Illustrative image

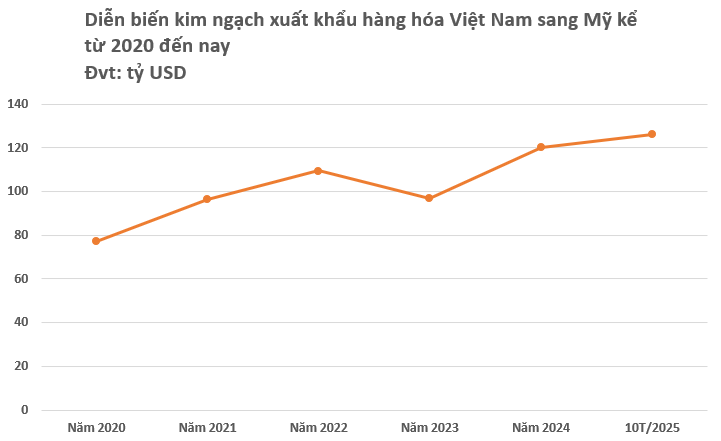

According to preliminary statistics from the General Department of Customs, Vietnam’s export turnover to the United States in October reached over $13.4 billion. Accumulated over the first 10 months, this figure soared to $126.16 billion, marking a 28% increase compared to the same period last year and setting a new record high.

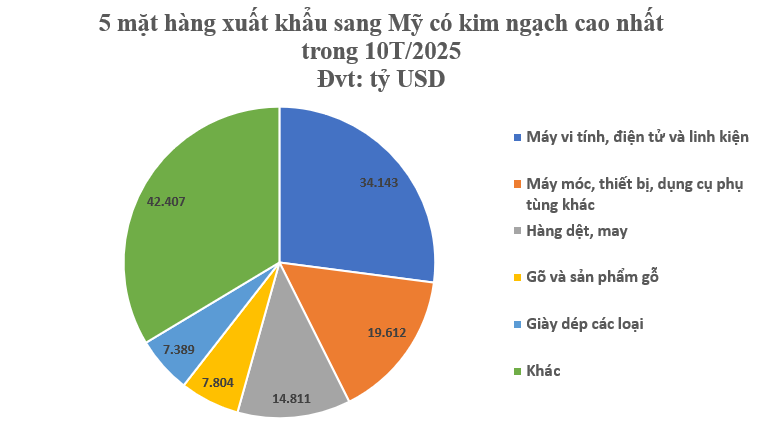

The U.S. remains Vietnam’s largest export market, accounting for over 30% of the total turnover. Notably, several key product groups experienced remarkable growth, reflecting the global shift in orders and rising demand in technology sectors.

Among these, computers, electronics, and components surged by nearly 78%, reaching over $34 billion—the highest growth rate in a decade, driven by demand for AI servers, technology devices, and semiconductor manufacturing components. Machinery and equipment maintained steady growth at 9.2%, totaling $19.6 billion; telephones and components saw a slight increase to $9.02 billion after two years of stagnation. The textile and garment industry, a traditional export sector, rebounded strongly with $14.81 billion, up 11.4%.

A notable highlight is the surge in toys and sports equipment, which skyrocketed by over 255%, from $1.47 billion to $5.24 billion, as many U.S. businesses shifted orders away from China. Additionally, wood and wood products reached $7.8 billion (up 6%), while vehicles and spare parts grew by nearly 11%.

The agriculture and aquaculture sectors also showed a clear recovery. Fruits and vegetables increased by 58.5%, coffee by over 60% due to high global prices, and rubber products by 51%. After a prolonged decline, seafood exports rebounded with a 7.5% increase, as inventory in the U.S. market decreased significantly and demand for premium products revived.

In other key markets, exports to China reached $56.98 billion (up 13.9%), the EU $46.5 billion (up 8.3%), ASEAN $31.79 billion (up 3.1%), South Korea $23.84 billion (up 12%), Japan $22.03 billion (up 8.8%), and Hong Kong (China) $14.33 billion (up 38.6%). These figures underscore the U.S. as the primary growth driver, while other markets maintained stable expansion.

Amid global economic fluctuations, Vietnam’s double-digit trade growth reinforces its resilience and position as a leading open trade economy in the region. Experts predict an optimistic outlook for late 2025, driven by strong holiday season orders from the U.S. and EU. Benefiting sectors include telephones and components, electronics, coffee, processed agricultural products, and textiles. Businesses are effectively leveraging agreements like EVFTA, CPTPP, and RCEP. Commodities such as coffee, fragrant rice, rubber, and cashews are trending upward in price.

Foreign-invested enterprises continue to lead export and import growth. As of November 15, 2025, the FDI sector remained the main trade driver with $579.11 billion, up 25.1%. Notably, the trade surplus by mid-November stood at $19.54 billion, ensuring macroeconomic stability amidst global economic volatility.

A New Chapter for Vietnam’s Industrial Real Estate

With the impending implementation of the new 2026 Land Price Schedule and the expiration of Corporate Income Tax incentives for tenants in Industrial Parks, David Jackson, Managing Director of Avison Young Vietnam, advises Industrial Real Estate businesses to remain optimistic and adopt a strategic approach.

Agricultural Products Surge, Setting New Records for Multiple Commodities

The agricultural sector is poised to achieve an unprecedented export value of $70 billion this year, with projections indicating monthly earnings of $5.5 to $6 billion in the final quarter.