Decree No. 306/2025/NĐ-CP amends and supplements regulations on penalties for administrative violations related to private placement of shares.

|

Violations of regulations on private placement of shares by public companies can result in fines of up to 1.5 billion VND.

Decree 306/2025/NĐ-CP amends and supplements Article 8 of Decree No. 156/2020/NĐ-CP, which regulates penalties for administrative violations in the securities and stock market sector. These amendments were further revised by Decree No. 128/2021/NĐ-CP as follows:

Violations of regulations on private placement of shares, convertible bonds, and bonds with warrants by public companies, securities companies, and investment fund management companies include:

Fines ranging from 50 million VND to 70 million VND for early bond repurchases or bond swaps without approval or not in accordance with the approved plan.

Fines ranging from 70 million VND to 100 million VND for the following violations:

Private placement of shares, convertible bonds, or bonds with warrants not conducted within the specified timeframe; failure to disclose capital usage reports or audited financial statements at the Annual General Meeting, Board of Members, or owner meetings; providing misleading statements or guarantees to investors about future share or bond prices, income, or profit levels.

Fines ranging from 100 million VND to 150 million VND for issuing organizations committing the following violations:

Failure to amend or supplement private placement registration files upon discovering inaccuracies or omissions; changes to capital usage plans without approval from the General Meeting of Shareholders, Board of Directors, Board of Members, Chairman, or owner; changes exceeding 50% of the capital or funds raised without proper authorization; failure to report changes in capital usage plans at the nearest General Meeting of Shareholders.

Disclosure of information containing promotional content or invitations to purchase privately placed shares, convertible bonds, or bonds with warrants; advertising private placements in mass media.

Violations of regulations regarding the determination of professional securities investor qualifications; failure to retain documentation verifying professional securities investor status as required by law.

Certification of share or bond transfers during restricted periods or in violation of legal provisions; transfers of shares, convertible bonds, or bonds with warrants in violation of securities laws and regulations on private placements.

Failure to deposit funds raised from private placements into escrow accounts until the completion of the offering and reporting to the State Securities Commission; use of funds before receiving written confirmation from the State Securities Commission.

Distribution of shares, convertible bonds, or bonds with warrants not in compliance with legal regulations.

Fines ranging from 150 million VND to 300 million VND for the following violations:

Private placement of shares, convertible bonds, or bonds with warrants not in accordance with the plan registered with the State Securities Commission; use of funds not in line with approved plans, disclosed information, or reported to regulatory authorities.

Fines ranging from 300 million VND to 400 million VND for the following violations:

Private placement of shares, convertible bonds, or bonds with warrants without meeting legal requirements; failure to register with the State Securities Commission; changes to bond terms not in compliance with legal regulations.

Fines ranging from 500 million VND to 600 million VND for filing or certifying private placement registration documents containing false or misleading information.

Fines ranging from 1 billion VND to 1.5 billion VND for forging documents or certifications to falsely demonstrate eligibility for private placements.

Additional regulations on violations related to private placement of bonds by non-public companies

Decree 306/2025/NĐ-CP also introduces Article 8a, addressing violations of regulations on private placement of corporate bonds by non-public companies, non-convertible bonds, and non-warrant bonds by public companies, securities companies, and investment fund management companies.

Fines ranging from 50 million VND to 70 million VND for early bond repurchases or swaps without approval or not in accordance with approved plans.

Fines ranging from 70 million VND to 100 million VND for private bond placements not conducted within the specified timeframe.

Fines ranging from 100 million VND to 150 million VND for the following violations:

Certification of bond transfers in violation of legal provisions; bond transfers not in compliance with regulations on private placements; distribution of bonds not in accordance with legal regulations.

Fines ranging from 200 million VND to 300 million VND for use of funds raised from bond placements not in line with approved plans, disclosed information, or legal regulations.

Fines ranging from 300 million VND to 400 million VND for bond placements without meeting legal requirements; filing or certifying bond placement documents containing inaccurate or false information.

Fines ranging from 1 billion VND to 1.5 billion VND for forging documents or certifications to falsely demonstrate eligibility for bond placements.

Violations of regulations on registration of private corporate bonds can result in fines of up to 200 million VND

Decree 306/2025/NĐ-CP also introduces Article 8b, addressing violations of regulations on the registration of private corporate bonds, trading registration, and information disclosure by private bond issuers.

Violations of registration deadlines with the Vietnam Securities Depository result in the following fines:

Fines ranging from 10 million VND to 20 million VND for delays of less than 3 months.

Fines ranging from 20 million VND to 30 million VND for delays of 3 to 12 months.

Fines ranging from 30 million VND to 50 million VND for delays of 12 months or more.

Violations of trading registration deadlines with stock exchanges result in the following fines:

Fines ranging from 10 million VND to 30 million VND for delays of less than 1 month.

Fines ranging from 30 million VND to 70 million VND for delays of 1 to 12 months.

Fines ranging from 70 million VND to 100 million VND for delays of 12 months or more.

Fines ranging from 30 million VND to 50 million VND for incomplete information disclosures.

Violations of information disclosure deadlines result in the following fines:

Fines ranging from 50 million VND to 70 million VND for delays of less than 10 working days.

Fines ranging from 70 million VND to 100 million VND for delays of 10 working days or more.

Fines ranging from 100 million VND to 200 million VND for misleading information disclosures.

Violations of regulations on services related to private bond placements can result in fines of up to 300 million VND

Decree 306/2025/NĐ-CP also introduces Article 8c, addressing violations of regulations on services related to private bond placements.

Fines ranging from 70 million VND to 100 million VND for violations of regulations on bondholder representation.

Fines ranging from 100 million VND to 150 million VND for violations of regulations on tender services, underwriting, and bond placement agencies.

Fines ranging from 150 million VND to 200 million VND for securities companies failing to ensure investors meet eligibility criteria, maintain sufficient funds or bonds before transactions, or verify the legality of transaction orders.

Fines ranging from 200 million VND to 300 million VND for consulting firms failing to ensure compliance with bond placement regulations or providing false or misleading information in bond placement documents.

Decree 306/2025/NĐ-CP takes effect from January 9, 2026.

The decree specifies that administrative violations occurring before January 9, 2026, with pending appeals or lawsuits, will be resolved under the regulations in effect at the time of the violation.

– 19:45 25/11/2025

Đạt Phương Group Gears Up to Raise Capital for Da Nang Resort Project

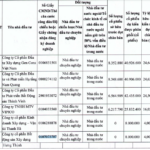

Following approval from the Annual General Meeting of Shareholders in late October, the Board of Directors of Dat Phuong Group (HOSE: DPG) has resolved to execute a private placement of nearly 17.8 million shares.

JVC Invests in New Pharmaceutical Venture

The Board of Directors of Vietnam Investment and Pharmaceutical Joint Stock Company (HOSE: JVC) has approved the establishment of a subsidiary with a chartered capital of 250 billion VND. Named Vietnam Pharmaceutical Investment and Trading Joint Stock Company, this subsidiary will primarily focus on pharmaceutical trading. JVC will hold a 98% stake in the new entity.