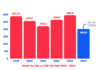

According to the plan, the issued shares will be listed on the Ho Chi Minh City Stock Exchange (HOSE) following the IPO. If fully subscribed, GELEX Infrastructure could raise approximately VND 2.8 trillion. This capital will be used to increase the charter capital of Titan Hai Phong JSC, funding Phase 1 of the Tran Duong – Hoa Binh Industrial Zone Infrastructure Development and Operation Project (Zone A), while also supporting financial restructuring.

The auction is expected to take place at the Ho Chi Minh City Stock Exchange, and details will be publicly announced as required.

GELEX Infrastructure Officially Approved for IPO of 100 Million Shares

|

Established in 2016, GELEX Infrastructure is a parent company holding direct capital in multiple entities operating in commercial real estate, industrial zones, construction materials, and utility infrastructure. Key enterprises within its ecosystem include Viglacera Corporation – JSC (VGC), Long Son Petroleum Industrial Zone Investment (PXL), Da River Clean Water Investment (VCW), FIH (Vietnam) LLC, and Titan Hai Phong JSC.

Recently, the company also acquired a 49% stake in Titan Corporation from its parent company, GELEX. Titan Corp is a joint venture with Frasers Property Vietnam, specializing in industrial real estate development with product lines including RBF (ready-built factories), RBW (ready-built warehouses), and BTS (custom-built factories/warehouses) meeting LEED standards. It is currently developing five projects spanning 100 hectares.

GELEX Infrastructure operates under a holding model and serves as a sub-holding of the GELEX Group. Its core activities focus on infrastructure investment through subsidiaries, encompassing industrial zone real estate, commercial real estate, construction materials, and utilities such as electricity and clean water.

The company’s revenue and profit from now until 2030 are primarily driven by real estate and construction materials, with new growth engines being commercial real estate and industrial zones.

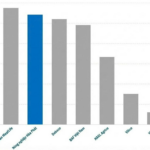

Following high-profile deals like TCBS, VPBankS, VPS, and most recently Hoa Phat Agriculture, the market views GELEX Infrastructure’s IPO as a notable event due to its substantial asset scale and clear growth prospects, attracting strategic investor interest.

– 3:40 PM, November 25, 2025

Record Dividend Announced by 911 Taxi Following Challenging Q3 Performance

{“is_finished”:false,”event_type”:”stream-start”,”generation_id”:”f50c4c80-7464-4ba0-9282-a86153c6068a”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”9″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”1″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”1″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” Group”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” Corporation”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” (“}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”H”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”OSE”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”:”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” NO”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”1″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”)”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” has”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” announced”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” a”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” 2″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”0″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”2″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”4″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” cash”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” dividend”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” payout”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” of”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” 6″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”%”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” (“}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”6″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”0″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”0″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” V”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”ND”}

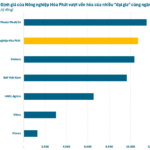

The New Ace of Mr. Trần Đình Long: A Billion-Dollar Agriculture Company Valued Higher Than Dabaco and BAF Vietnam

At an offer price of VND 41,900 per share, Hoa Phat Agriculture is valued at nearly VND 10,700 billion pre-IPO.