Source: BMP

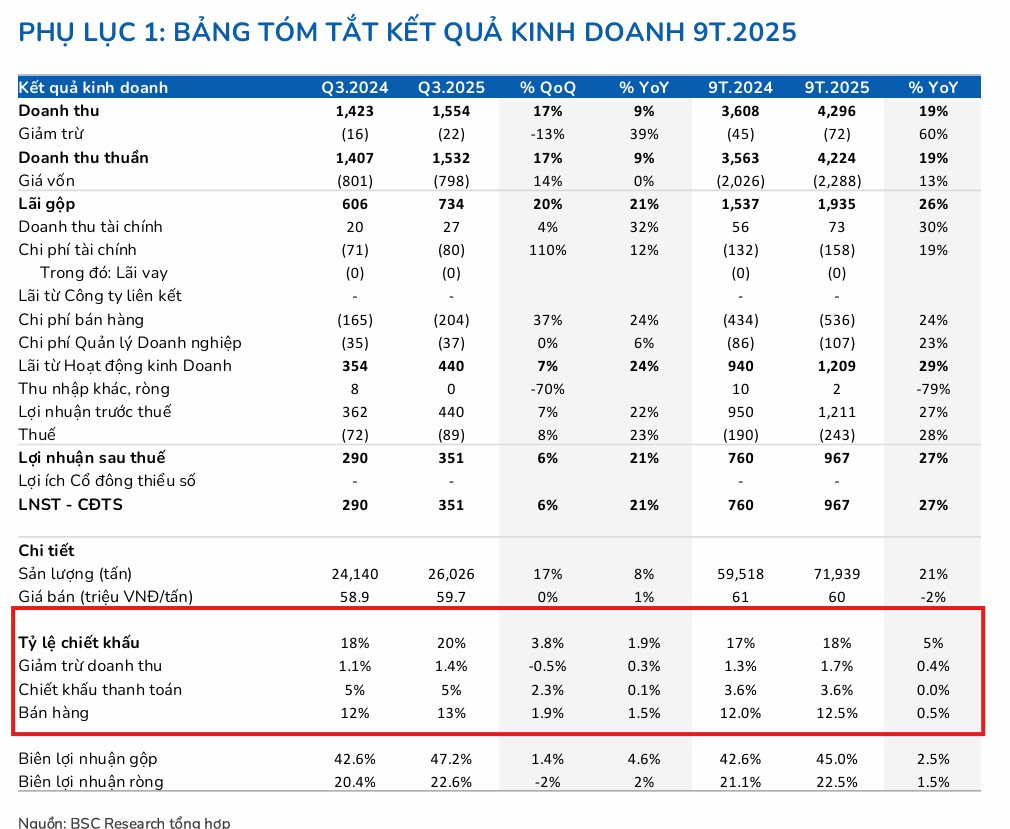

Binh Minh Plastics’ Q3/2025 financial report reveals a significant shift in its business cost structure. Despite a 9% year-on-year increase in net revenue to VND 1,554 billion, there was a notable rise in revenue deductions, payment discounts, and selling expenses.

Source: BSC

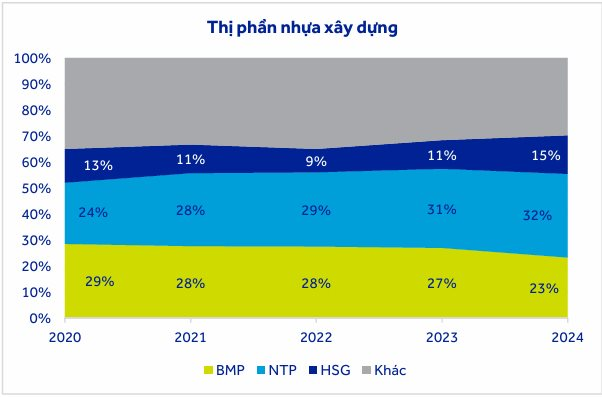

BIDV Securities (BSC) analysis highlights that the combined ratio of discounts and selling expenses to revenue reached 19.7%, the highest in the past five years. This aggressive sales policy adjustment comes amid an oversupply in the construction plastics sector, with actual consumption estimated at only 40% of the industry’s designed capacity.

Source: ACBS

In Southern Vietnam, where BMP holds a significant market share, competition from rivals like Hoa Sen and Stroman remains fierce. Given the functional similarity of plastic pipe products, discount policies are pivotal in maintaining distribution networks and project commitments. ACBS notes that BMP’s flexible pricing strategy helped boost its market share to 27% in Q3/2025, recovering from 23% in late 2024.

Source: BSC

Alongside market share efforts, BMP’s performance benefited from declining raw material costs. BSC data shows PVC resin prices in China dropped 14.3% year-to-date due to weak domestic demand. As PVC is petroleum-based, ACBS predicts sustained low raw material costs, supported by forecasts of Brent oil prices falling to $56-$58/barrel in 2026 (Goldman Sachs, EIA). This favorable trend lifted BMP’s Q3 gross margin to 47.2%, offsetting higher selling expenses.

Based on 9M/2025 results and raw material trends, analysts project BMP’s 2025 net revenue at VND 5,515–5,654 billion, up 19.5%–23% year-on-year, driven by demand recovery and current sales strategies. Post-tax profit is estimated at VND 1,316–1,347 billion, growing 33%–36% from 2024.

BMP maintains a generous dividend policy, distributing 127.5% of face value in 2025. Following a 62.5% payout in May, a second dividend of 65% was announced on November 17, 2025. With a 55% stake, major shareholder The Nawaplastic Industries (SCG Group, Thailand) is set to receive over VND 570 billion from these dividends.

Thai Billionaires Pocket Over $1.5 Billion in Dividends from Vinamilk, Sabeco, Binh Minh Plastics, and More

The aggressive acquisition of leading Vietnamese enterprises such as Vinamilk, Sabeco, and Nhựa Bình Minh by Thai tycoons has proven to be a lucrative strategy. Their substantial investments have yielded remarkable returns, generating billions of Vietnamese dong in annual dividends, solidifying their dominance in the market.

Dragon Capital Successfully Acquires Over 2.5 Million DXG Shares

Dragon Capital has successfully acquired over 2.5 million shares of DXG, elevating its ownership stake in Dat Xanh Group to 10.1510%.

Cen Land (CRE) Reports Q3 2025 Profit Doubling Year-Over-Year

Century Real Estate Joint Stock Company (Cen Land, stock code: CRE) has released its consolidated financial report for Q3/2025, showcasing robust business performance. In Q3/2025, the company’s after-tax profit reached 20 billion VND, a 25% increase year-over-year, bringing the nine-month cumulative profit to 63 billion VND—a remarkable 103% surge.

Major Shareholder Acquires Nearly 16% Stake in PGN Across Four Trading Sessions

Mr. Huynh Van Quang, a shareholder of Plastic Additives Joint Stock Company (HNX: PGN), has recently acquired nearly 1.5 million shares over four trading sessions, solidifying his position as the company’s largest shareholder.