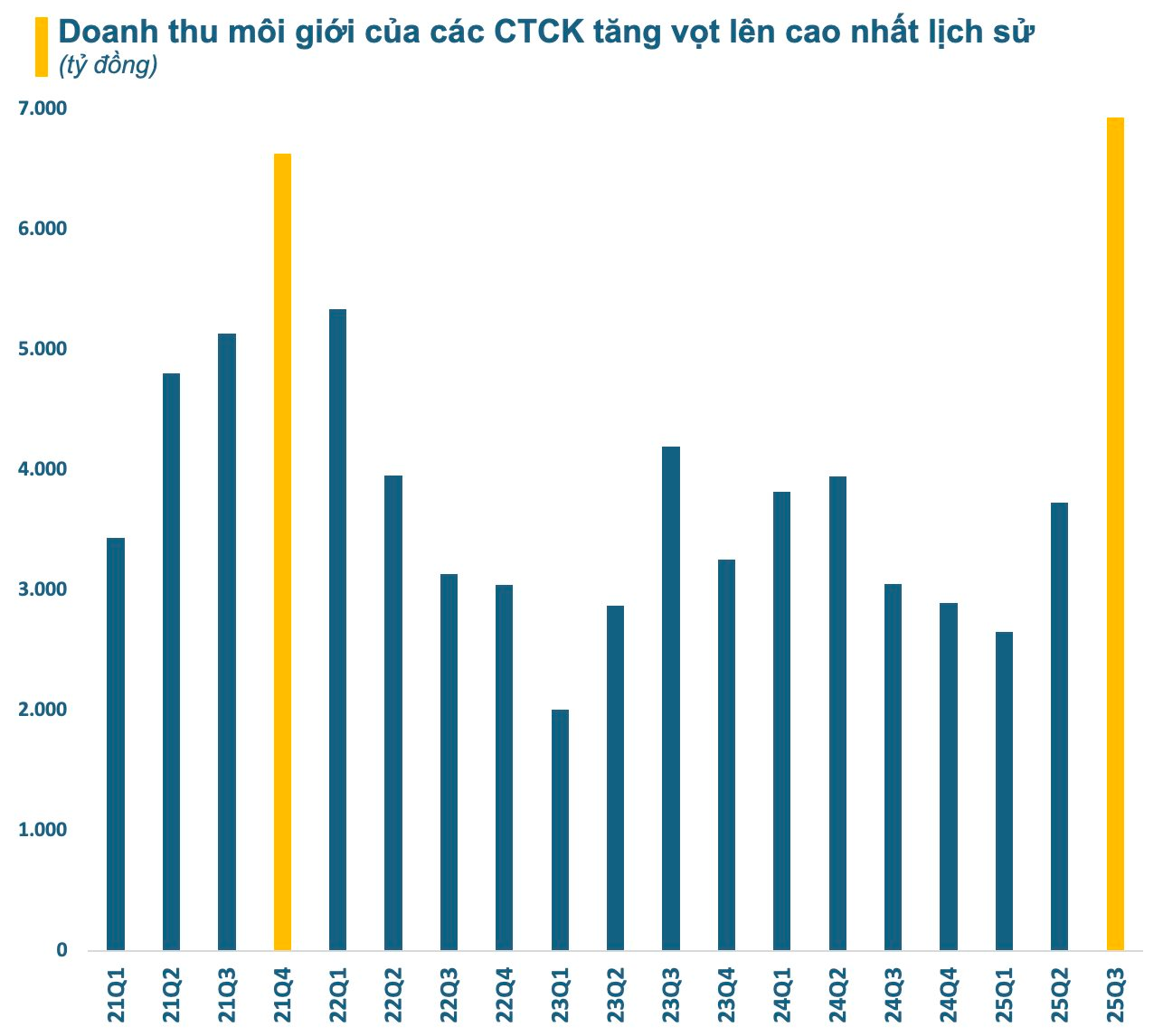

Not only lending activities, but brokerage services also boomed since the beginning of the year, particularly in the third quarter. The total brokerage revenue of SCs in the third quarter alone reached VND 7,000 billion, more than double that of the same period in 2024 and a record high in history. The accumulated nine-month brokerage revenue reached over VND 13,300 billion, a 23% increase compared to the same period and nearly equal to the figure for the entire previous year.

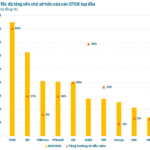

The SCs reaping significant profits from brokerage are mainly those with the largest market share in terms of trading value on HoSE. In the third quarter, the top 10 SCs with the largest market share in terms of trading value on HoSE were VPS, SSI, TCBS, Vietcap, HSC, MBS, VNDirect, Mirae Asset, VCBS, and KIS. The leading SCs with strong potential and many competitive advantages are increasingly dominating the market share race.

Dragon Capital and VinaCapital’s Open-Ended Funds Experience Breakthrough Growth

In the context of a strongly rising stock market alongside explosive liquidity, the scale of open-ended funds has also grown significantly. Notably, the two largest open-ended fund groups in the market managed by Dragon Capital and VinaCapital continue to attract strong capital for the market, thereby rapidly increasing their assets under management (AUM).

As of the end of October, the AUM of the open-ended fund group belonging to Dragon Capital had surpassed VND 10,000 billion, recording an impressive 54% increase compared to the beginning of the year. Meanwhile, the open-ended fund group managed by VinaCapital also recorded a nearly 20% increase in AUM from the beginning of the year, reaching over VND 9,400 billion by the end of October.

The growth in AUM of the funds is attributed to two factors: capital attraction capability and investment performance. Dragon Capital and VinaCapital are still known as the bridge between domestic and foreign investors and the stock market. With effective portfolio management and impressive performance, these open-ended funds have attracted strong capital in recent times.

The most outstanding is the Dynamic Securities Investment Fund (DCDS) managed by Dragon Capital, a name that frequently tops the performance rankings among open-ended funds. This is also the open-ended fund with a scale of over VND 1,000 billion achieving the best market performance (up 29%) in the first 10 months of 2025.

This result was achieved thanks to the sensitivity and flexibility of the analysis team in the face of market fluctuations, typically the portfolio restructuring to increase cash holdings at the end of the first quarter before the “black swan” event of U.S. tariffs. The fund then quickly reallocated its portfolio into stock groups with post-tariff support stories.

Additionally, Dragon Capital organized timely sharing sessions at critical market moments to update developments and provide analysis, helping investors gain a comprehensive view of the fluctuations, thereby contributing to improved investment performance. These contributions have been highly appreciated by investors, as evidenced by the growing community of Dragon Capital’s certificate fund investors.

Although the year-to-date performance is not very impressive, over the long term, the Sustainable Competitive Advantage Fund (SSISCA) managed by SSIAM still achieved impressive performance, exceeding 160% over the past five years.

Recently, SSIAM officially launched the SSI Future Building Investment Fund (SSI-EF), a balanced open-ended fund designed to help investors capitalize on the market upgrade wave and leverage long-term growth opportunities. With the introduction of SSI-EF, investors have an additional option suitable for their investment preferences.

TCBS, VPS, VPBankS Stir Up the IPO Wave

The vibrant market has created favorable conditions for companies to conduct initial public offerings (IPOs). Vinpearl, F88, and notably large SCs such as TCBS, VPS, and VPBankS have stirred up an IPO wave with a scale that could reach USD 40-50 billion over the next three years.

With subscription demand 2.5 times the offering volume, TCBS successfully conducted its IPO, raising nearly VND 11,000 billion with a valuation of over USD 4 billion. VPBankS’s offering also recorded subscription demand exceeding the offering volume and is expected to raise a record capital of nearly VND 13,000 billion. VPS has also completed its IPO process and attracted significant attention from domestic and foreign investors.

In addition to the aforementioned names, the non-financial group with representatives such as Hoa Phat Agriculture, Gelex Infrastructure, Long Chau, and subsidiaries of The Gioi Di Dong are also expected to IPO and list on the stock market in the coming years.

The main drivers of the explosive IPO wave include stable macroeconomic conditions alongside domestic and international monetary policy easing. Additionally, Vietnam has been approved by FTSE Russell for an upgrade to the “secondary emerging market” category, opening up significant opportunities to attract foreign capital.

An important factor is the shortened administrative procedures for IPO activities, while post-IPO investor protection policies have been strengthened. Along with this, the increasingly perfected policy framework helps IPO companies have better governance foundations before listing on the stock market.

Regulations on foreign ownership limits and free float ratios have also been more flexibly removed compared to before. Furthermore, the readiness of technical infrastructure, particularly the deployment of the new KRX trading system, helps the market operate more efficiently and transparently.

The IPO wave is expected to create a new source of goods, contributing to diversifying choices for investors and thereby promoting the deep and broad development of the stock market. This will create conditions for strong growth in the advisory activities of SCs, a segment that has been relatively sluggish in recent years.

The Upgrade is Just the Beginning of the “Emerging Era”

Alongside the return of the IPO wave, the upgrade is also expected to be a driving force for the strong development of the stock market in the coming time. According to the announcement from FTSE Russell, Vietnam has been confirmed for an upgrade from the Frontier market to the Secondary Emerging market, effective from September 21, 2025.

The upgrade is expected to bring tens of billions of USD in capital to Vietnam’s stock market, including both passive and active capital from international investment funds. According to estimates by the World Bank (WB), the upgrade “boost” could attract up to USD 25 billion in international investment capital into Vietnam by 2030. This huge figure is not just money, but also liquidity for the market and a re-evaluation of the value of enterprises.

Moreover, the Secondary Emerging market of FTSE is not the final destination for Vietnam’s stock market. The farther goal is to maintain the ranking, creating a springboard to advance to the Advanced Emerging market of FTSE Russell and meet the criteria for an upgrade to the Emerging market of MSCI by 2030. Upgrading the stock market also contributes to enhancing national credibility and affirming Vietnam’s position on the international stage.

“The upgrade is not the destination but a journey to develop Vietnam’s stock market towards quality, transparency, and sustainability. In this journey, each stage will be accompanied by the highest determination and effort to implement effective solutions to achieve important set goals,” affirmed Minister of Finance Nguyen Van Thang.

Overall, 2025 is a pivotal year for Vietnam’s stock market with many important milestones. Vietnam’s securities industry is standing at a historic turning point to transform and enter the “emerging” era, opening up great opportunities for ambitious and capable SCs to rise strongly.

FChoice is an annual award announced by CafeF to honor the most outstanding events, individuals, policies, and businesses in Vietnam’s economy. Launched in 2021, FChoice is not just a typical award but a “map of achievements” reflecting breakthrough stories with significant impacts on the national economy, especially in the financial sector. FChoice does not have fixed categories but selects based on the achievements of each event, individual, or company during the year, along with public interest, to present for voting.

In the context of the country’s economy strongly transforming towards digitalization and sustainability, FChoice becomes a “launchpad” for successful stories to spread, contributing to building a prosperous Vietnam. Let’s follow and vote to honor the factors changing the face of Vietnam’s economy this year!

The Race Among Securities Companies: Capital Hikes and Profit Comparisons Intensify

The robust growth of the stock market presents a prime opportunity for securities companies to surge ahead. Each firm brings unique strengths and competitive strategies to the table, fueling an exciting race within the industry.

Unraveling the Margin Record: Reflections and Insights

The VNIndex has declined for four consecutive weeks, while margin lending debt has reached an all-time high, presenting significant challenges to Vietnam’s stock market. To achieve sustainable growth, the market urgently requires fresh capital, driven by investor confidence and proactive decision-making.

Specialized Funds Take Center Stage, Delivering Benefits to Investors

Specialized equity funds are outperforming the broader market, with Techcom Capital’s TCFIN and TCRES funds leading the charge. These funds strategically focus on two pivotal sectors driving Vietnam’s economic growth: Banking & Finance and Real Estate, unlocking their full potential for investors.