FPT Telecom Completes Transfer of Over 50% State Capital

The State Capital Investment Corporation (SCIC) sold its entire holding of nearly 370.7 million shares, equivalent to 50.17% of the capital in FPT Telecom Joint Stock Company (FPT Telecom, UPCoM: FOX), on November 11th. This move aims to transfer the representation rights of state capital in FPT Telecom from SCIC to the Ministry of Public Security, as per the agreement signed on July 16th, 2025.

This marks the final step in the Ministry of Public Security’s process of assuming the representation rights of state capital in FPT Telecom. Following the transfer, the entire state capital in FPT Telecom will be managed by the Ministry of Public Security. Meanwhile, the other major shareholder, FPT Corporation (HOSE: FPT), holds 45.66% of the capital.

Chairman’s Daughters Transfer Shares to Mother at HTL

Lã Ngọc Đan Chinh and Lã Ngọc Đan Thanh, daughters of Mr. Lã Văn Trường Sơn, CEO of Truong Long Technical and Automobile Joint Stock Company (HOSE: HTL), and Mrs. Nguyễn Thị Kiều Diễm, Chairwoman of the Board, sold their entire holdings of over 362,000 and 284,000 shares, respectively, representing 3.02% and 2.37% of HTL‘s capital.

Conversely, Mrs. Nguyễn Thị Kiều Diễm purchased the exact number of shares sold by her daughters, totaling approximately 646,000 shares. After the transaction, Mrs. Diễm’s ownership in HTL will increase by 5.38%, reaching 30.7%. Following the transaction, the family leadership group of HTL will still hold a combined 63.55% of the company’s capital. Among them, Mrs. Lã Thị Thanh Phương, Mr. Sơn’s sister and current Deputy Director of HTL, owns 1.97% of the capital.

Biwase Increases Stake in VLW to Nearly 34%

Binh Duong Water Supply – Sewerage Joint Stock Company (Biwase, HOSE: BWE) announced the completion of an additional purchase of 2.63 million shares in Vinh Long Water Supply Joint Stock Company (UPCoM: VLW) as planned. The transaction was executed on November 14th, with a total value of nearly 66 billion VND.

After the transaction, Biwase’s ownership in VLW increased from 24.57% (7.1 million shares) to 33.65% (9.73 million shares), maintaining its position as the second-largest shareholder, after the controlling shareholder, the People’s Committee of Vinh Long Province (51% of capital).

Biwase’s stake increase coincides with its subsidiary, BIWASE Construction and Electricity Joint Stock Company, registering to sell all its VLW shares, equivalent to 9.1% of the capital, through negotiated transactions from October 30th to November 26th. After the transaction, this unit will no longer be a shareholder of VLW.

Previously, on May 21st, 2025, Biwase and this subsidiary also executed a negotiated transaction worth nearly 178 billion VND, in which BIWASE Construction and Electricity transferred 7.1 million VLW shares (24.57% of capital) to Biwase. Thus, through two negotiated transactions totaling approximately 244 billion VND, Biwase has increased its ownership to nearly 34% of VLW‘s capital, primarily through receiving share transfers from its subsidiary.

MBCapital Plans to Sell Entire Stake in MIG to Return Entrusted Assets

On November 17th, MB Investment Fund Management Joint Stock Company (MBCapital) announced its plan to sell its entire holding of over 3 million shares in Military Insurance Corporation (MIC, HOSE: MIG), equivalent to 1.43% of the capital, to return entrusted assets to clients. The transaction is expected to take place from November 25th to December 23rd.

At the close of November 18th, MIG‘s market price reached 17,500 VND per share, up nearly 8% since the beginning of 2025. Based on the market price, the transaction value could reach up to 53 billion VND.

Chairman’s Daughter at PC1 Plans to Invest Over 90 Billion VND to Acquire 4 Million Shares

Mrs. Trịnh Khánh Linh, daughter of Mr. Trịnh Văn Tuấn, Chairman of the Board at PC1 Group, registered to purchase 4 million new shares of PC1 from November 20th to December 18th. After the transaction, Mrs. Linh is expected to increase her ownership to 1.118%. Mr. Tuấn currently holds nearly 76.5 million shares, equivalent to 21.382% of the capital, and is the largest shareholder at PC1.

Based on the closing price of 22,550 VND per share on November 17th, Mrs. Linh’s new acquisition is valued at over 90 billion VND.

Series of Leaders and Relatives Divest Entire Stake in UNI

Mrs. Vũ Thị Như Mai, CEO of Sao Mai Vietnam Investment and Development Joint Stock Company (HNX: UNI), registered to sell her entire holding of over 3.4 million UNI shares (equivalent to 8.09% of the capital) to balance personal finances. The transaction is expected to take place from November 19th to December 12th.

Mrs. Mai’s divestment registration occurred just one day after a series of UNI‘s leaders and relatives registered to sell all their shares. Among them, Mr. Vũ Thanh Thủy, Member of the Board of Supervisors, and Mrs. Nguyễn Thị Lệ Thanh, Mr. Thủy’s mother and Member of the Board, registered to sell their entire holdings of 1.42 million shares and over 605 thousand shares, respectively. Additionally, Mr. Thủy’s father and sister, Mr. Vũ Duy Bé and Mrs. Vũ Thanh Thảo, also intend to divest their entire stakes, totaling over 1.5 million shares and nearly 1.38 million shares, respectively.

Mrs. Mai’s sister, Mrs. Vũ Thị Kim Liên, also registered to divest all her shares in UNI (over 1.08 million shares, equivalent to 2.54% of the capital).

These transactions are expected to take place from November 18th to December 12th, all for the purpose of balancing personal finances, similar to the CEO of UNI. The reason behind the simultaneous divestment by the company’s leadership and relatives remains unclear.

|

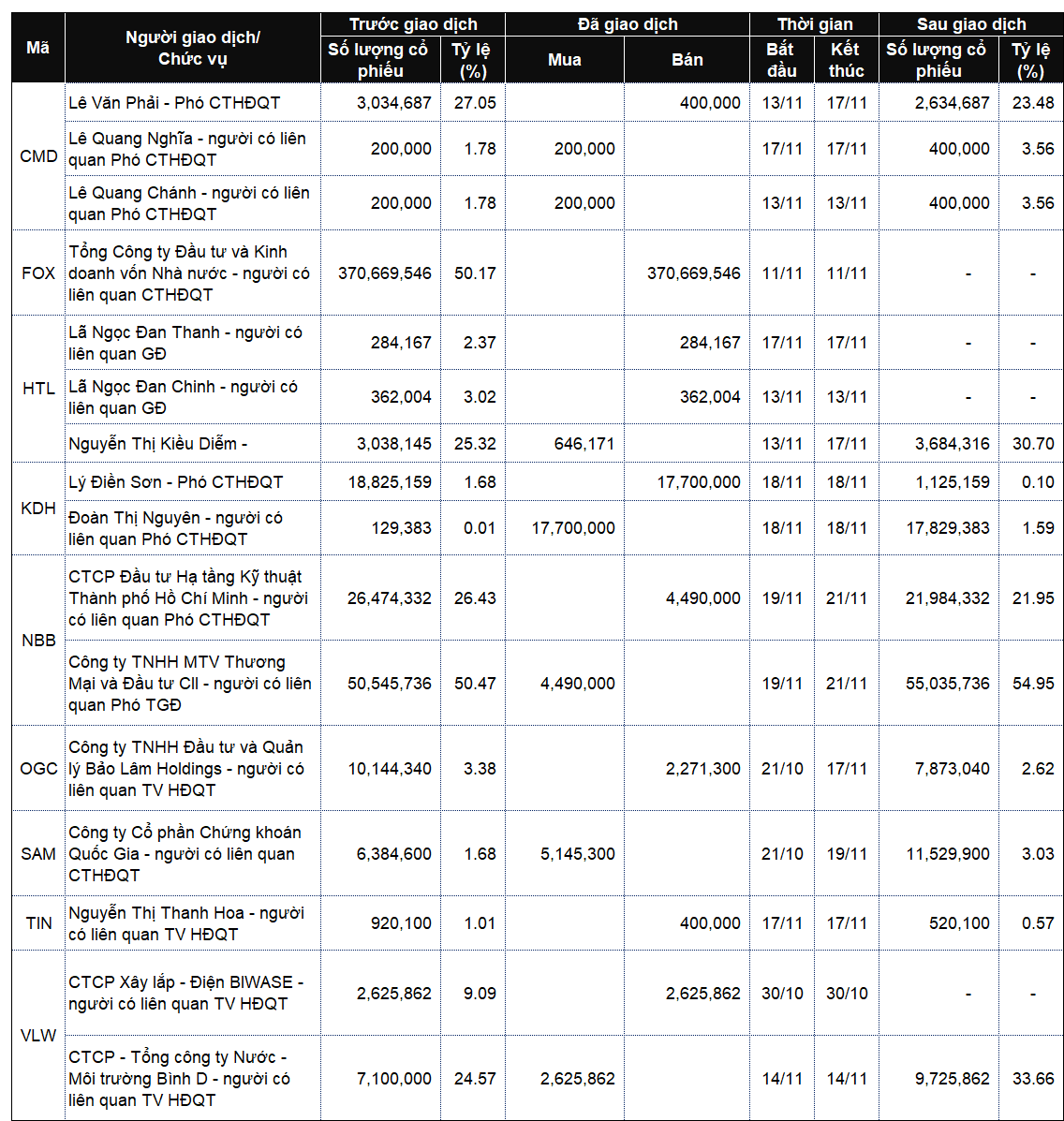

List of Company Leaders and Relatives Trading from November 17th to 21st, 2025

Source: VietstockFinance

|

|

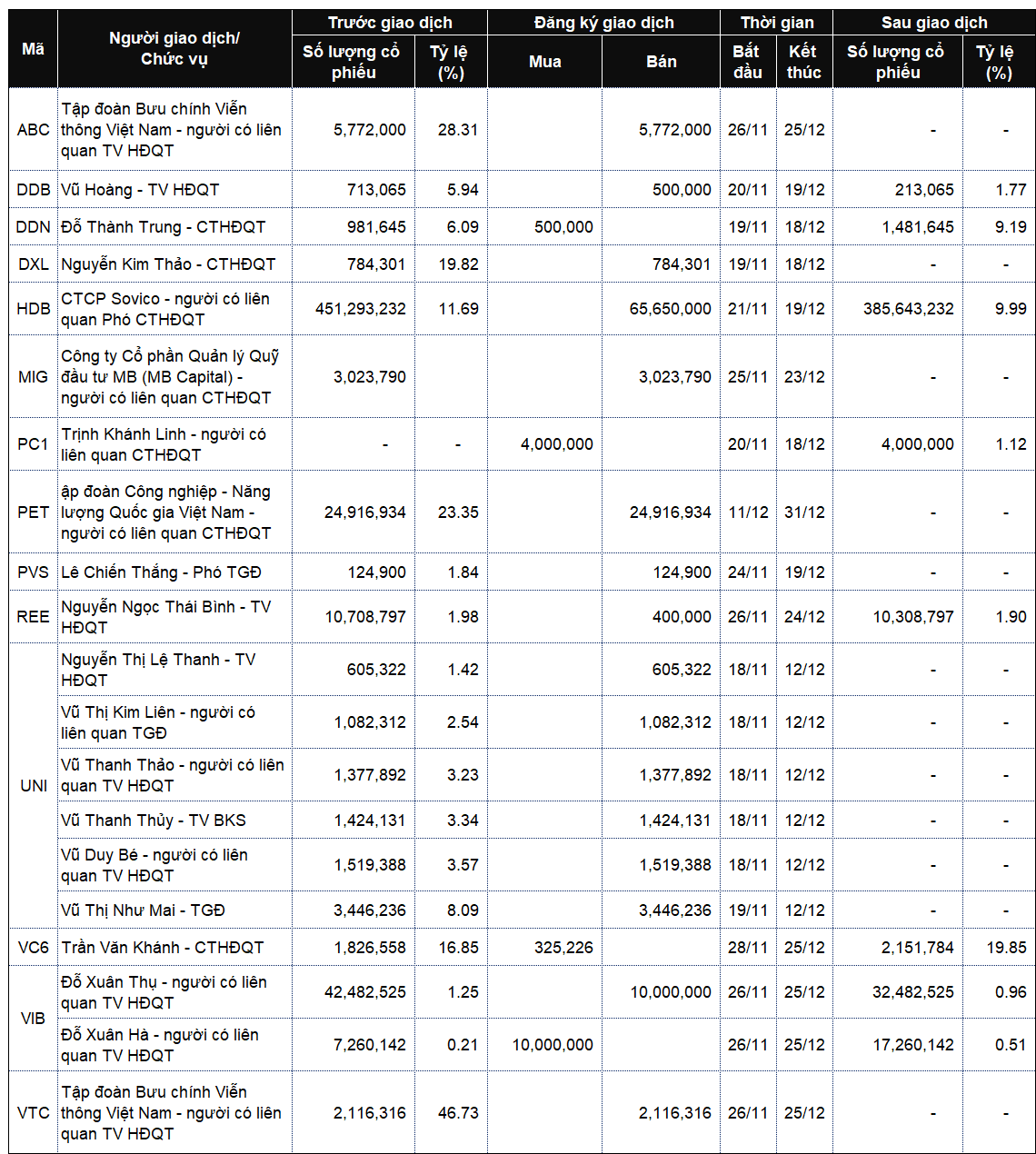

List of Company Leaders and Relatives Registering Trades from November 17th to 21st, 2025

Source: VietstockFinance

|

– 14:00 24/11/2025