|

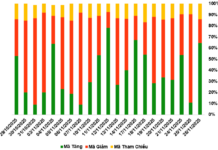

Trends in OMO Net Injection Operations Over the Past Year. Unit: Billion VND

Source: VietstockFinance

|

Notably, during the sessions on November 21 and 24, the regulator significantly increased disbursements to several commercial banks through term purchases, amounting to 33,000 billion VND and 50,358 billion VND respectively, at an interest rate of 4% per annum to support end-of-month liquidity.

Over the entire week, the State Bank of Vietnam (SBV) lent a total of 111,802 billion VND against collateralized securities with terms ranging from 7 to 105 days. The maturity volume reached 101,463 billion VND, resulting in a net injection of 10,339 billion VND by the SBV, bringing the total circulating capital through term purchases to 310,781 billion VND.

|

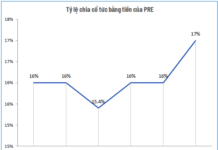

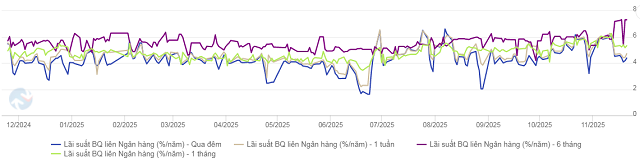

Trends in Interbank Interest Rates Over the Past Year

Source: VietstockFinance

|

In the interbank market, interest rates showed mixed movements across different terms. The overnight rate decreased by 13 basis points to 4.38% per annum by the end of the week on November 21, with the average transaction value slightly declining by 1% to over 736 trillion VND per day. The 1-week and 1-month rates rose slightly by 4-5 basis points, ranging between 4.71% and 5.32% per annum, while the 6-month rate increased by 12 basis points to 7.3% per annum.

|

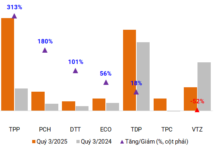

Trends in the DXY Index from the Beginning of 2025 to November 24

Source: VietstockFinance

|

In the international market, the USD Index (DXY) closed the session on November 21 up by 0.91 points at 100.11 points, its highest level in nearly 5 months. The USD strengthened following the U.S. jobs report, which showed the economy added 119,000 jobs in September 2025, more than double the forecast, reducing expectations that the Federal Reserve would cut interest rates in December.

Domestically, Vietcombank listed the exchange rate at the end of the week at 26,142 – 26,392 VND/USD (buy – sell), an increase of 14 VND in both directions over the week.

– 11:28 25/11/2025

“Governor Directs State Bank’s Zone 2 Branch to Ensure Seamless, Secure Operations Post-Restructuring”

On November 22nd, Governor of the State Bank of Vietnam (SBV) Nguyen Thi Hong, accompanied by Deputy Governor Pham Tien Dung and representatives from various SBV departments, held a working session with key officials from the SBV’s Zone 2 Branch.

Credit Growth in Ho Chi Minh City and Dong Nai Surges 10.37% Over 10 Months

By the end of October 2025, the total credit outstanding in Ho Chi Minh City and Dong Nai Province reached nearly 5.53 quadrillion VND, marking a 1.19% increase from the previous month and a 10.37% surge compared to the end of the previous year.