The VN-Index surged in the first session of the week, though its upward momentum heavily relied on pillar stocks. The index’s green hue was primarily bolstered by Vingroup and leading stocks in the VN30 basket, such as VJC and VNM. However, market breadth remained narrow, with declining stocks outnumbering gainers.

The Vingroup trio continued to dominate the index’s performance. VIC alone contributed 8.45 points to the VN-Index, while VHM and VRE further reinforced the rally. VIC climbed over 4%, nearing the 240,000 VND per share milestone, shattering its historical peak and pushing Vingroup’s market capitalization to nearly 930 trillion VND. VRE hit its ceiling at 34,450 VND, and VHM surged 3.42%, approaching the 103,000 VND mark.

Pham Nhat Vuong’s wealth surged by $784 million in a single day.

This rally significantly boosted Pham Nhat Vuong’s net worth. According to Forbes’ real-time data, his fortune rose by $784 million in one session, reaching $21.9 billion, a 3.71% increase, propelling him to the 104th spot among the world’s wealthiest individuals.

Beyond the Vin group, VJC and VNM played crucial supportive roles. VJC rose 5.24%, while VNM climbed 5.18%, ranking as the third most influential stock on the VN-Index. Conversely, MWG, FPT, STB, and HPG led the negative impact.

Market polarization was evident. Despite the Vingroup effect, real estate stocks remained in the red, with CII, DIG, CEO, DXG, HQC, SCR, PDR, and GEX all declining. Banks and securities firms showed mixed performances.

Notably, TCX emerged as a market leader within the securities group. However, its IPO investors have yet to break even. TCX recently finalized a 25% dividend plan, comprising 5% in cash and 20% in stock. With over 2.3 billion shares outstanding, the cash dividend is estimated at 1.155 trillion VND.

The stock dividend involves issuing 462.2 million new shares at a 5:1 ratio. Post-issuance, TCBS’s chartered capital is expected to rise to over 27.735 trillion VND.

At the close, the VN-Index gained 13.05 points (0.79%) to 1,667.98. The HNX-Index fell 1.91 points (0.73%) to 261.22, while the UPCoM-Index rose 0.24 points (0.20%) to 118.93.

Liquidity continued to decline, with HoSE trading value exceeding 17.2 trillion VND. Foreign investors net sold 1.247 trillion VND, focusing on VRE, VHM, STB, VIC, and MWG.

Billionaire Pham Nhat Vuong Sets Unprecedented Record: Vingroup’s Market Cap Surpasses $38 Billion for the First Time

Vingroup, the conglomerate founded by billionaire Pham Nhat Vuong, has made history as the first Vietnamese company to surpass a market capitalization of 900 trillion VND.

Market Pulse 24/11: Divergence Persists as Vingroup Stocks Continue to Shine

At the close of trading, the VN-Index climbed 13.05 points (+0.79%) to reach 1,667.98, while the HNX-Index dipped 1.91 points (-0.73%) to 261.22. Market breadth tilted toward decliners, with 370 stocks falling and 298 advancing. The VN30 basket saw red dominate, as 18 constituents declined, 10 rose, and 2 remained unchanged.

Vietstock Daily 25/11/2025: Cautious Growth on the Horizon?

The VN-Index has resumed its upward trajectory, approaching the 50-day SMA. A decisive break above this level, coupled with trading volume surpassing the 20-day average, would confirm the bullish momentum. The MACD indicator continues its ascent following a buy signal, and a crossover above the zero line in upcoming sessions would further strengthen the short-term outlook.

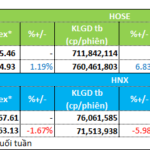

Seafood & Food Stocks Lead the Week in Attracting Investment

Liquidity trends diverged between the Ho Chi Minh City Stock Exchange (HOSE) and the Hanoi Stock Exchange (HNX) during the trading week of November 17–21. Investor sentiment remained cautious, with a selective focus on specific sectors. Notably, the seafood and food stocks emerged as the week’s favorites, attracting significant capital inflows.