The Vietnamese stock market kicked off the week on a positive note. However, the upward momentum was not widespread, primarily focusing on specific stock groups. By the close of the November 24th session, the VN-Index surged by 13 points, reaching nearly 1,668 points. Trading liquidity remained low, with the order-matching value on HoSE at 15.42 trillion VND.

In terms of foreign trading, foreign investors continued their net selling streak, offloading 1.247 trillion VND across the market. The breakdown is as follows:

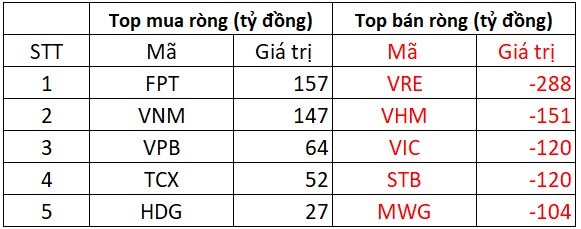

On HoSE, foreign investors net sold approximately 1.153 trillion VND

On the buying side, FPT was the most heavily accumulated stock by foreign investors, with a value of around 157 billion VND. VNM followed closely, with a net buy of 147 billion VND. Banking and real estate stocks such as VPB, TCX, and HDG also attracted foreign capital, with net buys of approximately 64 billion, 52 billion, and 27 billion VND, respectively.

Conversely, selling pressure was concentrated on blue-chip stocks. VRE led with a net sell of around 288 billion VND. VHM followed with 151 billion VND, while VIC and STB each recorded net sells of approximately 120 billion VND. Retail stock MWG was also offloaded by foreign investors, with a net sell of around 104 billion VND.

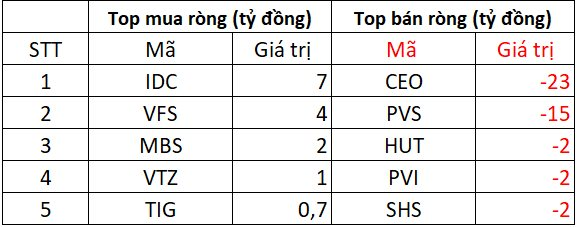

On HNX, foreign investors net sold approximately 33 billion VND

On the buying side, foreign investors heavily accumulated IDC with a value of 7 billion VND, while also investing a few billion VND in VTZ, MBS, and VFS.

Conversely, CEO and PVS were significantly offloaded by foreign investors, with net sells ranging from 15 to 23 billion VND per stock. HUT, PVI, and SHS also made the top net sell list, with values of 2 billion VND each.

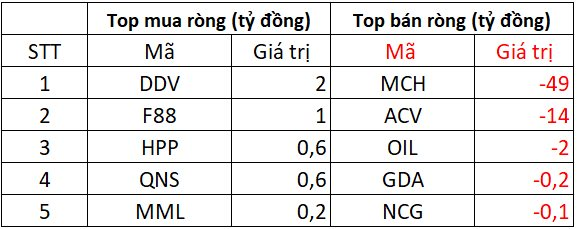

On UPCOM, foreign investors net sold approximately 61 billion VND

On the buying side, foreign investors invested around 1-2 billion VND in DDV and F88. Additionally, HPP, QNS, and MML saw modest net buys of a few hundred million VND.

Conversely, MCH and ACV were heavily offloaded, with net sells of 49 billion and 14 billion VND, respectively. OIL also saw a net sell of 2 billion VND, while GDA and NCG experienced insignificant net sells.

“Brokerage Firms’ Proprietary Trading Arms Invest Nearly $17 Million in Vietnamese Stocks on Monday: Which Stocks Were Most Sought After?”

Proprietary trading desks at Vietnamese securities firms collectively executed a net buy of VND 364 billion on the Ho Chi Minh Stock Exchange (HOSE) during the referenced period.

Billionaire Pham Nhat Vuong Sets Unprecedented Record: Vingroup’s Market Cap Surpasses $38 Billion for the First Time

Vingroup, the conglomerate founded by billionaire Pham Nhat Vuong, has made history as the first Vietnamese company to surpass a market capitalization of 900 trillion VND.