On the morning of November 25th, Orient Commercial Joint Stock Bank (HOSE: OCB), OCBS Securities JSC (OCBS), and Hoang Anh Gia Lai JSC (HAGL, HOSE: HAG) signed a strategic cooperation agreement, aiming to promote green finance and sustainable development.

Mr. Nguyễn Xuân Thắng – CEO of HAGL

|

At the event, Mr. Nguyễn Xuân Thắng – CEO of HAGL, shared the 20-year journey of HAGL through three historical phases.

Phase 1 (2006-2015): The Peak and the Abyss. In 2008, when HAGL was listed, Mr. Đoàn Nguyên Đức‘s stock value reached 6.16 trillion VND. Just a year later (2009), this figure doubled to 12 trillion VND. At that time, HAGL was the “king” of real estate, with land holdings stretching from Da Nang and Ho Chi Minh City to Can Tho, and even expanding to Laos and Myanmar (HAGL Myanmar Centre project).

However, in 2012, HAGL made a controversial decision to abandon real estate. The reason given was the challenging economic context, with lending interest rates soaring to 22%, and in some cases, 25-27%. HAGL shifted its focus to agriculture, with a strategy centered on rubber (51,000 hectares) and oil palm (28,000 hectares) cultivation.

Unfortunately, commodity markets plummeted. Rubber prices fell from $5,700 per ton (at the start of the project) to a low of $1,100 per ton, a decline that persisted for a decade. Oil palm prices dropped from $1,200 per ton to $400 per ton.

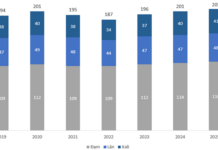

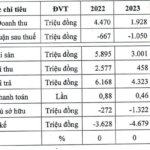

The financial burden became overwhelming. From 2010 to 2015, HAGL spent 8.6 trillion VND just on interest payments. By 2016, total debt reached 36 trillion VND, with a loss of 2 trillion VND, pushing the company to the brink of collapse as no bank was willing to lend.

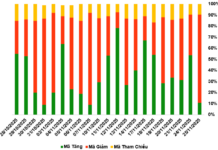

Phase 2 (2016-2025): Comprehensive Restructuring. Facing a critical situation, the Annual General Meeting in September 2016 decided on a comprehensive restructuring. HAGL agreed to sell key assets and shift crop cultivation from rubber to fruit trees (bananas, durians) to generate short-term cash flow.

With support from financial partners, particularly OCB and OCBS, HAGL achieved impressive results:

Phase 3 (from 2025): The Era of Green Agriculture. Mr. Thắng emphasized that HAGL is now focused on Circular Agriculture – Green Agriculture – Sustainable Development. The goal is to increase the area of GlobalGAP-certified crops from the current 15,000 hectares to 24,000 hectares by 2027 and 30,000 hectares by 2030.

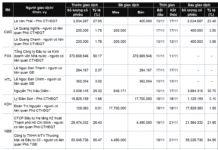

Mr. Nguyễn Đức Tung – Board Member and CEO of OCBS, discussed the role of financial institutions in HAGL’s revival. Since early 2024, OCBS and OCB have been deeply involved in HAGL’s financial restructuring: reducing the Debt-to-Equity ratio from over 2 times to below 0.6 times, with a target of below 0.4 times by the end of 2025. In 2025, OCBS successfully advised on raising over 2.1 trillion VND in equity and 1 trillion VND in bonds.

Strategic Roadmap for 2026

Mr. Nguyễn Đức Quân Tùng – CEO of OCBS, announced specific plans for the coming year. In 2026, HAGL will issue approximately 2.5 trillion VND in public bonds, marking its return to the capital market after nearly a decade. Additionally, they aim to raise 1-2 trillion VND through IPOs or sales of subsidiaries.

OCBS will advise on building an ESG framework aligned with international standards, helping HAGL access green capital from global financial institutions.

Building on the success of the Cross-Country Farm Visit program, HAGL will continue to strengthen its position in high-tech agriculture.

Aspiring to Become a Billion-Dollar Company

HAGL Chairman Đoàn Nguyên Đức

|

HAGL Chairman – Mr. Đoàn Nguyên Đức (Bầu Đức) reflected on the 10-year “hibernation” and the drastic measures taken to save the company.

Recalling the darkest times, Bầu Đức shared that by 2016, HAGL was truly “gasping for air.” Many advisors and friends suggested creating a “grand stage” and beautifying reports to hide the difficulties.

“I said no. Hiding the illness would be fatal. This illness, if hidden for another three years, would be incurable. I chose my own path: to save myself through honesty,” Mr. Đức asserted.

He recalled December 30, 2016, waiting until the last days of the fiscal year to announce HAGL’s loss of liquidity. At that time, HAGL’s total debt had ballooned from 10 trillion VND to a peak of 36 trillion VND.

Facing 36 trillion VND in debt, with annual interest payments of 4 trillion VND, Bầu Đức calculated that if left unchecked, within 1-2 years, the principal and interest would accumulate to 50 trillion VND—an insurmountable figure.

He proactively requested government approval for restructuring. Fortunately, the Governor of the State Bank at the time agreed, calling on 10 banks to freeze and extend debt. However, this was only a temporary solution.

“To survive, we had to cut interest. To cut interest, we had to sell assets,” Bầu Đức shared.

HAGL entered a phase of massive asset sales: selling hydropower plants, sugar mills, real estate projects in Da Nang (a 40km stretch along the Han River), projects in Myanmar, Laos, Cambodia, and even the HAGL University of Medicine and Pharmacy Hospital.

“Many people gleefully said I was selling assets out of desperation. Yes, it was desperate, but by selling those assets, we removed the tumor of debt,” Mr. Đức reflected.

The result of this nearly decade-long “surgery” reduced HAGL’s debt from 36 trillion VND to approximately 6 trillion VND. The Debt-to-Equity ratio, once above 2 times, now stands at 0.4 times—a completely safe level.

In the story of revival, Bầu Đức particularly emphasized the role of OCB Bank as a “benefactor” appearing at the right moment due to the law of cause and effect.

“In the past, I was too embarrassed to meet with banks because I was rejected so many times. When Mr. Trịnh Văn Tuấn (Chairman of OCB) invited me, I was hesitant. But fate brought us together,” Mr. Đức recounted.

OCB helped HAGL resolve issues related to collateral mechanisms. As a result, a significant portion of HAGL’s assets were freed up, helping the group regain its position and even leaving it with “a surplus of assets.”

After shedding the burden of debt, Bầu Đức stated that HAGL is now completely transformed.

In terms of investment strategy, HAGL recently announced a 10,000-hectare land investment in Can Tho, but without reckless borrowing. The group will use accumulated profits and proceeds from selling subsidiaries for reinvestment.

Regarding profitability, “from cumulative losses of trillions, Bầu Đức now confidently aims for a profit of 2 trillion VND per year. The more ambitious goal is 5 trillion, even 10 trillion VND per year in the near future. Striving to make HAGL a billion-dollar company,” Mr. Đức shared his vision.

– 14:54 25/11/2025

Real Estate Giant Acquires Struggling Forestry Firm in Multi-Billion-Dollar Deal

Vietnam Forestry Corporation (Vinafor, HNX: VIF) has successfully auctioned 96,200 shares, representing 48.1% of the equity in Central Forestry Seedling Company (SFS). The starting price was set at 603,900 VND per share, and the winning bidder was Thanh Vinh Real Estate Development Investment Corporation, with a total transaction value exceeding 58 billion VND.

Unlocking the Golden Demographic: Why Youth Empowerment is Key to Transforming Potential into Power

Vietnam’s Deputy Prime Minister, Bùi Thanh Sơn, highlights the country’s fortunate “golden population structure,” but warns that this demographic advantage will not automatically translate into “golden thinking” or “golden capabilities” unless the younger generation proactively strives to keep pace with the evolving trends of the modern era.

Prime Minister Proposes ‘Three Strategic Guarantees’ at G20 Summit

Speaking at the G20 Summit in Johannesburg, South Africa, Prime Minister Pham Minh Chinh proposed “three strategic assurances,” urging the G20 to strengthen cooperation and combat the politicization of science and trade.