Global Fertilizer Demand Continues to Rise Amid Limited Supply

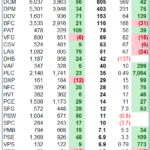

According to the International Fertilizer Association (IFA), global fertilizer demand is projected to grow steadily between 2025 and 2029, with an annual growth rate of 1-2%. Total global consumption in 2025 is estimated to reach approximately 205 million tons, surpassing the record 201.5 million tons achieved in 2020.

Global Fertilizer Consumption (2019-2025F)

(Unit: Million tons)

Source: IFA

Meanwhile, global fertilizer supply remains constrained as major exporting countries like China and Russia continue to impose export quotas to control domestic prices. China’s policy stems from its 2021-2025 Five-Year Plan, emphasizing self-sufficiency and food security. This trend is expected to persist until at least 2026, creating opportunities for Vietnamese producers, including DPM, to secure export orders in regional markets.

High Urea Prices Drive Robust Business Performance

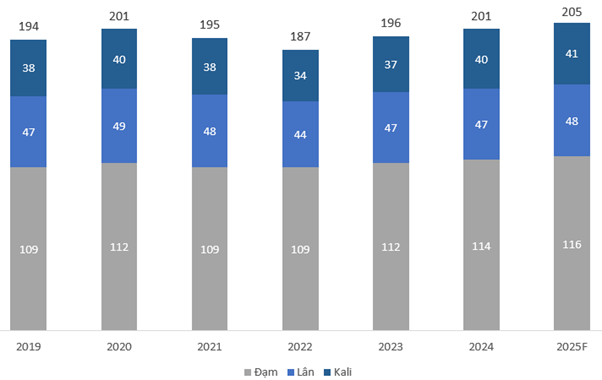

Urea is DPM’s flagship product, accounting for approximately 84% of production volume and 68% of fertilizer sales revenue between 2021 and 2025F. Phú Mỹ Urea holds a 38% domestic market share, maintaining its industry leadership and serving as a key revenue and profit driver for the company.

DPM’s Urea Production Process

Source: DPM

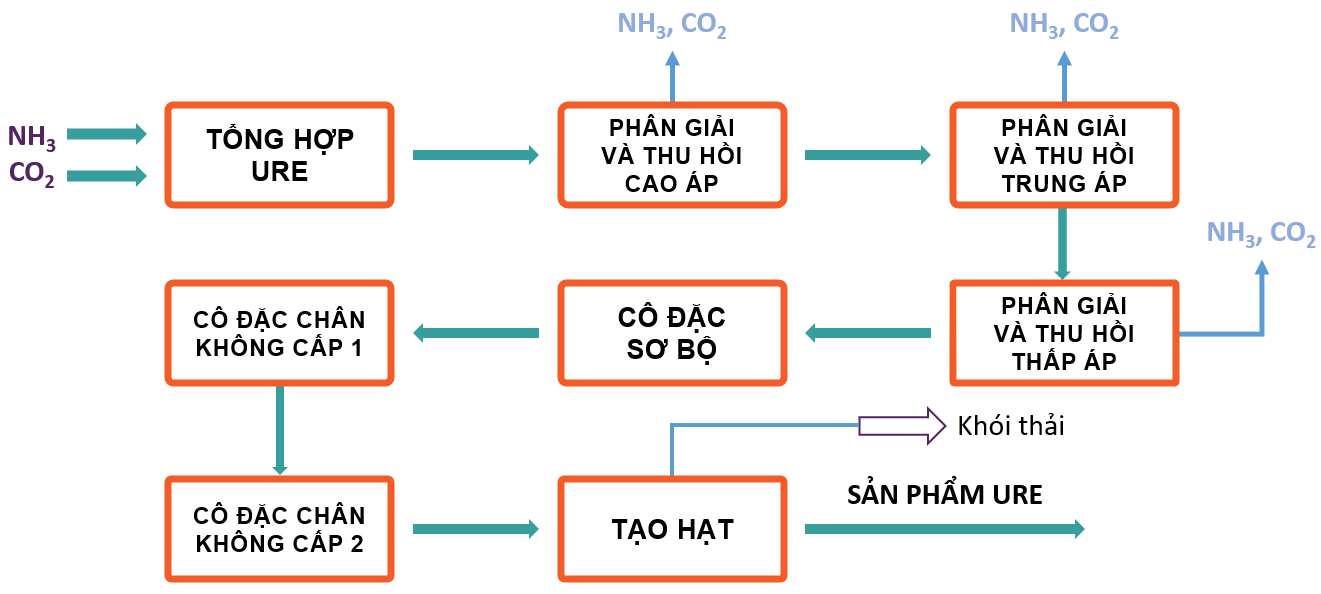

Internationally, urea prices in 2025 have rebounded significantly from 2024 levels, reaching around $380/ton—an 18% year-over-year increase—due to supply disruptions. This trend has positively impacted DPM’s margins, as input costs remain controlled and sales volumes stay stable.

Urea Price Fluctuations (2021-Oct/2025)

(Unit: USD/Ton)

Source: Tradingview

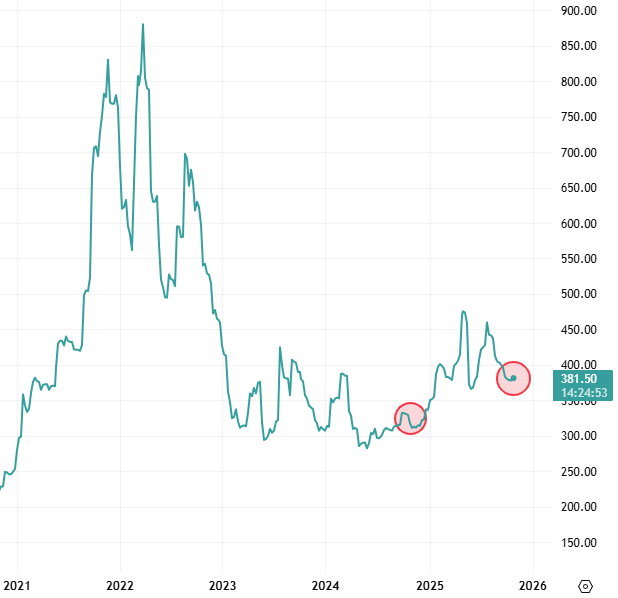

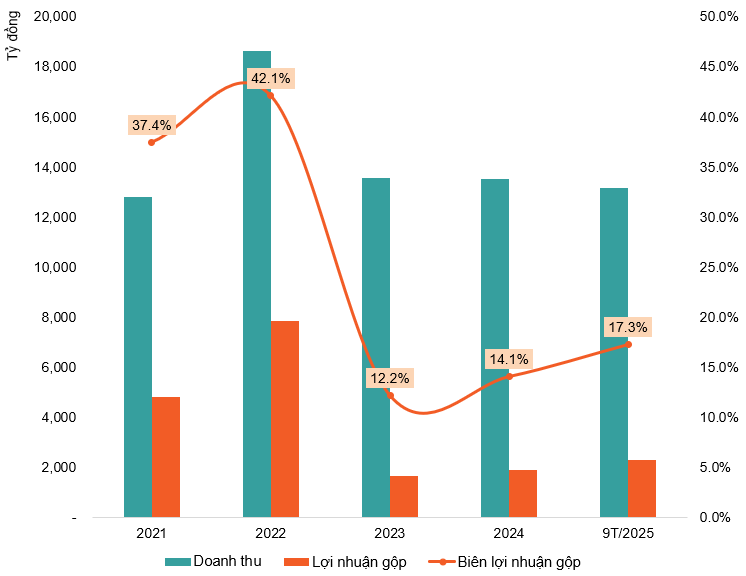

In the first nine months of 2025, DPM reported revenue exceeding VND 13 trillion and gross profit of VND 2.3 trillion, up 27.3% and 50.8% year-over-year, respectively. Gross margin also improved significantly, rising from 14.1% in late 2024 to 17.3%. These results highlight DPM’s entry into a positive growth phase, supported by favorable market conditions and strong operational capabilities.

DPM’s Business Performance (2021-9M/2025)

Source: DPM

Corporate Analysis Department, Vietstock Advisory

– 09:00 25/11/2025