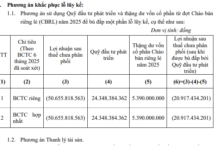

The issuance of shares was approved at the Extraordinary Shareholders’ Meeting of VUA in September 2025. Accordingly, VUA will privately offer 166.1 million shares at a price of 10,000 VND per share, expecting to raise 1.66 trillion VND to supplement business resources. This price is 38% lower than the current market price (16,900 VND per share as of November 24th).

| Price Movement of VUA Shares |

The post-issuance charter capital is expected to be 2 trillion VND. The raised capital will be used to invest in information technology systems, supplement capital for margin lending, proprietary trading, and securities underwriting activities.

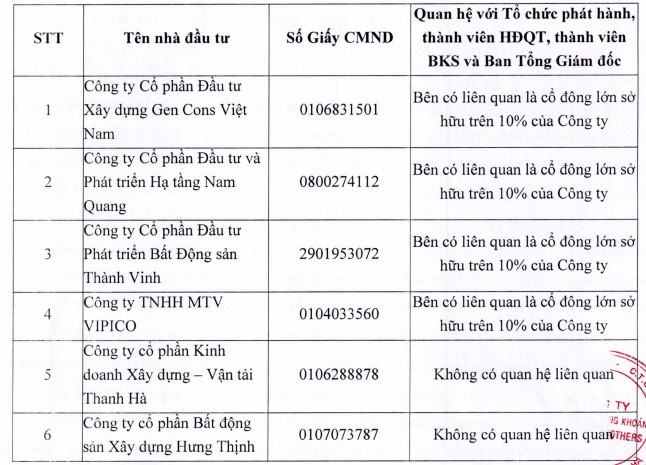

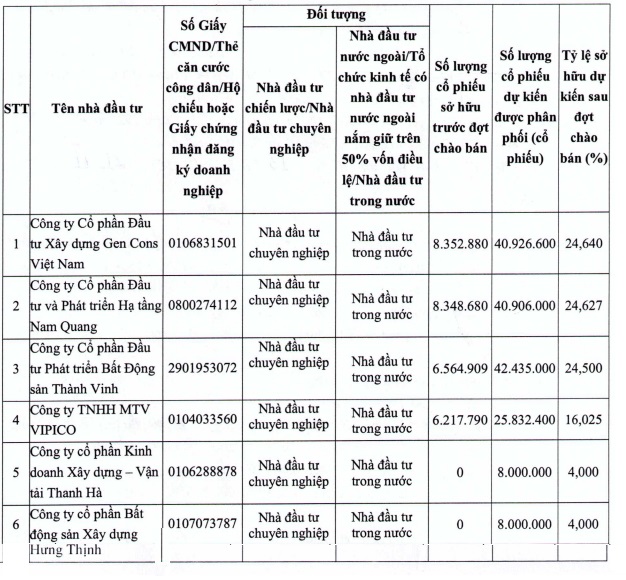

The target investors are professional securities investors. According to the published list in the resolution, six institutional investors are participating in this offering. Alongside the four major shareholders—Gen Cons Vietnam Construction Investment JSC (holding 24.64% of capital, equivalent to 8.4 million shares), Nam Quang Infrastructure Investment and Development JSC (24.63%, over 8.3 million shares), Thanh Vinh Real Estate Development Investment JSC (19.37%, nearly 6.6 million shares), and VIPICO LLC (18.34%, over 6.2 million shares)—two other investors, Thanh Ha Construction and Transportation Business JSC and Hung Thinh Construction Real Estate JSC, are also participating. If the offering is successful, Thanh Ha and Hung Thinh Construction Real Estate will each own 4% of VUA, equivalent to 4 million shares.

Source: VUA

|

|

Relationships Between Investors and VUA

Source: VUA

|

The offering is expected to be implemented in Q4/2025 or Q1/2026, following approval from the State Securities Commission. The issued shares will be restricted from transfer for one year.

New Major Shareholder of Stanley Brothers Securities Massively Issues Bonds

Stanley Brothers Securities “Changes Ownership”?

SBSI Extraordinary Shareholders’ Meeting: Approves Capital Increase Plan

SBSI Aims to Increase Capital to 2,000 Billion VND, Replaces “9x” Leadership Team

At the meeting, VUA’s leadership emphasized that the capital increase is essential to enhance financial capacity, expand the capital scale for business operations, margin lending, financial investment, and securities underwriting; provide new financial products and services to meet competitive industry demands; and strengthen competitive capabilities while ensuring financial resources to execute business plans.

– 13:00 24/11/2025

MBS to Issue Over 342 Million Shares in Capital Expansion Move

Having recently completed two successful share issuances, MBS is now presenting shareholders with a capital increase plan involving the issuance of over 342 million shares through an ESOP program and a rights offering.

Hodeco Boosts Capital to Nearly VND 2 Trillion Following Bonus Share Issuance

On November 12th, Hodeco successfully distributed 21.39 million shares out of a total of 21.4 million to 23,101 shareholders. This strategic move has bolstered the company’s capital to nearly 2,000 billion VND.